Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you Soto Company uses the percentage of receivables method for recording bad debt expense. The accounts receivable balance is $500,000 and credit sales are

thank you

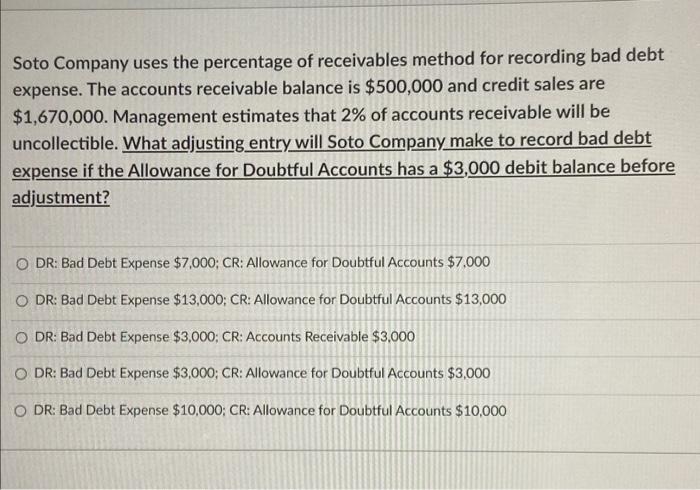

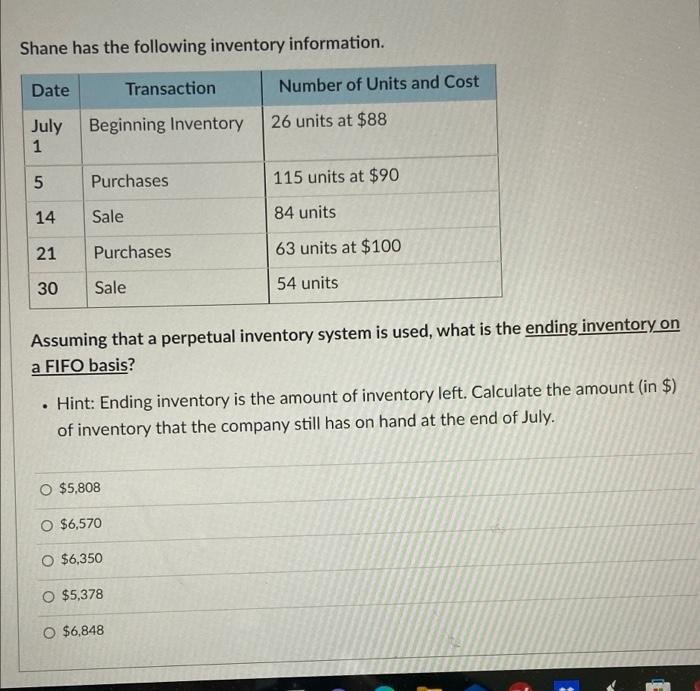

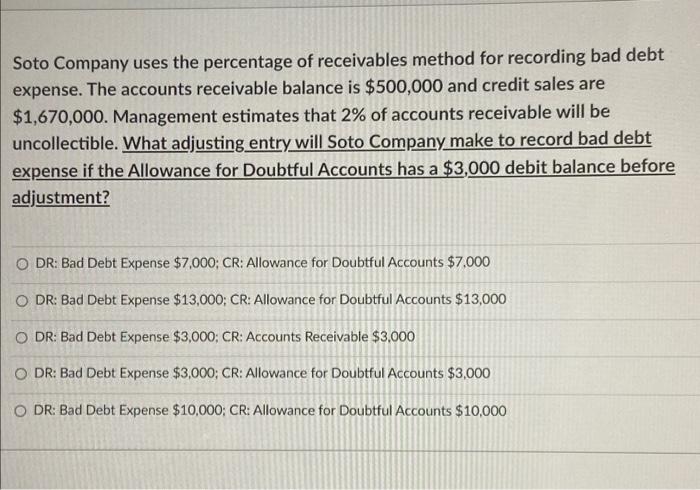

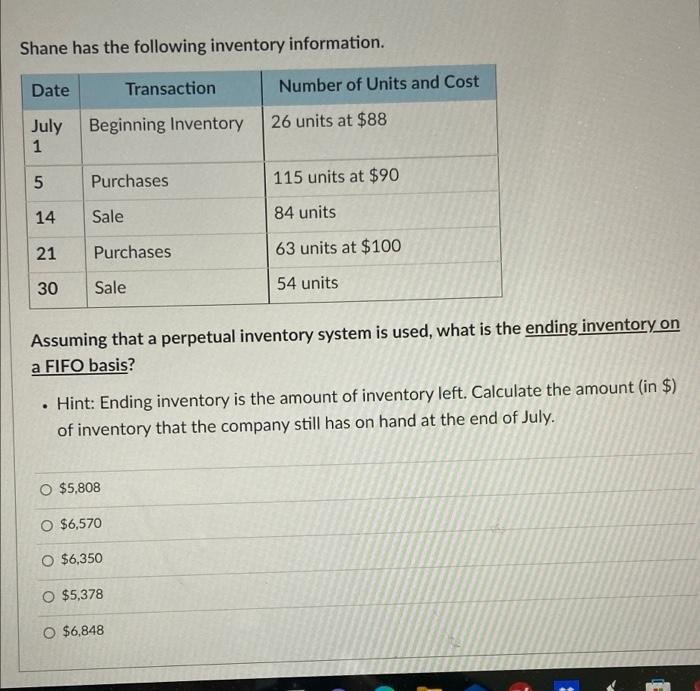

Soto Company uses the percentage of receivables method for recording bad debt expense. The accounts receivable balance is $500,000 and credit sales are $1,670,000. Management estimates that 2% of accounts receivable will be uncollectible. What adjusting entry will Soto Company make to record bad debt expense if the Allowance for Doubtful Accounts has a $3,000 debit balance before adjustment? O DR: Bad Debt Expense $7,000; CR: Allowance for Doubtful Accounts $7.000 O DR: Bad Debt Expense $13,000; CR: Allowance for Doubtful Accounts $13,000 O DR: Bad Debt Expense $3,000; CR: Accounts Receivable $3.000 O DR: Bad Debt Expense $3,000; CR: Allowance for Doubtful Accounts $3,000 O DR: Bad Debt Expense $10,000; CR: Allowance for Doubtful Accounts $10,000 Shane has the following inventory information. Date Transaction Number of Units and Cost July 1 Beginning Inventory 26 units at $88 un 5 Purchases 115 units at $90 14 Sale 84 units 21 Purchases 63 units at $100 30 Sale 54 units a Assuming that a perpetual inventory system is used, what is the ending inventory on a FIFO basis? . Hint: Ending inventory is the amount of inventory left. Calculate the amount (in $) of inventory that the company still has on hand at the end of July. O $5,808 O $6,570 O $6,350 O $5,378 O $6,848

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started