Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you so much for your time! You have decided you don't like working and would rather travel and shop, so you are going to

Thank you so much for your time!

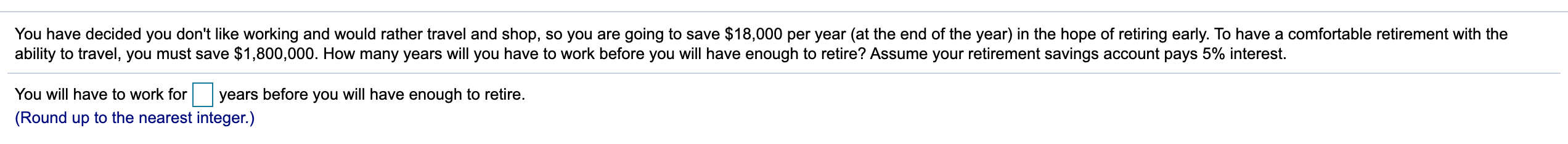

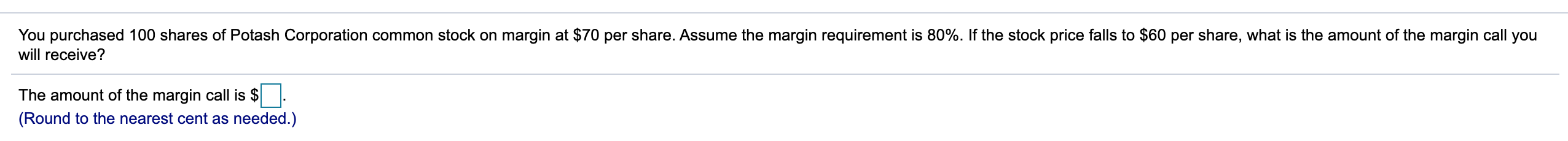

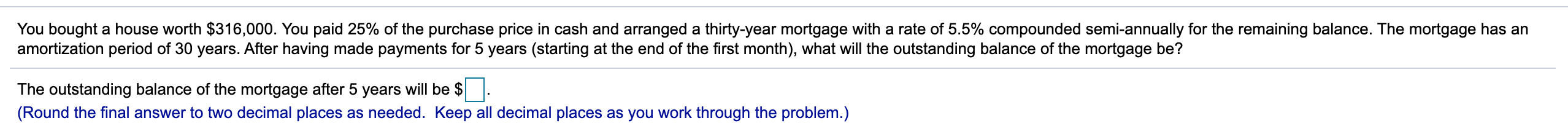

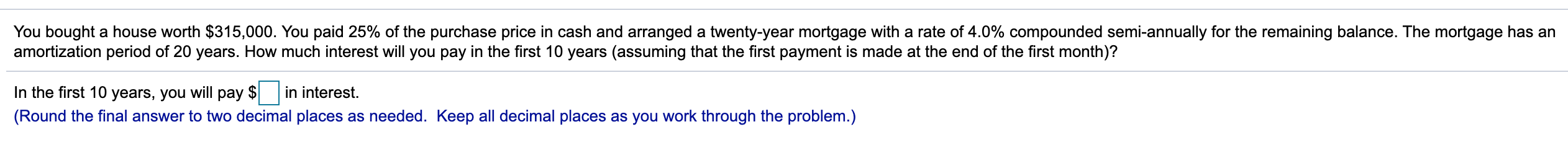

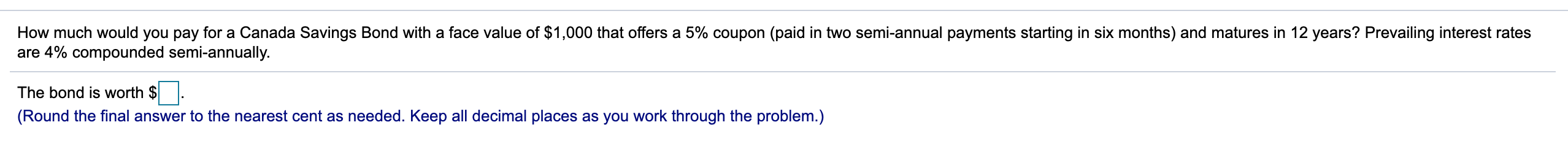

You have decided you don't like working and would rather travel and shop, so you are going to save $18,000 per year (at the end of the year) in the hope of retiring early. To have a comfortable retirement with the ability to travel, you must save $1,800,000. How many years will you have to work before you will have enough to retire? Assume your retirement savings account pays 5% interest. You will have to work for years before you will have enough to retire. (Round up to the nearest integer.) You purchased 100 shares of Potash Corporation common stock on margin at $70 per share. Assume the margin requirement is 80%. If the stock price falls to $60 per share, what is the amount of the margin call you will receive? The amount of the margin call is $ (Round to the nearest cent as needed.) You bought a house worth $316,000. You paid 25% of the purchase price in cash and arranged a thirty-year mortgage with a rate of 5.5% compounded semi-annually for the remaining balance. The mortgage has an amortization period of 30 years. After having made payments for 5 years (starting at the end of the first month), what will the outstanding balance of the mortgage be? The outstanding balance of the mortgage after 5 years will be $0. (Round the final answer to two decimal places as needed. Keep all decimal places as you work through the problem.) You bought a house worth $315,000. You paid 25% of the purchase price in cash and arranged a twenty-year mortgage with a rate of 4.0% compounded semi-annually for the remaining balance. The mortgage has an amortization period of 20 years. How much interest will you pay in the first 10 years (assuming that the first payment is made at the end of the first month)? In the first 10 years, you will pay $ in interest. (Round the final answer to two decimal places as needed. Keep all decimal places as you work through the problem.) How much would you pay for a Canada Savings Bond with a face value of $1,000 that offers a 5% coupon (paid in two semi-annual payments starting in six months) and matures in 12 years? Prevailing interest rates are 4% compounded semi-annually. The bond is worth $ (Round the final answer to the nearest cent as needed. Keep all decimal places as you work through the problem.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started