Answered step by step

Verified Expert Solution

Question

1 Approved Answer

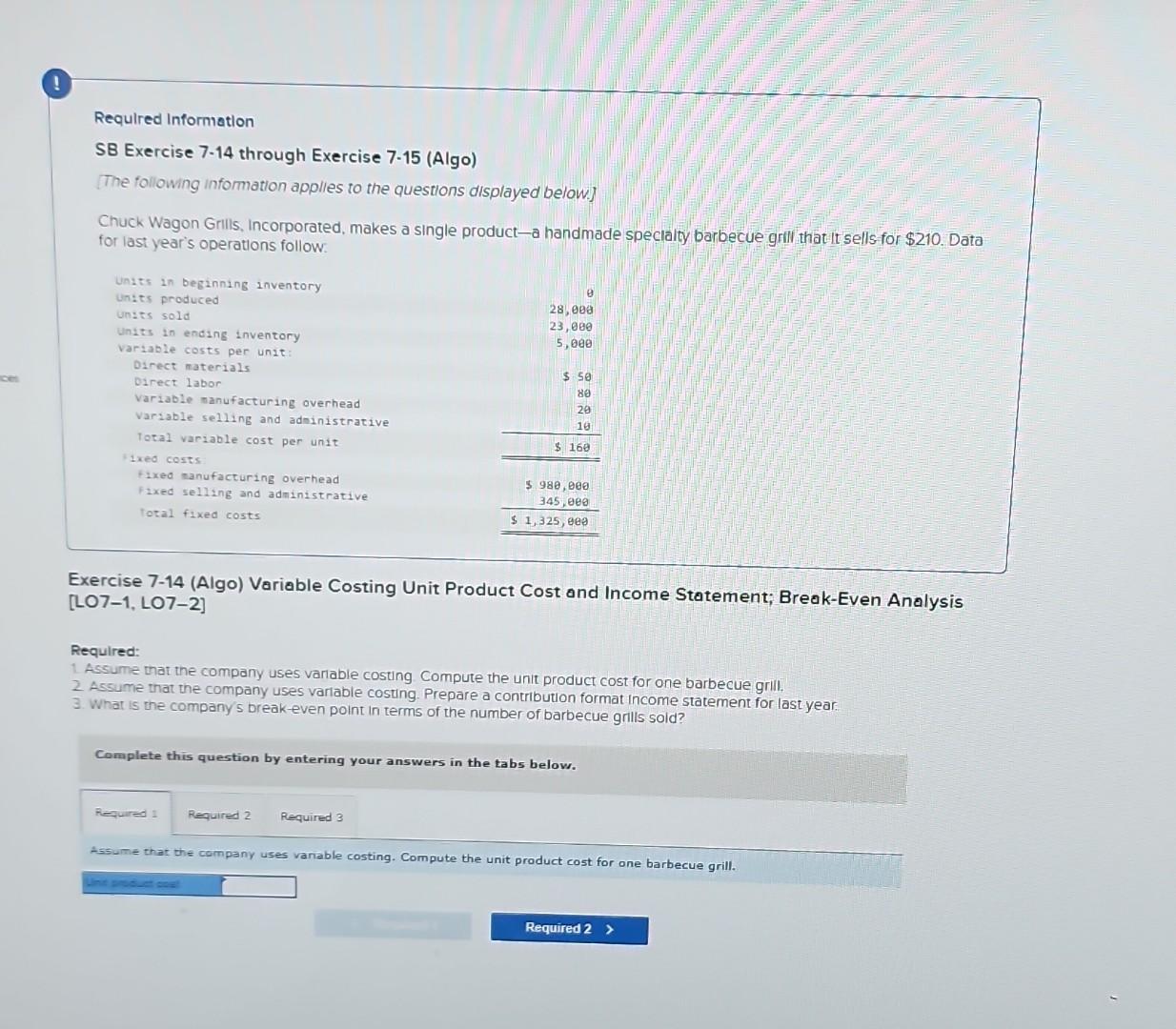

Thank you! Requlred Information SB Exercise 7-14 through Exercise 7-15 (Algo) [The following information applies to the questions displayed below.] Chuck Wagon Grills, Incorporated, makes

Thank you!

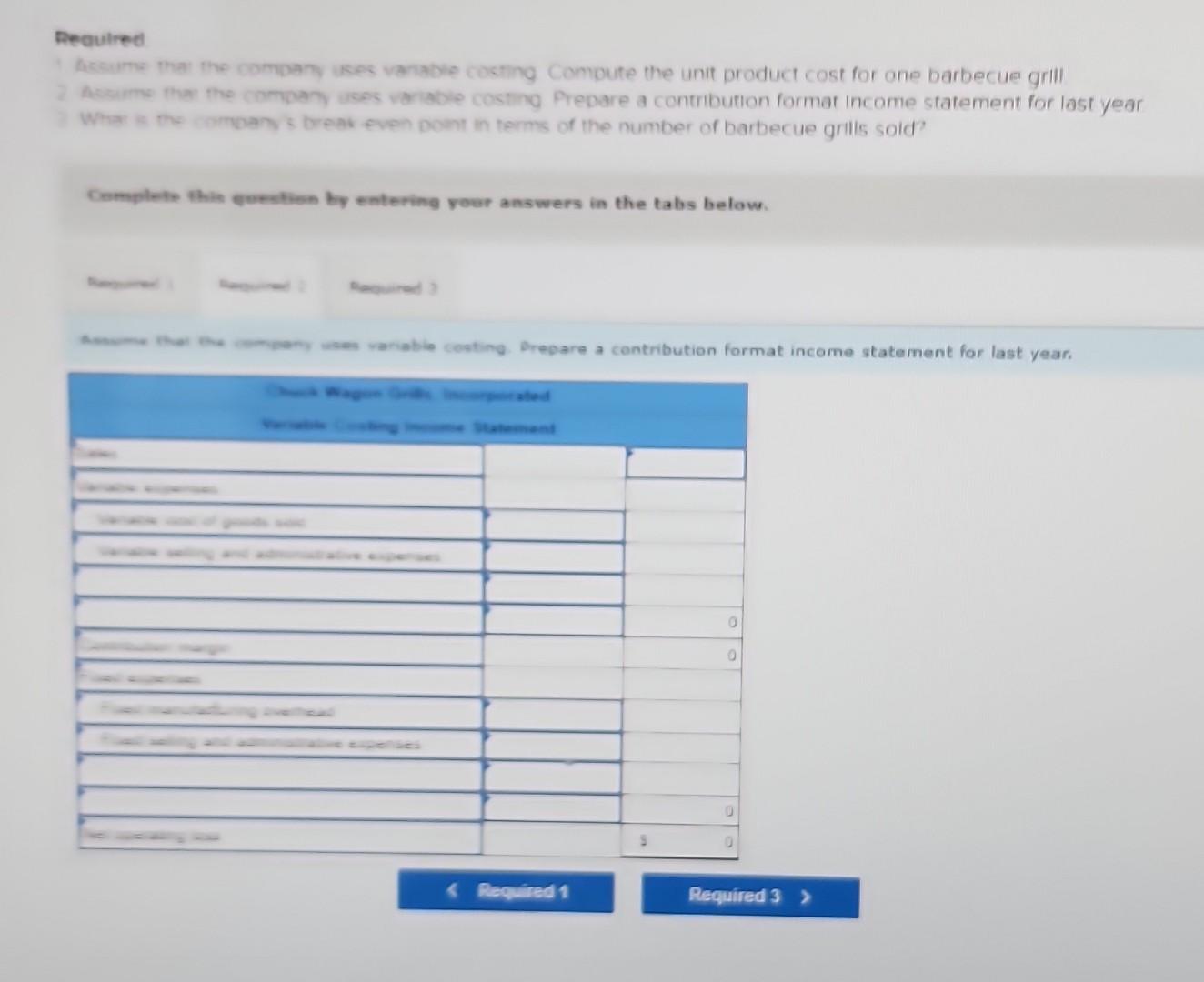

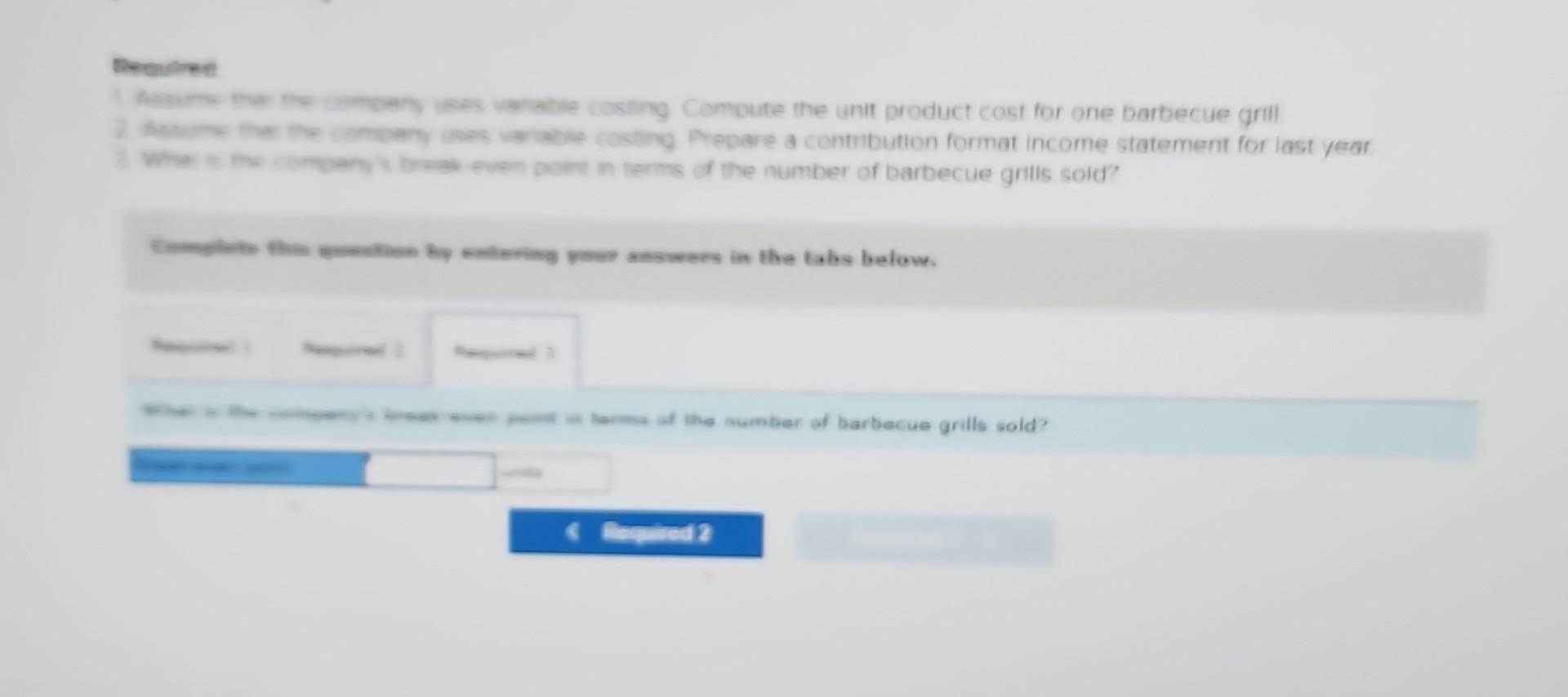

Requlred Information SB Exercise 7-14 through Exercise 7-15 (Algo) [The following information applies to the questions displayed below.] Chuck Wagon Grills, Incorporated, makes a single product-a handmade specialty barbecue grill that it sells-for $210. Data for last year's operations follow. Exercise 7-14 (Algo) Variable Costing Unit Product Cost and Income Statement; Break-Even Analysis [LO7-1, LO7-2] Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grili. 2. Assume that the company uses variable costing. Prepare a contribution format income statement for last year: What companys breakeven point in terms of the number of barbecue grills sold? Complete this question by entering your answers in the tabs below. Assume that the company uses vanable costing. Compute the unit product cost for one barbecue grill. Regulred Ascirms mant the comoany ukes varabie costing Comoute the unit product cost for one barbecue grill Acsums that the company uses variabie costing Prepare a contribution format income statement for last year Whar is me pmoans s breas even Doth in terms of the number of barbecue grilis sold? 9. Compute the unit product cost for one barbecue griil 9. Preoare a contrbution format income statement for last year of the number of barbecue grilis soldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started