Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you so much 8. Investors seeking a diversified, professionally managed portfolio of securities can purchase shares of A) preferred stock. B) convertible securities. C)

thank you so much

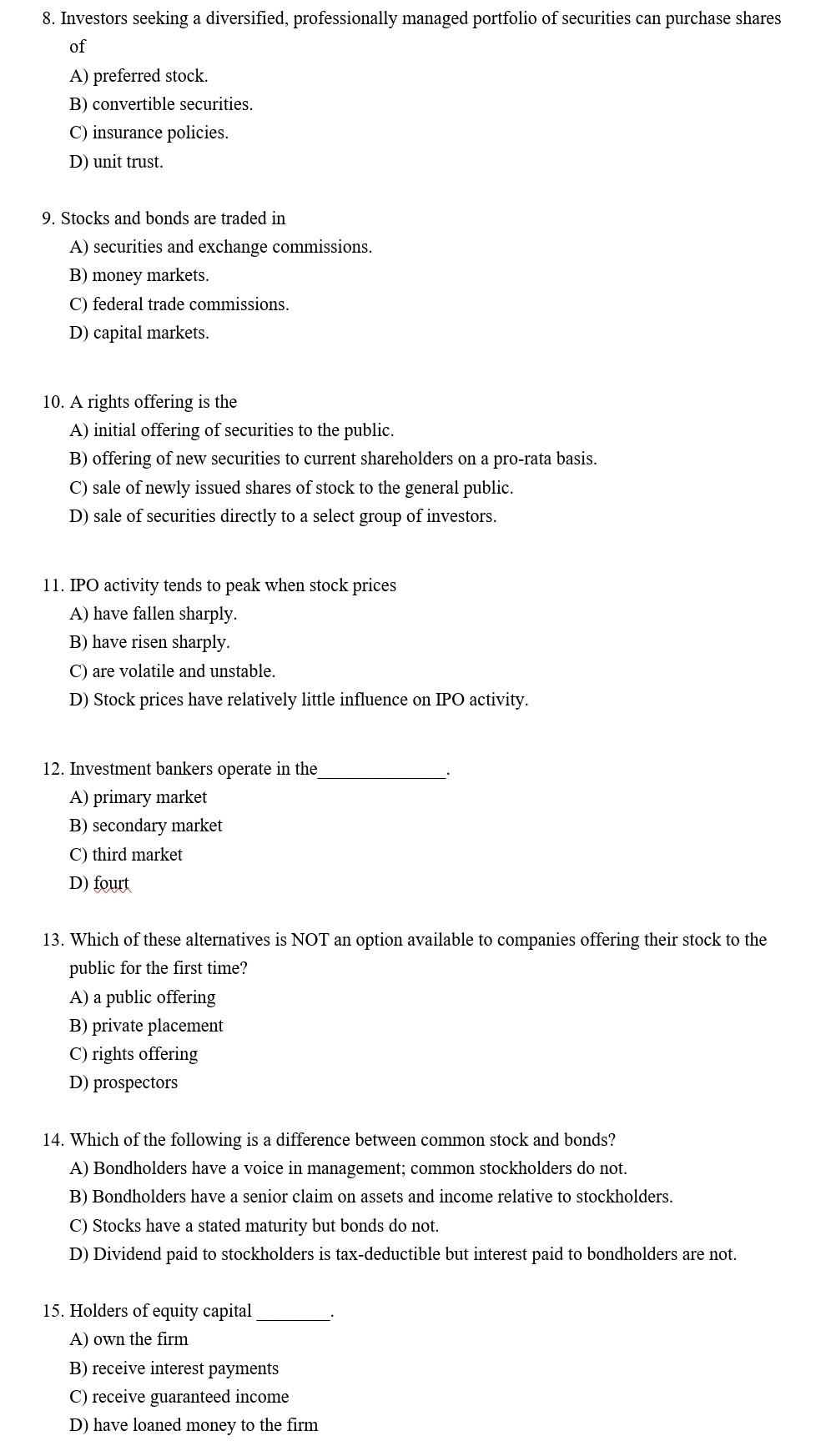

8. Investors seeking a diversified, professionally managed portfolio of securities can purchase shares of A) preferred stock. B) convertible securities. C) insurance policies. D) unit trust. 9. Stocks and bonds are traded in A) securities and exchange commissions. B) money markets. C) federal trade commissions. D) capital markets. 10. A rights offering is the A) initial offering of securities to the public. B) offering of new securities to current shareholders on a pro-rata basis. C) sale of newly issued shares of stock to the general public. D) sale of securities directly to a select group of investors. 11. IPO activity tends to peak when stock prices A) have fallen sharply. B) have risen sharply. C) are volatile and unstable. D) Stock prices have relatively little influence on IPO activity. 12. Investment bankers operate in the A) primary market B) secondary market C) third market D) fourt 13. Which of these alternatives is NOT an option available to companies offering their stock to the public for the first time? A) a public offering B) private placement C) rights offering D) prospectors 14. Which of the following is a difference between common stock and bonds? A) Bondholders have a voice in management; common stockholders do not. B) Bondholders have a senior claim on assets and income relative to stockholders. C) Stocks have a stated maturity but bonds do not. D) Dividend paid to stockholders is tax-deductible but interest paid to bondholders are not. 15. Holders of equity capital A) own the firm B) receive interest payments C) receive guaranteed income D) have loaned money to the firmStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started