Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you Suppose a US-based MNC will receive 10 Million Brazilian Real (BRL) in 6 months. Forward contracts on the BRL are available for USD

Thank you

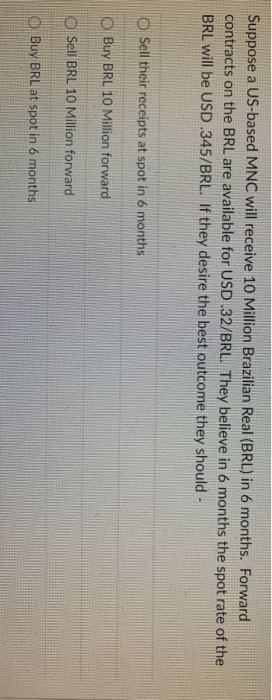

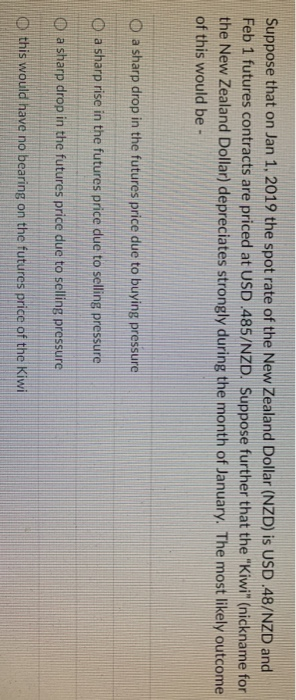

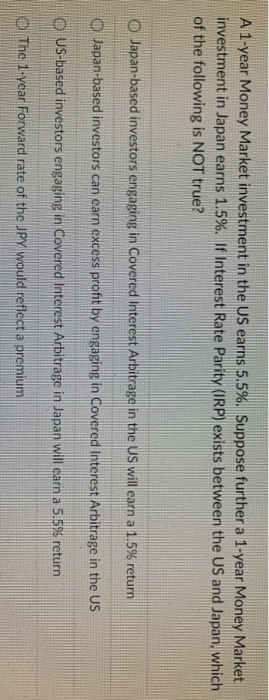

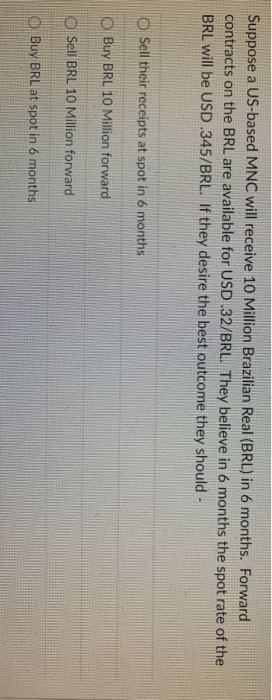

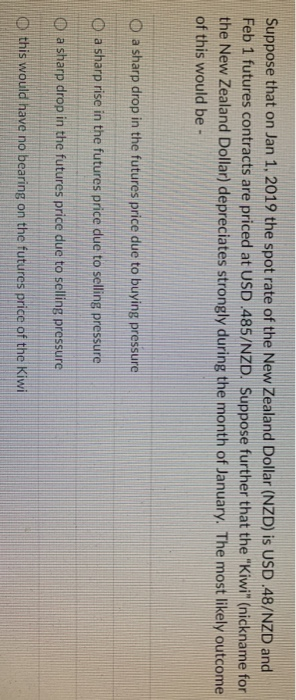

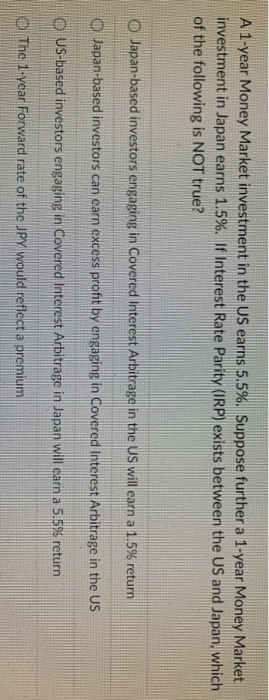

Suppose a US-based MNC will receive 10 Million Brazilian Real (BRL) in 6 months. Forward contracts on the BRL are available for USD 32/BRL. They believe in 6 months the spot rate of the BRL will be USD.345/BRL. If they desire the best outcome they should - O Sell their receipts at spot in 6 months O Buy BRL 10 Million forward Sell BRL 10 Million forward Buy BRL at spot in 6 months Suppose that on Jan 1, 2019 the spot rate of the New Zealand Dollar (NZD) is USD .48/NZD and Feb 1 futures contracts are priced at USD .485/NZD. Suppose further that the "Kiwi" (nickname for the New Zealand Dollar) depreciates strongly during the month of January. The most likely outcome of this would be - O a sharp drop in the futures price due to buying pressure O a sharp rise in the futures price due to selling pressure O a sharp drop in the futures price due to selling pressure O this would have no bearing on the futures price of the Kiwi A 1-year Money Market investment in the US earns 5.5%. Suppose further a 1-year Money Market investment in Japan earns 1.5%. If Interest Rate Parity (IRP) exists between the US and Japan, which of the following is NOT true? Japan-based investors engaging in Covered Interest Arbitrage in the US will earn a 1.5% return O Japan-based investors can earn excess profit by engaging in Covered Interest Arbitrage in the US O US-based investors engaging in Covered Interest Arbitrage in Japan will earn a 5.5% return The 1-year Forward rate of the JPY would reflect a premium

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started