Answered step by step

Verified Expert Solution

Question

1 Approved Answer

22. The TDH Corp. is a taxable entity. Tom, who is the T in TDH, owns 40% of the outstanding common stock of the

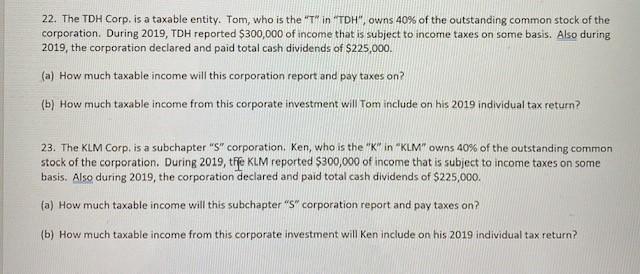

22. The TDH Corp. is a taxable entity. Tom, who is the "T" in "TDH", owns 40% of the outstanding common stock of the corporation. During 2019, TDH reported $300,000 of income that is subject to income taxes on some basis. Also during 2019, the corporation declared and paid total cash dividends of $225,000. (a) How much taxable income will this corporation report and pay taxes on? (b) How much taxable income from this corporate investment will Tom include on his 2019 individual tax return? 23. The KLM Corp. is a subchapter "S" corporation. Ken, who is the "K" in "KLM" owns 40% of the outstanding common stock of the corporation. During 2019, tfe KLM reported $300,000 of income that is subject to income taxes on some basis. Also during 2019, the corporation declared and paid total cash dividends of $225,000. (a) How much taxable income will this subchapter "S" corporation report and pay taxes on? (b) How much taxable income from this corporate investment will Ken include on his 2019 individual tax return?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

22 I As TDH corp is a taxable entity it pay taxes at the corporate level ii They also face the possi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started