Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you! Which type(s) of investment security is (arc) reported at fair value in the balance sheet? The income statement reports changes in fair (market)

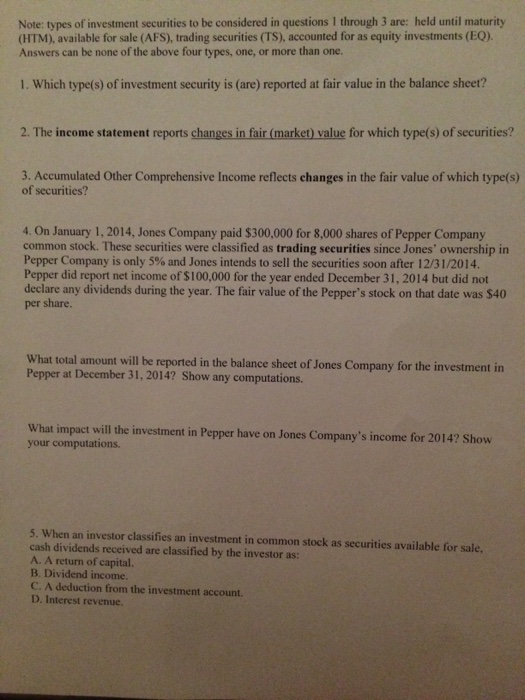

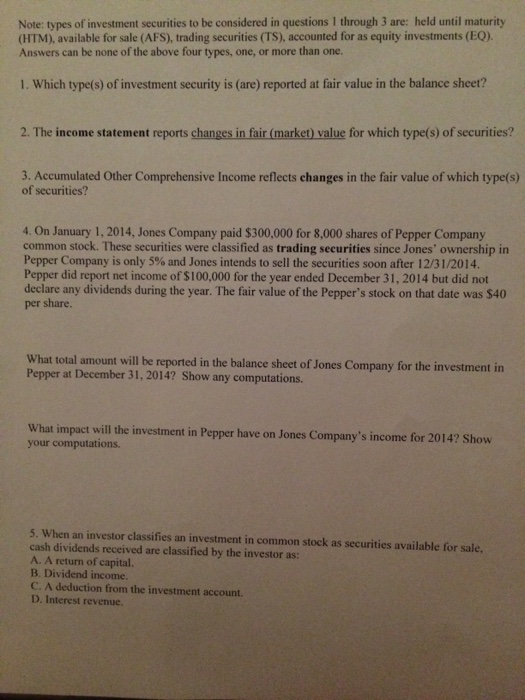

Thank you! Which type(s) of investment security is (arc) reported at fair value in the balance sheet? The income statement reports changes in fair (market) value for which type(s) of securities? Accumulated Other Comprehensive Income reflects changes in the fair value of which type(s) of securities? On January 1, 2014, Jones Company paid $300,000 for 8,000 shares of Pepper Company common stock. These securities were classified as trading securities since Jones' ownership in Pepper Company is only 5% and Jones intends to sell the securities soon after 12/31/2014. Pepper did report net income of $100,000 for the year ended December 31. 2014 but did not declare any dividends during the year. The fair value of the Pepper's stock on that date was $40 per share. What total amount will be reported in the balance sheet of Jones Company for the investment in Pepper at December 31. 2014? Show any computations. What impact will the investment in Pepper have on Jones Company's income for 2014? Show your computations. When an investor classifies an investment in common stock as securities available for sale, cash dividends received are classified by the investor as: A return of capital. Dividend income. A deduction from the investment account. Interest revenue

Thank you! Which type(s) of investment security is (arc) reported at fair value in the balance sheet? The income statement reports changes in fair (market) value for which type(s) of securities? Accumulated Other Comprehensive Income reflects changes in the fair value of which type(s) of securities? On January 1, 2014, Jones Company paid $300,000 for 8,000 shares of Pepper Company common stock. These securities were classified as trading securities since Jones' ownership in Pepper Company is only 5% and Jones intends to sell the securities soon after 12/31/2014. Pepper did report net income of $100,000 for the year ended December 31. 2014 but did not declare any dividends during the year. The fair value of the Pepper's stock on that date was $40 per share. What total amount will be reported in the balance sheet of Jones Company for the investment in Pepper at December 31. 2014? Show any computations. What impact will the investment in Pepper have on Jones Company's income for 2014? Show your computations. When an investor classifies an investment in common stock as securities available for sale, cash dividends received are classified by the investor as: A return of capital. Dividend income. A deduction from the investment account. Interest revenue

Thank you!

Thank you!Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started