Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you The direct labor budget of Yuvwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours Budgeted direct laboe-hours

thank you

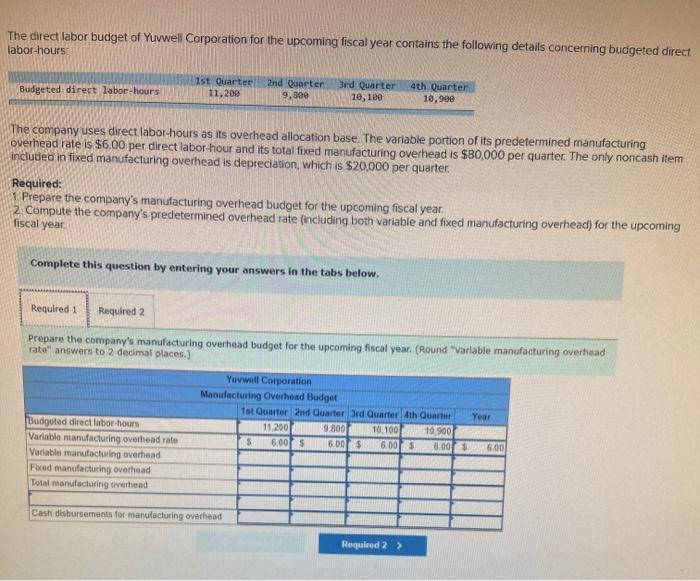

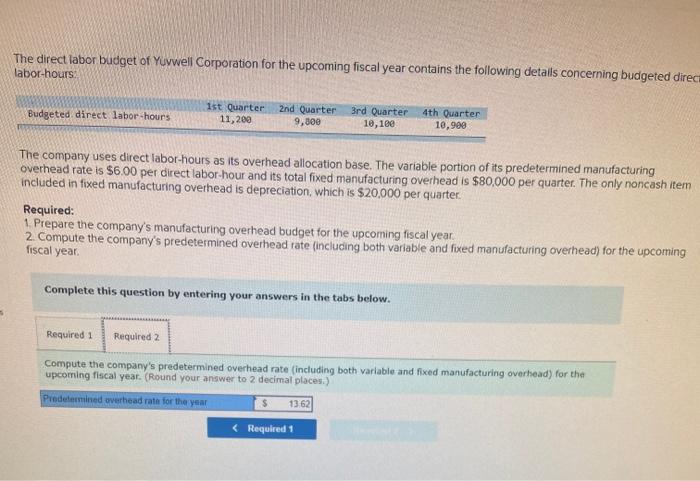

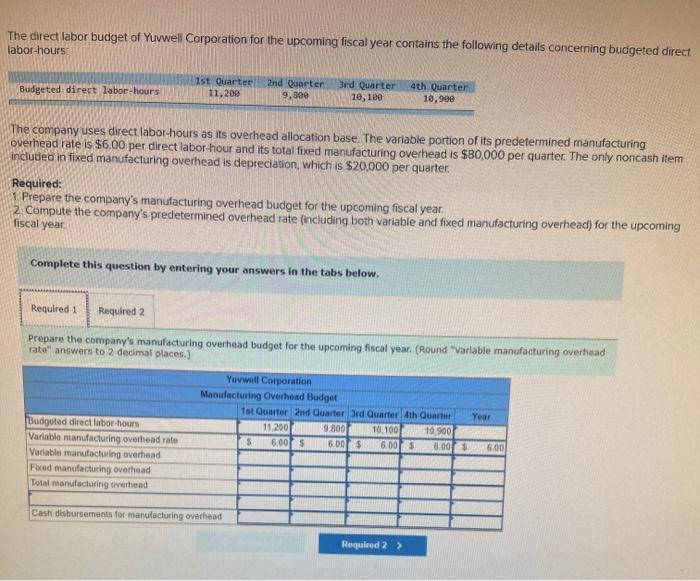

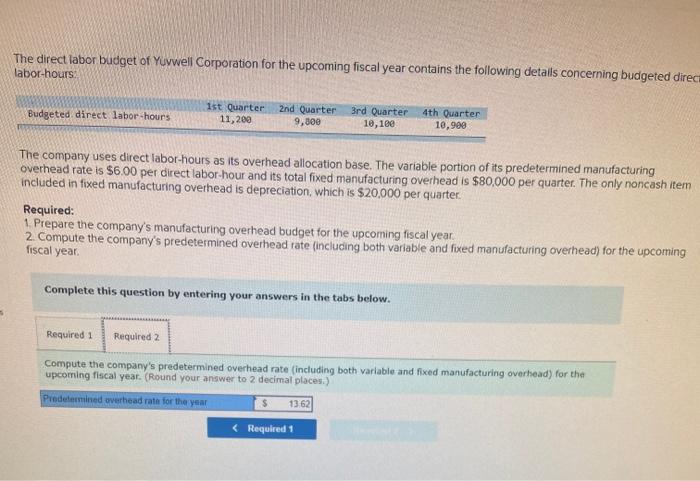

The direct labor budget of Yuvwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours Budgeted direct laboe-hours 1st Quarter 11,200 2nd Quarter 9,300 3rd Quarter 10,100 4th Quarter 10,990 The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor hour and its total fixed manufacturing overhead is $80,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter. Required: Prepare the company's manufacturing overhead budget for the upcoming fiscal year. 2 Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's manufacturing overhead budget for the upcoming fiscal year. (Round "variable manufacturing overhead rate" answers to 2 decimal places.) Yuvwell Corporation Manufacturing Overhead Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year 11,200 9.800 10.100 10,500 $ 6.00 $ 6.00 $ 6.00 5 6.00 $ 6.00 Budgeted direct labor hours Variable manufacturing overhead rate Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Cash disbursement for manufacturing overhead Required 2 > The direct labor budget of Yuvwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direc labor-hours Budgeted direct labor-hours 1st Quarter 11,200 2nd Quarter 9,300 3rd Quarter 10,100 4th Quarter 10,909 The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor-hour and its total fixed manufacturing overhead is $80,000 per quarter. The only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal year 2. Compute the company's predetermined overhead tate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year. (Round your answer to 2 decimal places.) Predetermined overhead rate for the year $ 13.62

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started