Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you!! Review the information about The Coffee Critter Ltd. regarding intangibles and the related expenses. (Click here for Part 1.) (Click here for Part

Thank you!!

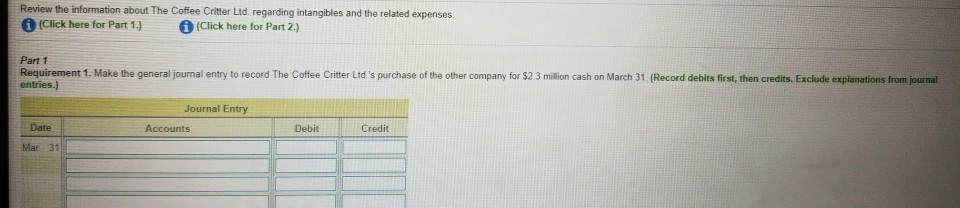

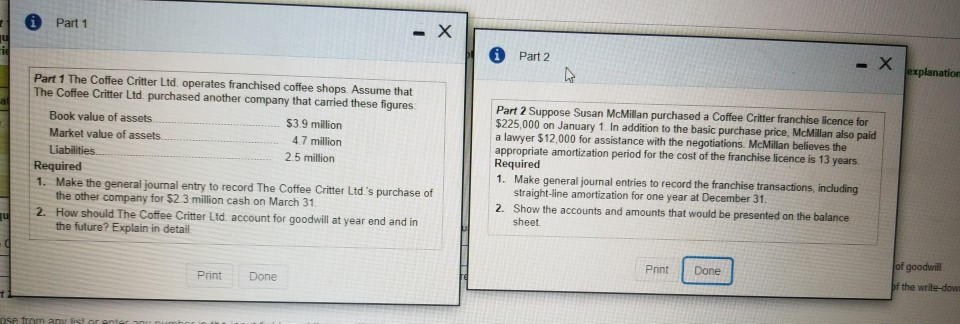

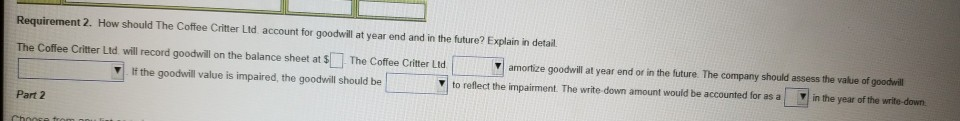

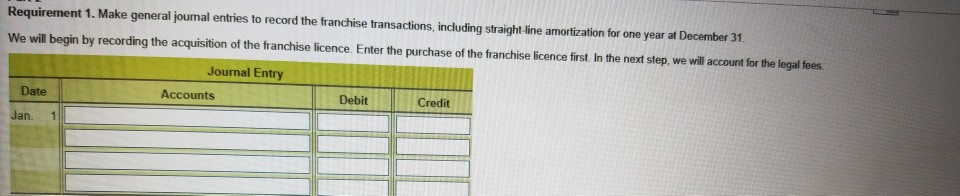

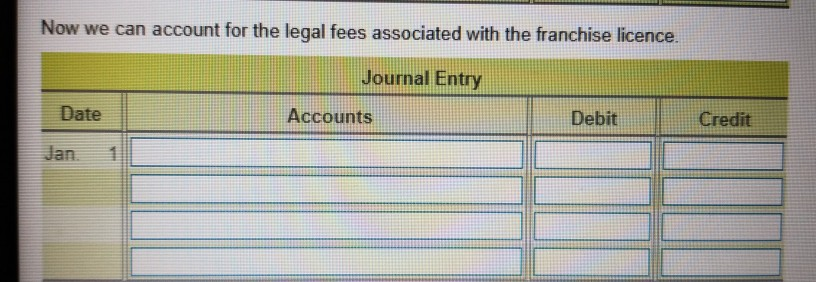

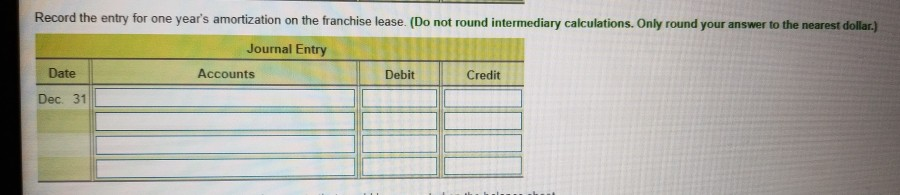

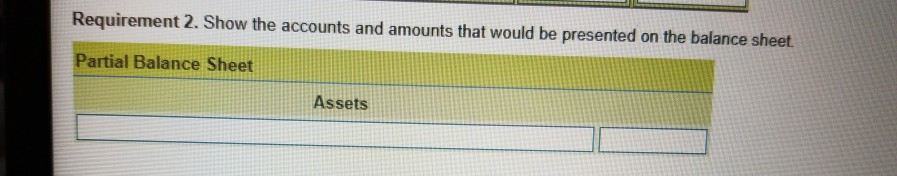

Review the information about The Coffee Critter Ltd. regarding intangibles and the related expenses. (Click here for Part 1.) (Click here for Part 2.) Part 1 Requirement 1. Make the general journal entry to record The Coffee Critter Lid's purchase of the other company for $2 3 million cash on March 31. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Accounts Date Debit Credit Mar 31 i Part 1 i Part 2 explanatio Part 1 The Coffee Critter Ltd. operates franchised coffee shops. Assume that The Coffee Critter Ltd. purchased another company that carried these figures Book value of assets $3.9 million Market value of assets 4.7 million Liabilities 2.5 million Required 1. Make the general journal entry to record The Coffee Critter Ltd's purchase of the other company for $2.3 million cash on March 31 2. How should The Coffee Critter Ltd. account for goodwill at year end and in the future? Explain in detail Part 2 Suppose Susan McMillan purchased a Coffee Critter franchise licence for $225,000 on January 1 In addition to the basic purchase price, McMillan also paid a lawyer $12,000 for assistance with the negotiations. McMillan believes the appropriate amortization period for the cost of the franchise licence is 13 years Required 1. Make general journal entries to record the franchise transactions, including straight-line amortization for one year at December 31. 2. Show the accounts and amounts that would be presented on the balance sheet Print Done of goodwill bf the write-dow Print Done Requirement 2. How should The Coffee Critter Lid account for goodwill at year end and in the future? Explain in detail The Coffee Critter Lid will record goodwill on the balance sheet at $ The Coffee Critter Lid If the goodwill value is impaired, the goodwill should be amortize goodwill at year end or in the future. The company should assess the value of goodwill to reflect the impairment. The write down amount would be accounted for as al in the year of the write down Part 2 Requirement 1. Make general journal entries to record the franchise transactions, including straight line amortization for one year at December 31. We will begin by recording the acquisition of the franchise licence. Enter the purchase of the franchise licence first. In the next step, we will account for the legal fees. Journal Entry Date Accounts Debit Credit Jan. Now we can account for the legal fees associated with the franchise licence. Journal Entry Accounts Date Debit Credit Record the entry for one year's amortization on the franchise lease. (Do not round intermediary calculations. Only round your answer to the nearest dollar.) Journal Entry Accounts Debit Credit Date Dec. 31 Requirement 2. Show the accounts and amounts that would be presented on the balance sheet. Partial Balance Sheet AssetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started