Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks! 1. T-Accounts 2. Income Summary and Income Statement Mary Lou Black, M.D., president of Narcolarm, Inc., was in the process of preparing a business

Thanks!

1. T-Accounts

2. Income Summary and Income Statement

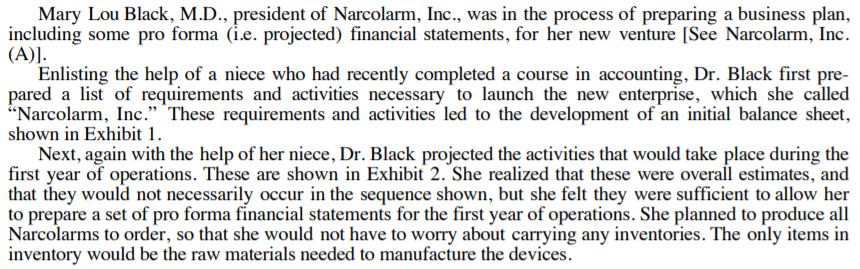

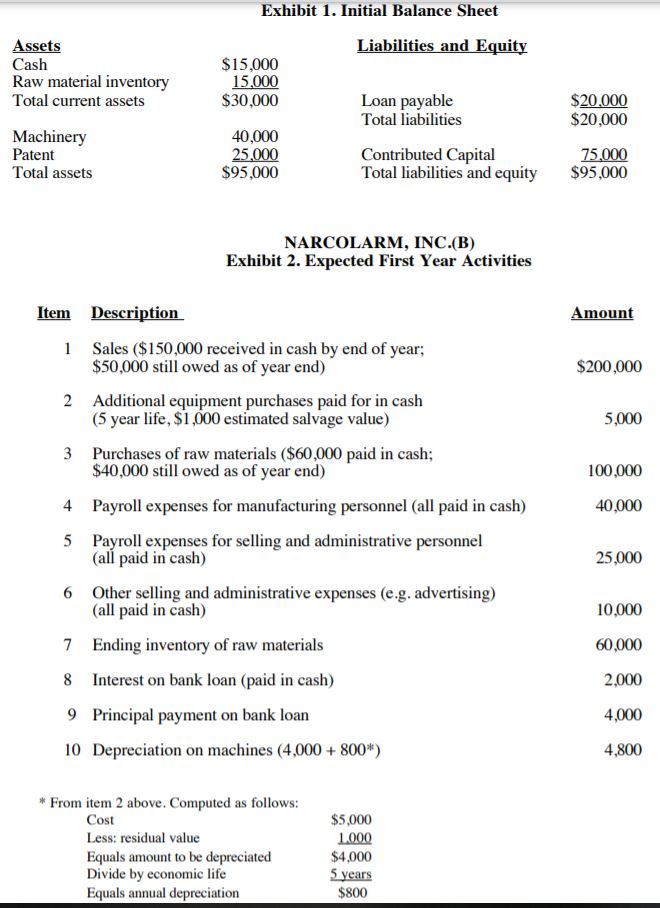

Mary Lou Black, M.D., president of Narcolarm, Inc., was in the process of preparing a business plan, including some pro forma (i.e. projected) financial statements, for her new venture [See Narcolarm, Inc. (A)]. Enlisting the help of a niece who had recently completed a course in accounting, Dr. Black first pre- pared a list of requirements and activities necessary to launch the new enterprise, which she called "Narcolarm, Inc." These requirements and activities led to the development of an initial balance sheet, shown in Exhibit 1. Next, again with the help of her niece, Dr. Black projected the activities that would take place during the first year of operations. These are shown in Exhibit 2. She realized that these were overall estimates, and that they would not necessarily occur in the sequence shown, but she felt they were sufficient to allow her to prepare a set of pro forma financial statements for the first year of operations. She planned to produce all Narcolarms to order, so that she would not have to worry about carrying any inventories. The only items in inventory would be the raw materials needed to manufacture the devices. Exhibit 1. Initial Balance Sheet Liabilities and Equity Assets Cash Raw material inventory Total current assets Machinery Patent Total assets $15,000 15.000 $30,000 $20,000 $20,000 40,000 25,000 $95,000 Loan payable Total liabilities Contributed Capital Total liabilities and equity 75.000 $95,000 NARCOLARM, INC.(B) Exhibit 2. Expected First Year Activities Amount $200,000 5,000 100,000 40,000 Item Description 1 Sales ($150,000 received in cash by end of year; $50,000 still owed as of year end) 2 Additional equipment purchases paid for in cash (5 year life, $1,000 estimated salvage value) 3 Purchases of raw materials ($60,000 paid in cash; $40,000 still owed as of year end) 4 Payroll expenses for manufacturing personnel (all paid in cash) 5 Payroll expenses for selling and administrative personnel (all paid in cash) 6 Other selling and administrative expenses (e.g. advertising) (all paid in cash) 7 Ending inventory of raw materials 8 Interest on bank loan (paid in cash) 9 Principal payment on bank loan 10 Depreciation on machines (4,000 + 800*) 25,000 10,000 60,000 2,000 4,000 4,800 * From item 2 above. Computed as follows: Cost Less: residual value Equals amount to be depreciated Divide by economic life Equals annual depreciation $5,000 1.000 $4,000 5 years $800 Mary Lou Black, M.D., president of Narcolarm, Inc., was in the process of preparing a business plan, including some pro forma (i.e. projected) financial statements, for her new venture [See Narcolarm, Inc. (A)]. Enlisting the help of a niece who had recently completed a course in accounting, Dr. Black first pre- pared a list of requirements and activities necessary to launch the new enterprise, which she called "Narcolarm, Inc." These requirements and activities led to the development of an initial balance sheet, shown in Exhibit 1. Next, again with the help of her niece, Dr. Black projected the activities that would take place during the first year of operations. These are shown in Exhibit 2. She realized that these were overall estimates, and that they would not necessarily occur in the sequence shown, but she felt they were sufficient to allow her to prepare a set of pro forma financial statements for the first year of operations. She planned to produce all Narcolarms to order, so that she would not have to worry about carrying any inventories. The only items in inventory would be the raw materials needed to manufacture the devices. Exhibit 1. Initial Balance Sheet Liabilities and Equity Assets Cash Raw material inventory Total current assets Machinery Patent Total assets $15,000 15.000 $30,000 $20,000 $20,000 40,000 25,000 $95,000 Loan payable Total liabilities Contributed Capital Total liabilities and equity 75.000 $95,000 NARCOLARM, INC.(B) Exhibit 2. Expected First Year Activities Amount $200,000 5,000 100,000 40,000 Item Description 1 Sales ($150,000 received in cash by end of year; $50,000 still owed as of year end) 2 Additional equipment purchases paid for in cash (5 year life, $1,000 estimated salvage value) 3 Purchases of raw materials ($60,000 paid in cash; $40,000 still owed as of year end) 4 Payroll expenses for manufacturing personnel (all paid in cash) 5 Payroll expenses for selling and administrative personnel (all paid in cash) 6 Other selling and administrative expenses (e.g. advertising) (all paid in cash) 7 Ending inventory of raw materials 8 Interest on bank loan (paid in cash) 9 Principal payment on bank loan 10 Depreciation on machines (4,000 + 800*) 25,000 10,000 60,000 2,000 4,000 4,800 * From item 2 above. Computed as follows: Cost Less: residual value Equals amount to be depreciated Divide by economic life Equals annual depreciation $5,000 1.000 $4,000 5 years $800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started