Thank you!!!

Thank you!!!

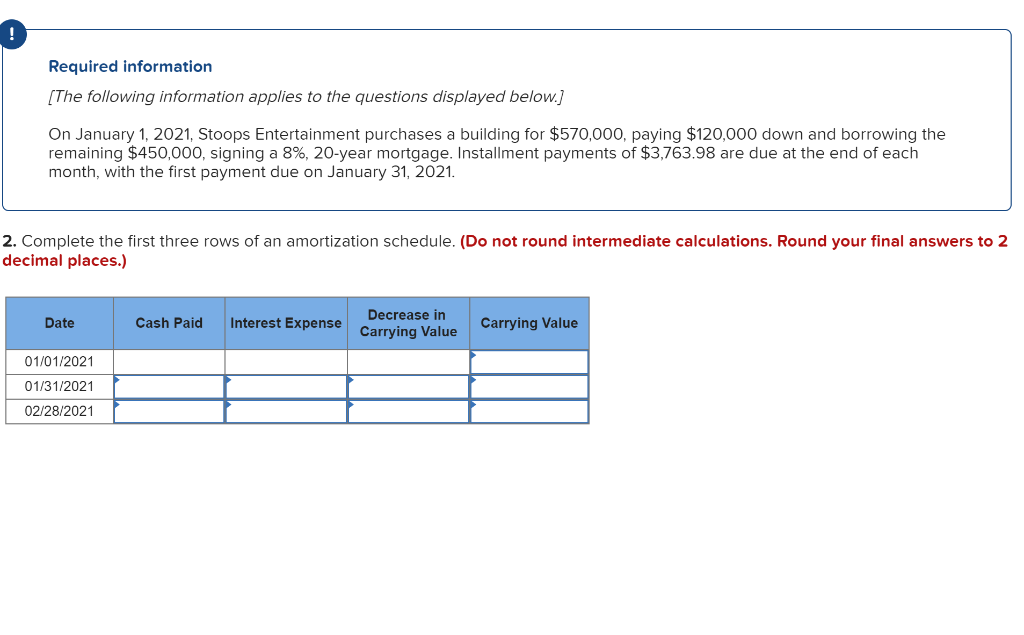

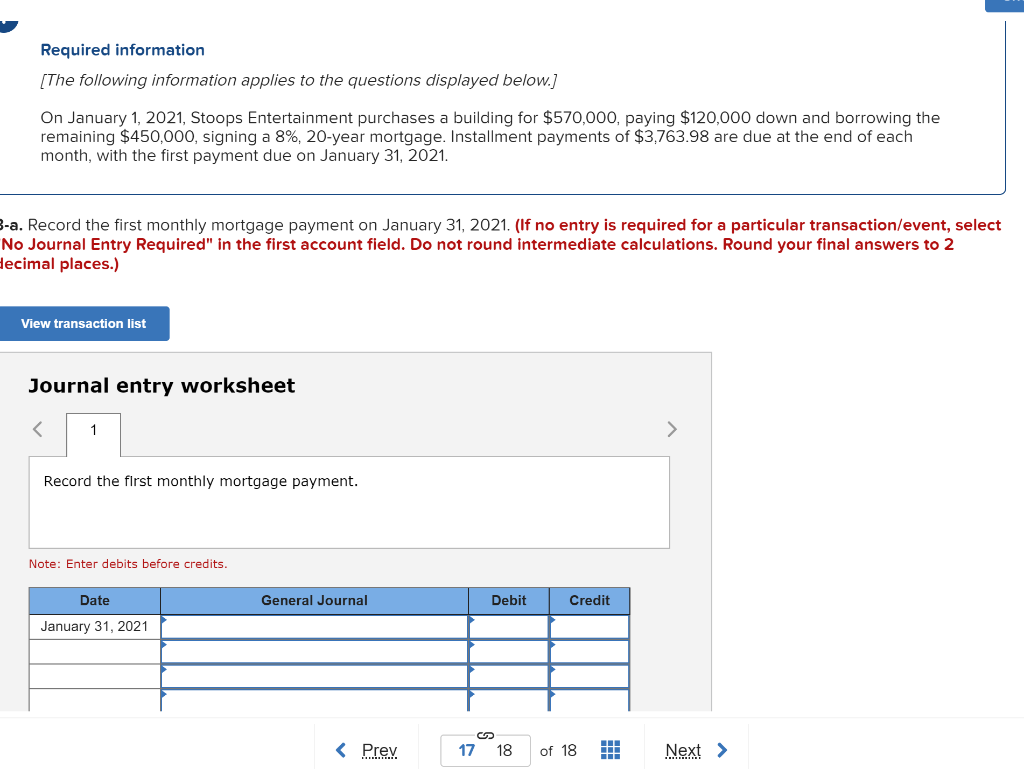

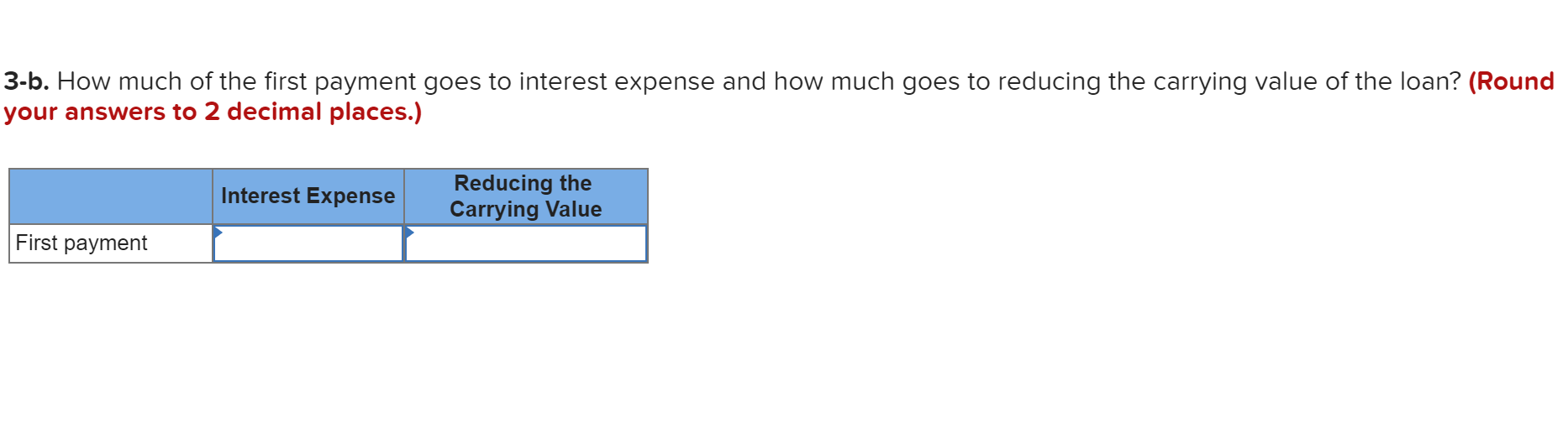

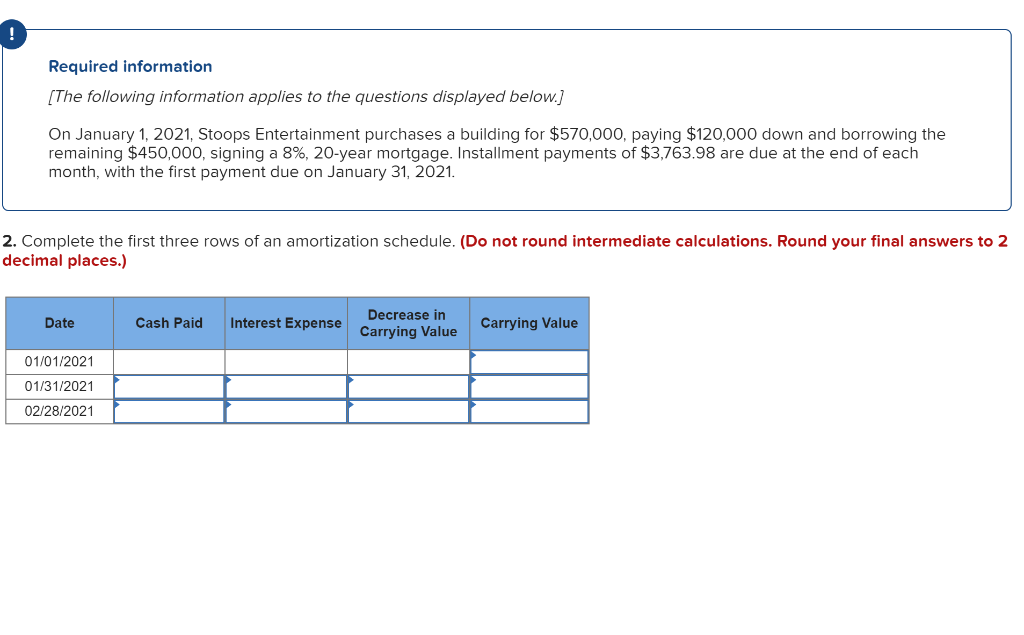

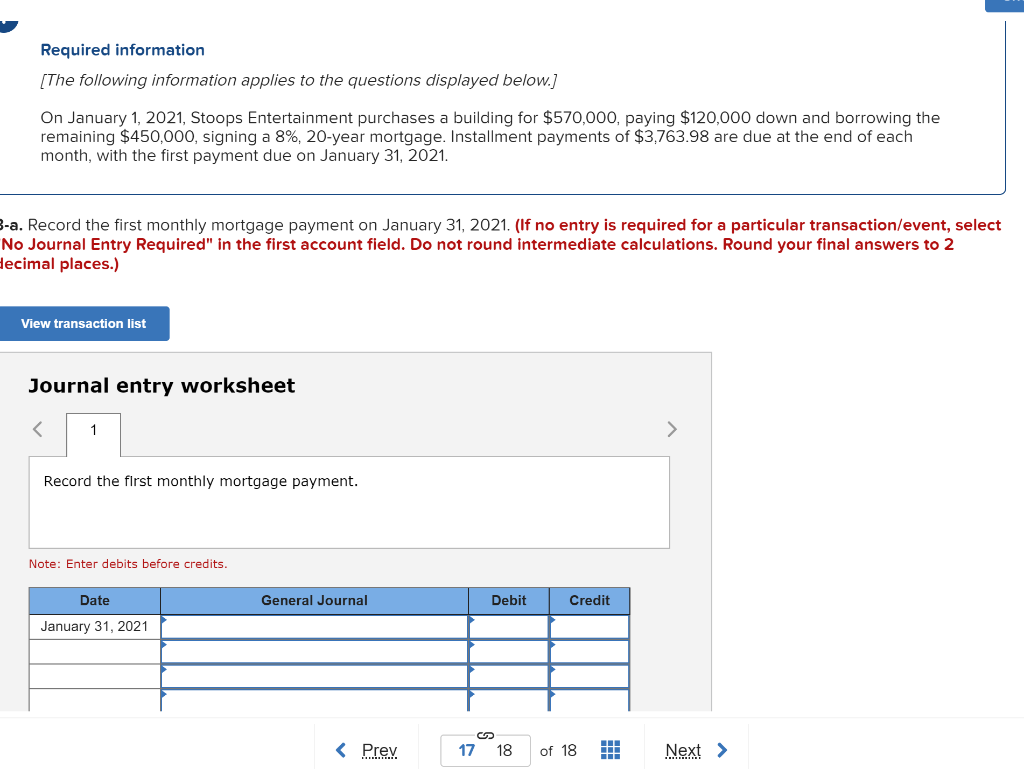

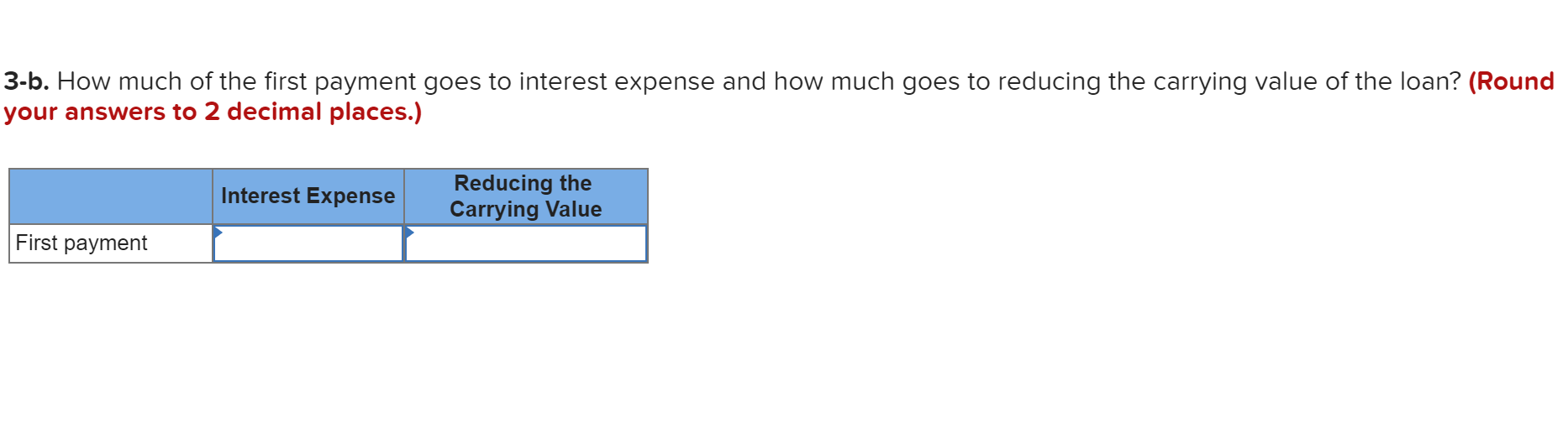

Required information [The following information applies to the questions displayed below.] On January 1, 2021, Stoops Entertainment purchases a building for $570,000, paying $120,000 down and borrowing the remaining $450,000, signing a 8%, 20-year mortgage. Installment payments of $3,763.98 are due at the end of each month, with the first payment due on January 31, 2021. 2. Complete the first three rows of an amortization schedule. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Date Cash Paid Interest Expense Decrease in Carrying Value Carrying Value 01/01/2021 01/31/2021 02/28/2021 Required information [The following information applies to the questions displayed below.] On January 1, 2021, Stoops Entertainment purchases a building for $570,000, paying $120,000 down and borrowing the remaining $450,000, signing a 8%, 20-year mortgage. Installment payments of $3,763.98 are due at the end of each month, with the first payment due on January 31, 2021. B-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2 decimal places.) View transaction list Journal entry worksheet Record the first monthly mortgage payment. Note: Enter debits before credits. General Journal Debit Credit Date January 31, 2021 3-b. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan? (Round your answers to 2 decimal places.) Interest Expense Reducing the Carrying Value First payment Required information (The following information applies to the questions displayed below.) On January 1, 2021, Stoops Entertainment purchases a building for $570,000, paying $120,000 down and borrowing the remaining $450,000, signing a 8%, 20-year mortgage. Installment payments of $3,763.98 are due at the end of each month, with the first payment due on January 31, 2021. 4. Total payments over the 20 years are $903,355 ($3,763.98 x 240 monthly payments). How much of this is interest expense and how much is actual payment of the loan? Interest expense Actual payments on the loan

Thank you!!!

Thank you!!!