Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thanks a A firm is considering installing a sprinkler system to minimize damage in the event of a fire. The sprinkler system will last only

thanks

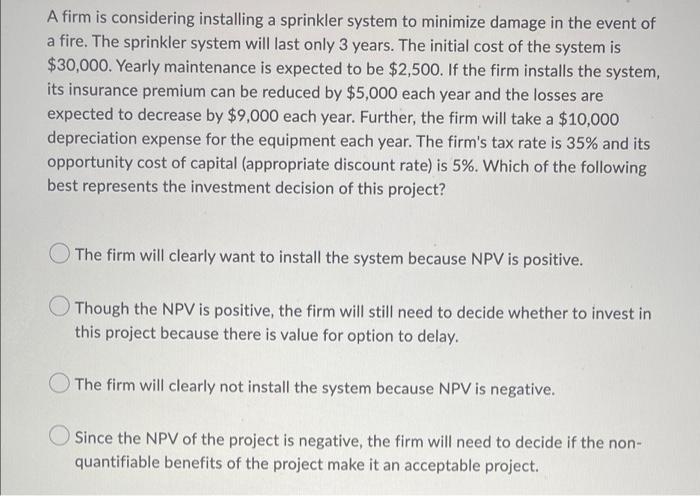

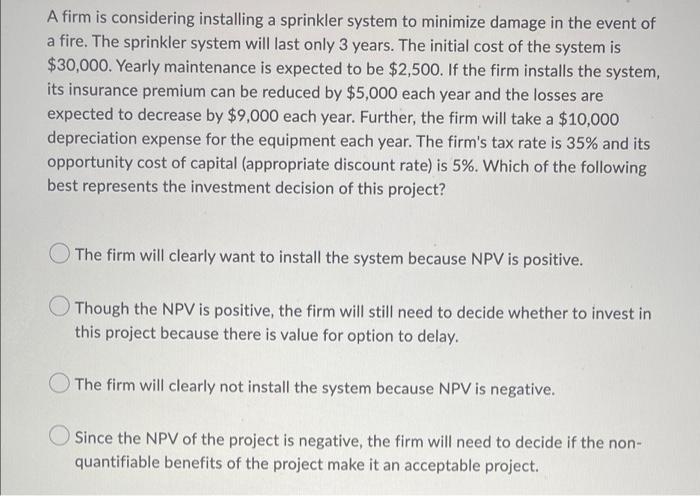

a A firm is considering installing a sprinkler system to minimize damage in the event of a fire. The sprinkler system will last only 3 years. The initial cost of the system is $30,000. Yearly maintenance is expected to be $2,500. If the firm installs the system, its insurance premium can be reduced by $5,000 each year and the losses are expected to decrease by $9,000 each year. Further, the firm will take a $10,000 depreciation expense for the equipment each year. The firm's tax rate is 35% and its opportunity cost of capital (appropriate discount rate) is 5%. Which of the following best represents the investment decision of this project? The firm will clearly want to install the system because NPV is positive. Though the NPV is positive, the firm will still need to decide whether to invest in this project because there is value for option to delay. The firm will clearly not install the system because NPV is negative. Since the NPV of the project is negative, the firm will need to decide if the non- quantifiable benefits of the project make it an acceptable project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started