Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you so much for the help! life saver! I will thumbs up for the help! 5. All of the following are true regarding depreciation

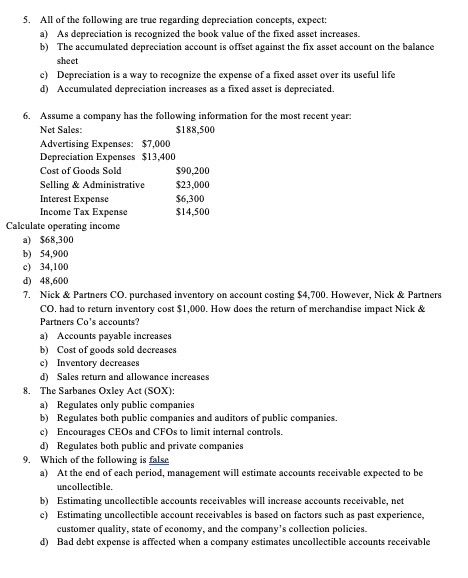

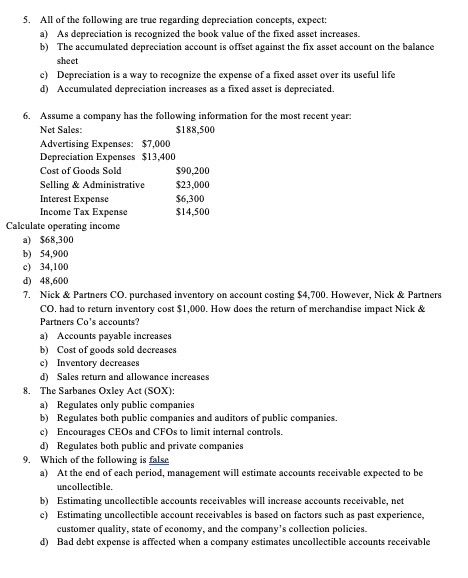

thank you so much for the help! life saver! I will thumbs up for the help!  5. All of the following are true regarding depreciation concepts, expect: a) As depreciation is recognized the book value of the fixed asset increases. b) The accumulated depreciation account is offset against the fix asset account on the balance sheet c) Depreciation is a way to recognize the expense of a fixed asset over its useful life d) Accumulated depreciation increases as a fixed asset is depreciated. 6. Assume a company has the following information for the most recent year: Net Sales: $188,500 Advertising Expenses: $7,000 Depreciation Expenses $13,400 Cost of Goods Sold $90,200 Selling & Administrative $23,000 Interest Expense $6,300 Income Tax Expense $14,500 Calculate operating income a) $68,300 b) 54,900 c) 34,100 d) 48,600 7. Nick & Partners CO. purchased inventory on account costing $4,700. However, Nick & Partners Co. had to return inventory cost $1,000. How does the return of merchandise impact Nick & Partners Co's accounts? a) Accounts payable increases b) Cost of goods sold decreases c) Inventory decreases d) Sales return and allowance increases 8. The Sarbanes Oxley Act (SOX): a) Regulates only public companies b) Regulates both public companies and auditors of public companies. c) Encourages CEOs and CFOs to limit internal controls. d) Regulates both public and private companies 9. Which of the following is false a) At the end of each period, management will estimate accounts receivable expected to be uncollectible. b) Estimating uncollectible accounts receivables will increase accounts receivable, net c) Estimating uncollectible account receivables is based on factors such as past experience, customer quality, state of economy, and the company's collection policies. d) Bad debt expense is affected when a company estimates uncollectible accounts receivable

5. All of the following are true regarding depreciation concepts, expect: a) As depreciation is recognized the book value of the fixed asset increases. b) The accumulated depreciation account is offset against the fix asset account on the balance sheet c) Depreciation is a way to recognize the expense of a fixed asset over its useful life d) Accumulated depreciation increases as a fixed asset is depreciated. 6. Assume a company has the following information for the most recent year: Net Sales: $188,500 Advertising Expenses: $7,000 Depreciation Expenses $13,400 Cost of Goods Sold $90,200 Selling & Administrative $23,000 Interest Expense $6,300 Income Tax Expense $14,500 Calculate operating income a) $68,300 b) 54,900 c) 34,100 d) 48,600 7. Nick & Partners CO. purchased inventory on account costing $4,700. However, Nick & Partners Co. had to return inventory cost $1,000. How does the return of merchandise impact Nick & Partners Co's accounts? a) Accounts payable increases b) Cost of goods sold decreases c) Inventory decreases d) Sales return and allowance increases 8. The Sarbanes Oxley Act (SOX): a) Regulates only public companies b) Regulates both public companies and auditors of public companies. c) Encourages CEOs and CFOs to limit internal controls. d) Regulates both public and private companies 9. Which of the following is false a) At the end of each period, management will estimate accounts receivable expected to be uncollectible. b) Estimating uncollectible accounts receivables will increase accounts receivable, net c) Estimating uncollectible account receivables is based on factors such as past experience, customer quality, state of economy, and the company's collection policies. d) Bad debt expense is affected when a company estimates uncollectible accounts receivable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started