Thank you very much.

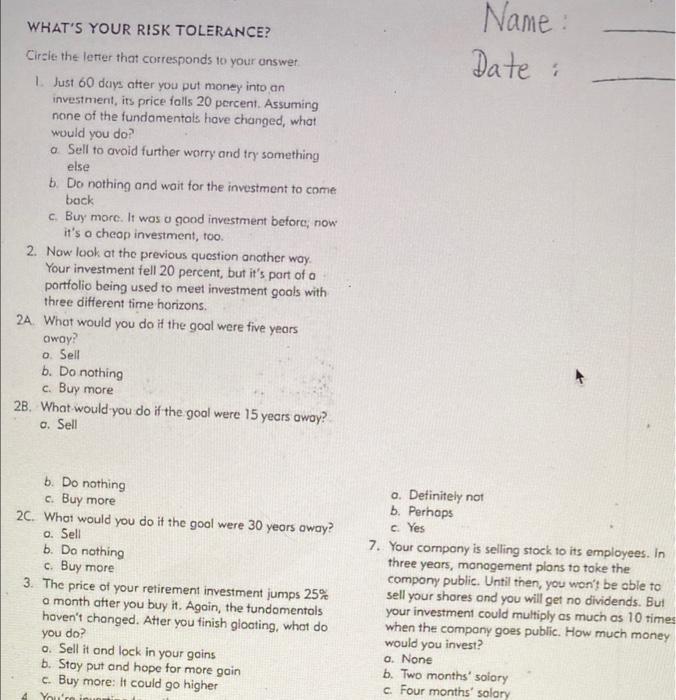

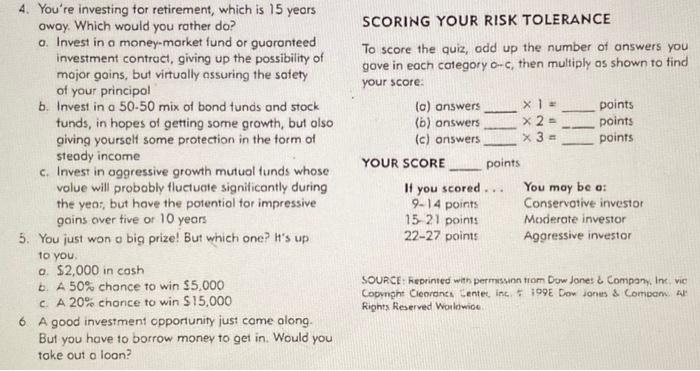

Please answer the 7 questions in the survey below. Then, calculate your numerical score using the information at the bottom of the survey. Be sure to indicate whether you are a conservative, moderate or aggressive investor given your score. Please type the alphabetical answer to each question, show your numerical score calculation, and indicate you risk profile. Then, upload your file to canvas. WHAT'S YOUR RISK TOLERANCE? Circle the letter that corresponds to your answer 1. Just 60 days after you put money into an investment, its price falls 20 percent. Assuming none of the fundamentals have changed, what would you do? a Sell to avoid further worry and try something else b. Do nothing and wait for the investment to come back c. Buy more. It was a good investment before, now it's a cheap investment, too. 2. Now look at the previous question another way. Your investment fell 20 percent, but it's part of a portfolio being used to meet investment goals with three different time horizons. 2A. What would you do if the goal were five years away? o. Sell b. Do nothing c. Buy more 2B. What would you do if the goal were 15 years away? a. Sell b. Do nothing c. Buy more 2C. What would you do if the goal were 30 years away? a. Sell b. Do nothing c. Buy more 3. The price of your retirement investment jumps 25% a month after you buy it. Again, the fundamentals haven't changed. After you finish gloating, what do you do? o. Sell it and lock in your goins b. Stay put and hope for more goin c. Buy more: It could go higher 4 You're Name : Date : a. Definitely not b. Perhaps c. Yes 7. Your company is selling stock to its employees. In three years, management plans to take the compony public. Until then, you won't be able to sell your shares and you will get no dividends. But your investment could multiply as much as 10 times when the company goes public. How much money would you invest? a. None b. Two months' solary c. Four months salary 4. You're investing for retirement, which is 15 years away. Which would you rather do? a. Invest in a money-market fund or guaranteed investment contract, giving up the possibility of major gains, but virtually assuring the safety of your principol b. Invest in a 50-50 mix of bond tunds and stock tunds, in hopes of getting some growth, but also giving yourself some protection in the form of steady income c. Invest in aggressive growth mutual funds whose value will probably fluctuate significantly during the year, but have the potential for impressive gains over five or 10 years 5. You just won a big prize! But which one? It's up to you. a. $2,000 in cash b. A 50% chance to win $5,000 c. A 20% chance to win $15,000 6 A good investment opportunity just came along. But you have to borrow money to get in. Would you take out a loan? SCORING YOUR RISK TOLERANCE To score the quiz, add up the number of answers you gove in each category o-c, then multiply as shown to find your score: points - (a) answers (b) answers (c) answers x 2 = points x3 = points YOUR SCORE You may be a: If you scored 9-14 points 15-21 points 22-27 points Conservative investor Moderate investor Aggressive investor SOURCE: Reprinted with permission Copyright Cleorancs Center inc. Rights Reserved Worldwide. from Dow Jones & Company, Inc, vic 1998 Dow Jones & Compan At points ... Please answer the 7 questions in the survey below. Then, calculate your numerical score using the information at the bottom of the survey. Be sure to indicate whether you are a conservative, moderate or aggressive investor given your score. Please type the alphabetical answer to each question, show your numerical score calculation, and indicate you risk profile. Then, upload your file to canvas. WHAT'S YOUR RISK TOLERANCE? Circle the letter that corresponds to your answer 1. Just 60 days after you put money into an investment, its price falls 20 percent. Assuming none of the fundamentals have changed, what would you do? a Sell to avoid further worry and try something else b. Do nothing and wait for the investment to come back c. Buy more. It was a good investment before, now it's a cheap investment, too. 2. Now look at the previous question another way. Your investment fell 20 percent, but it's part of a portfolio being used to meet investment goals with three different time horizons. 2A. What would you do if the goal were five years away? o. Sell b. Do nothing c. Buy more 2B. What would you do if the goal were 15 years away? a. Sell b. Do nothing c. Buy more 2C. What would you do if the goal were 30 years away? a. Sell b. Do nothing c. Buy more 3. The price of your retirement investment jumps 25% a month after you buy it. Again, the fundamentals haven't changed. After you finish gloating, what do you do? o. Sell it and lock in your goins b. Stay put and hope for more goin c. Buy more: It could go higher 4 You're Name : Date : a. Definitely not b. Perhaps c. Yes 7. Your company is selling stock to its employees. In three years, management plans to take the compony public. Until then, you won't be able to sell your shares and you will get no dividends. But your investment could multiply as much as 10 times when the company goes public. How much money would you invest? a. None b. Two months' solary c. Four months salary 4. You're investing for retirement, which is 15 years away. Which would you rather do? a. Invest in a money-market fund or guaranteed investment contract, giving up the possibility of major gains, but virtually assuring the safety of your principol b. Invest in a 50-50 mix of bond tunds and stock tunds, in hopes of getting some growth, but also giving yourself some protection in the form of steady income c. Invest in aggressive growth mutual funds whose value will probably fluctuate significantly during the year, but have the potential for impressive gains over five or 10 years 5. You just won a big prize! But which one? It's up to you. a. $2,000 in cash b. A 50% chance to win $5,000 c. A 20% chance to win $15,000 6 A good investment opportunity just came along. But you have to borrow money to get in. Would you take out a loan? SCORING YOUR RISK TOLERANCE To score the quiz, add up the number of answers you gove in each category o-c, then multiply as shown to find your score: points - (a) answers (b) answers (c) answers x 2 = points x3 = points YOUR SCORE You may be a: If you scored 9-14 points 15-21 points 22-27 points Conservative investor Moderate investor Aggressive investor SOURCE: Reprinted with permission Copyright Cleorancs Center inc. Rights Reserved Worldwide. from Dow Jones & Company, Inc, vic 1998 Dow Jones & Compan At points