Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you! Scenario: You were recently hired by a $35 million manufacturing company ($35 million in sales) as the company staff accountant. The controller (your

Thank you!

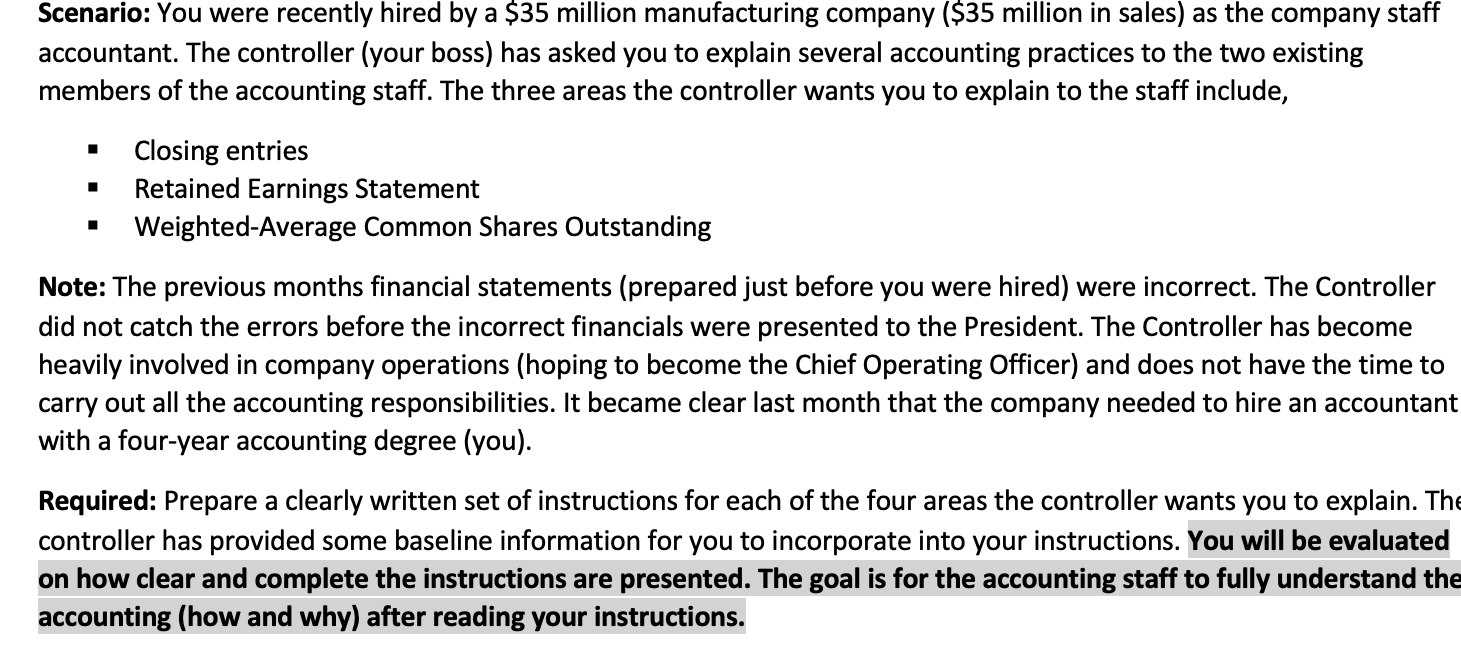

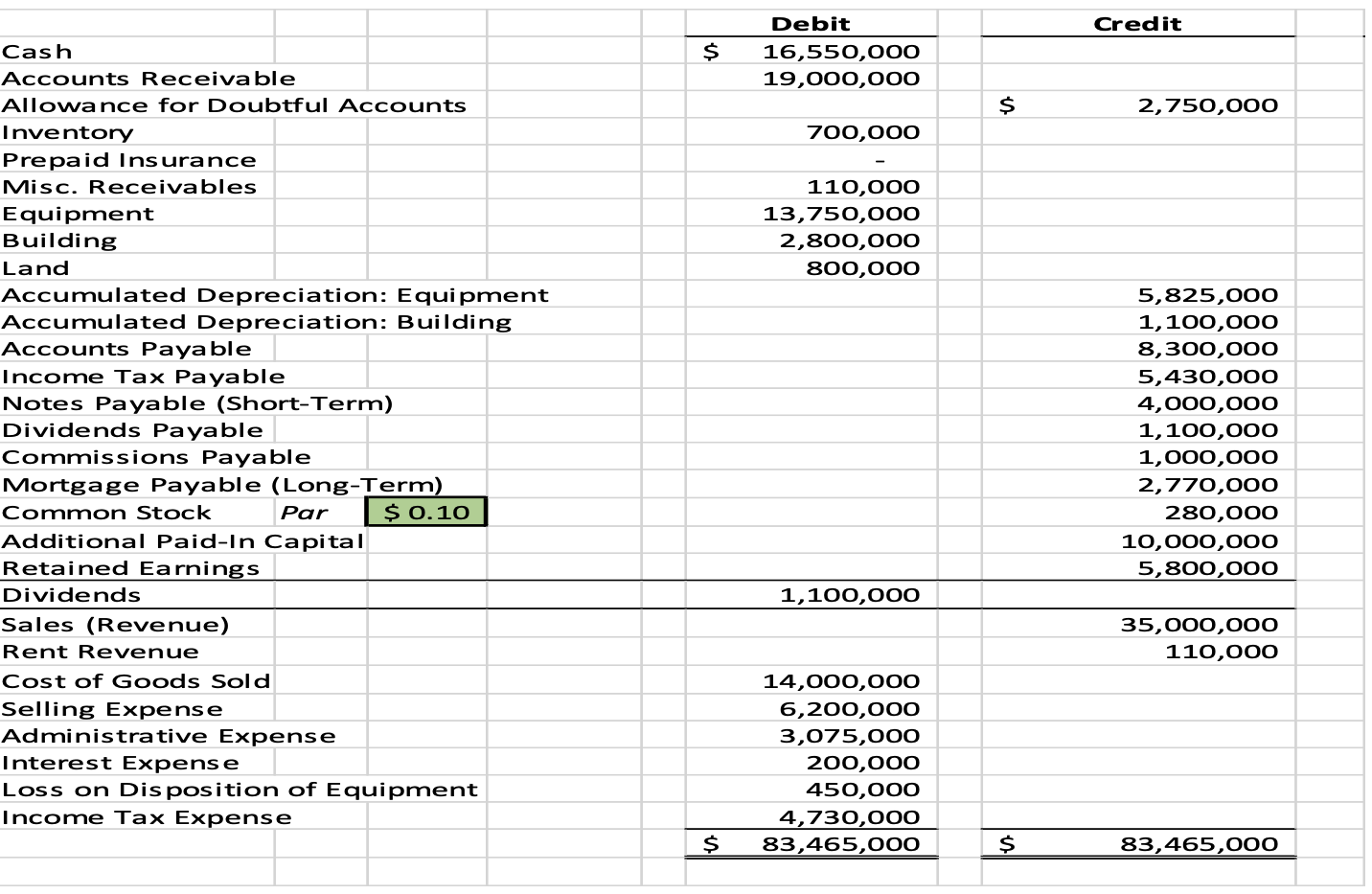

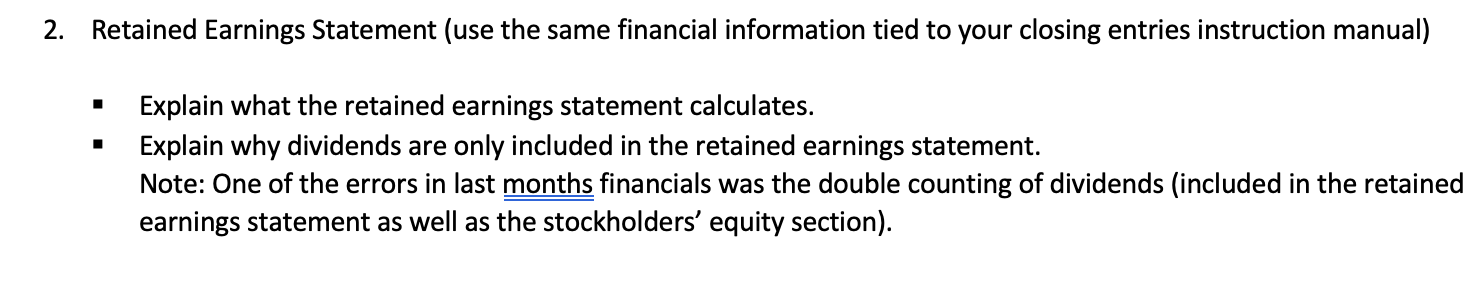

Scenario: You were recently hired by a $35 million manufacturing company ($35 million in sales) as the company staff accountant. The controller (your boss) has asked you to explain several accounting practices to the two existing members of the accounting staff. The three areas the controller wants you to explain to the staff include, 1 Closing entries Retained Earnings Statement Weighted-Average Common Shares Outstanding Note: The previous months financial statements (prepared just before you were hired) were incorrect. The Controller did not catch the errors before the incorrect financials were presented to the President. The Controller has become heavily involved in company operations (hoping to become the Chief Operating Officer) and does not have the time to carry out all the accounting responsibilities. It became clear last month that the company needed to hire an accountant with a four-year accounting degree (you). Required: Prepare a clearly written set of instructions for each of the four areas the controller wants you to explain. The controller has provided some baseline information for you to incorporate into your instructions. You will be evaluated on how clear and complete the instructions are presented. The goal is for the accounting staff to fully understand the accounting (how and why) after reading your instructions. Credit $ Debit 16,550,000 19,000,000 $ 2,750,000 700,000 110,000 13,750,000 2,800,000 800,000 Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Misc. Receivables Equipment Building Land Accumulated Depreciation: Equipment Accumulated Depreciation: Building Accounts Payable Income Tax Payable Notes Payable (Short-Term) Dividends Payable Commissions Payable Mortgage Payable (Long-Term) Common Stock Par $ 0.10 Additional Paid-in Capital Retained Earnings Dividends Sales (Revenue) Rent Revenue Cost of Goods Sold Selling Expense Administrative Expense Interest Expense Loss on Disposition of Equipment Income Tax Expense 5,825,000 1,100,000 8,300,000 5,430,000 4,000,000 1,100,000 1,000,000 2,770,000 280,000 10,000,000 5,800,000 1,100,000 35,000,000 110,000 14,000,000 6,200,000 3,075,000 200,000 450,000 4,730,000 83,465,000 $ $ 83,465,000 2. Retained Earnings Statement (use the same financial information tied to your closing entries instruction manual) 1 Explain what the retained earnings statement calculates. Explain why dividends are only included in the retained earnings statement. Note: One of the errors in last months financials was the double counting of dividends (included in the retained earnings statement as well as the stockholders' equity section)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started