Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you so much! Requirements 1. Complete the worksheet for Hamilton Veterinary Hospital. 2. Prepare the closing entries. 3. Prepare a post-closing trial balance. Print

Thank you so much!

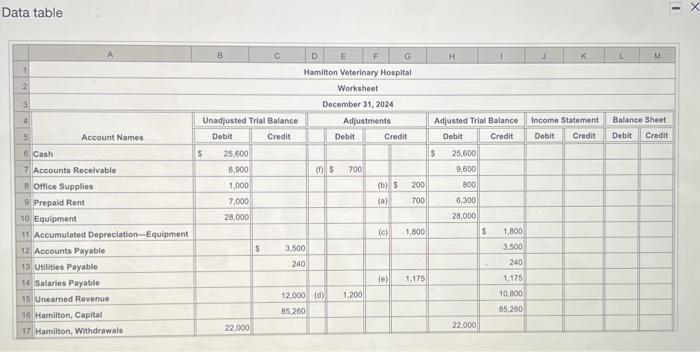

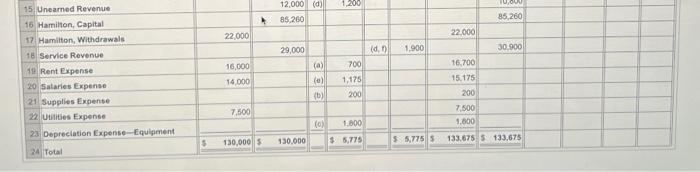

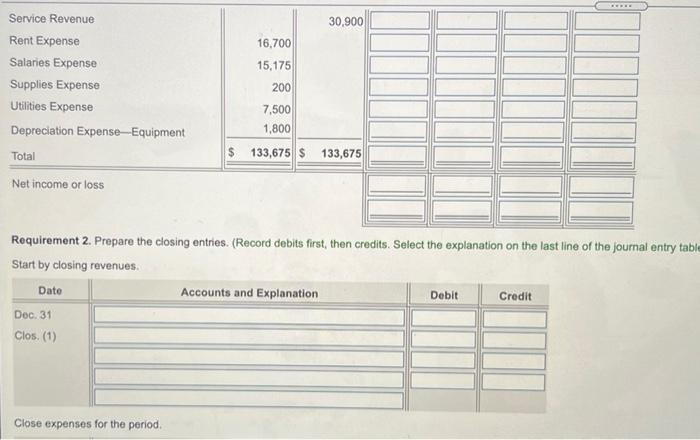

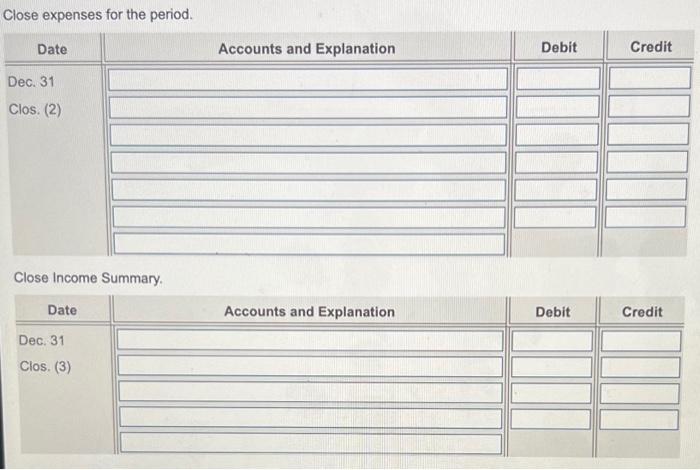

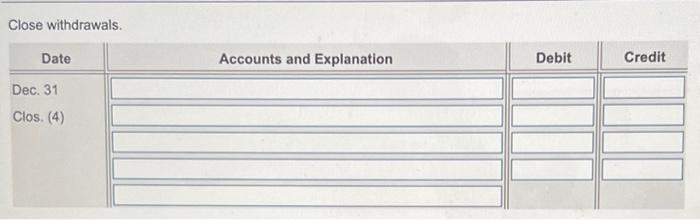

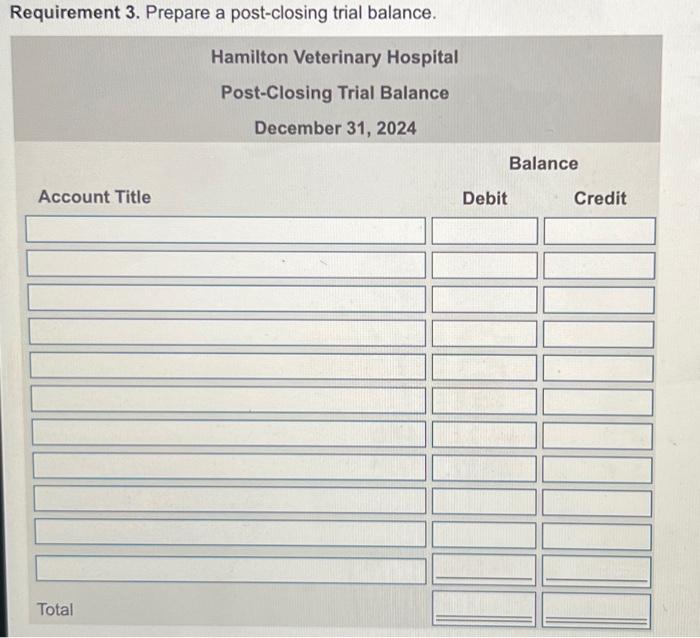

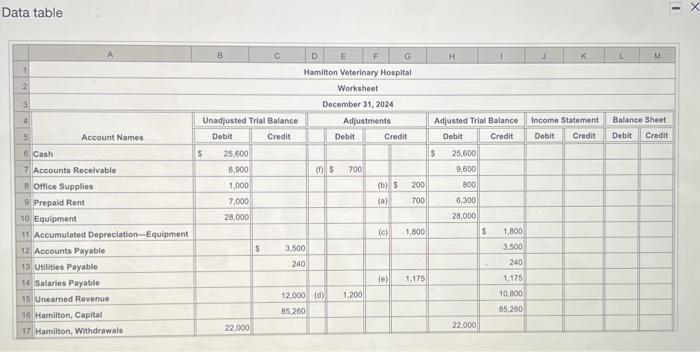

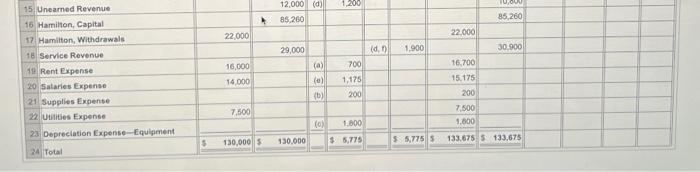

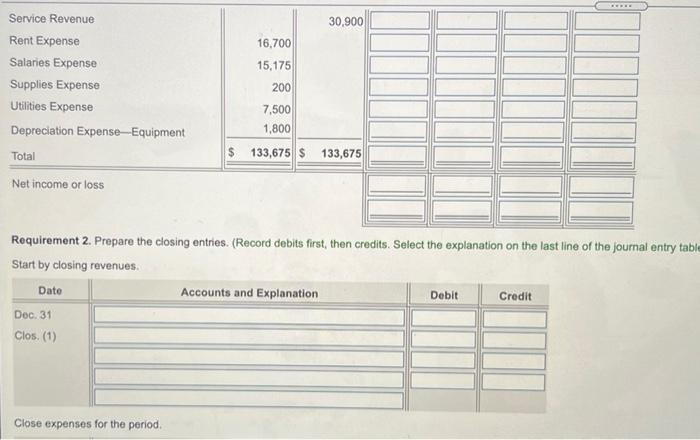

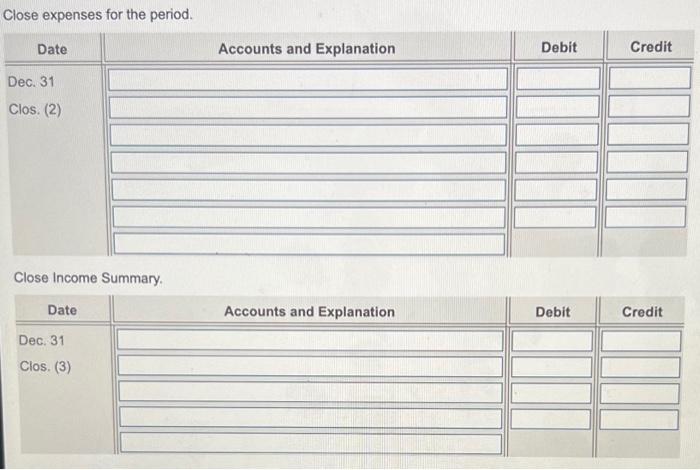

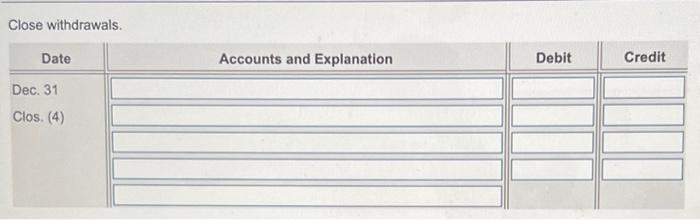

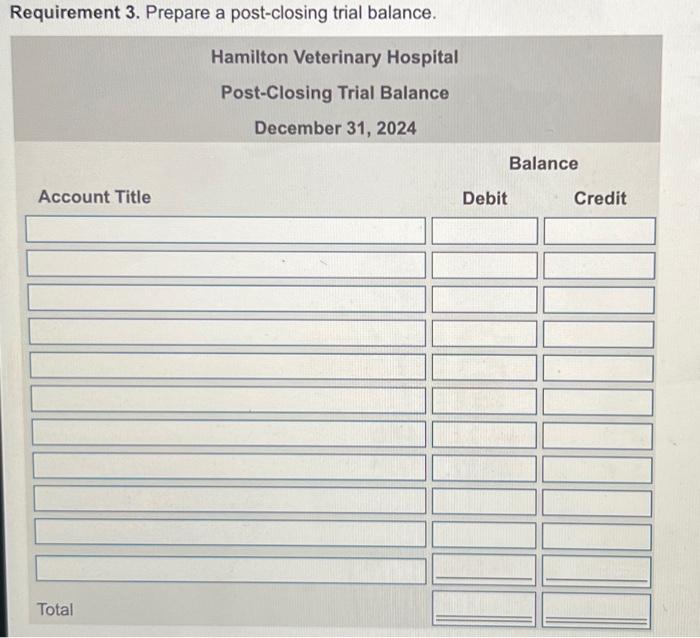

Requirements 1. Complete the worksheet for Hamilton Veterinary Hospital. 2. Prepare the closing entries. 3. Prepare a post-closing trial balance. Print Done Data table M 1 D E G Hamilton Veterinary Hospital Worksheet December 31, 2024 Adjustments Debit Credit 3 4 Income Statement Balance Sheet Unadjusted Trial Balance Debit Credit 5 Account Names Debit Credit Debit Credit Cash 5 25.600 8.900 700 Adjusted Trial Balance Debit Credit $ 25,600 9.500 800 6,300 28,000 200 1,000 7,000 (b) $ (0) 700 28,000 ( (c) 1,800 7 Accounts Receivable Office Supplies Prepaid Rent 10 Equipment 11 Accumulated Depreciation Equipment 12 Accounts Payable 13 Utilities Payable 14 Salaries Payable 15 Uneamed Revenue 16 Hamilton, Capital 17 Hamilton, Withdrawals s 3.500 3,500 240 240 le) 1,175 1,175 12,000 (d) 1,200 10.800 25,260 85.260 22.000 22.000 1,200 12.000 (0) 85.260 VON 85,260 -- 22,000 22.000 29,000 (d, 1.900 30.900 16.700 15 Unearned Revenue 16 Hamilton, Capital 17 Hamilton, Withdrawals 18 Service Revenue 19 Rent Expense 20 Salaries Expanse 21 Supplies Expense 22 Utilities Expense 23 Depreciation Expense-Equipment 24 Total 16,000 14.000 (a) (0) 700 1,175 200 15.175 200 (6) 7,500 7.500 1.800 (0) 1.000 $ 5,770 130,000 $ 130.000 $5.7755 133.675 5 133,675 Requirement 1. Complete the worksheet for Hamilton Veterinary Hospital Complete the worksheet by preparing the Income Statement and Balance Sheet columns. Be sure to calculate the total debits and credits Hamilton Veterinary Hospital Worksheet December 31, 2024 Adjusted Income Balance Trial Balance Statement Sheet Account Names Debit Credit Debit Credit Debit Credit Cash $ 25,600 Accounts Receivable 9,600 Office Supplies 800 Prepaid Rent 6,300 Equipment 28,000 Accumulated Depreciation-Equipment 1,800 Accounts Payablo 3,500 Utilities Payable 240 Salaries Payable 1,175 Uneamed Revenue 10,800 Hamilton, Capital 85,260 Hamilton, Withdrawals 22,000 30,900 16,700 15,175 200 Service Revenue Rent Expense Salaries Expense Supplies Expense Utilities Expense Depreciation Expense-Equipment Total Net income or loss 7,500 1,800 $ 133,675 $ 133,675 Requirement 2. Prepare the closing entries (Record debits first, then credits. Select the explanation on the last line of the journal entry table Start by closing revenues. Dato Accounts and Explanation Debit Dec. 31 Clos. (1) Credit Close expenses for the period. Close expenses for the period. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (2) Close Income Summary Accounts and Explanation Debit Credit Date Dec. 31 Clos. (3) Close withdrawals. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (4) Requirement 3. Prepare a post-closing trial balance. Hamilton Veterinary Hospital Post-Closing Trial Balance December 31, 2024 Balance Account Title Debit Credit Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started