Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks a lot!! Firm Y produces bottled bee honey. The company has a stirring machine that has been in use for three years. On Jan

Thanks a lot!!

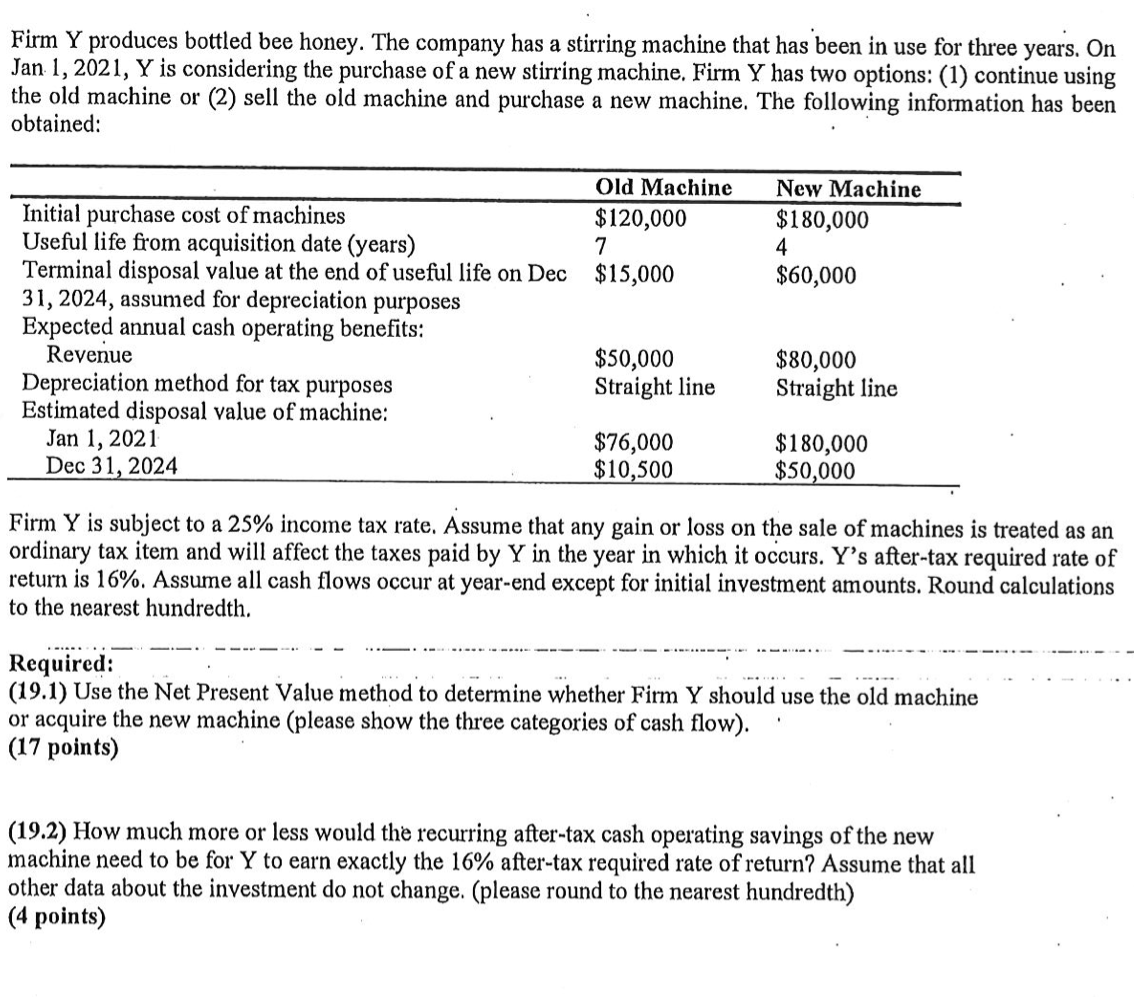

Firm Y produces bottled bee honey. The company has a stirring machine that has been in use for three years. On Jan 1, 2021, Y is considering the purchase of a new stirring machine. Firm Y has two options: (1) continue using the old machine or (2) sell the old machine and purchase a new machine. The following information has been obtained: Firm Y is subject to a 25% income tax rate. Assume that any gain or loss on the sale of machines is treated as an ordinary tax item and will affect the taxes paid by Y in the year in which it occurs. Y's after-tax required rate of return is 16%. Assume all cash flows occur at year-end except for initial investment amounts. Round calculations to the nearest hundredth. Required: (19.1) Use the Net Present Value method to determine whether Firm Y should use the old machine or acquire the new machine (please show the three categories of cash flow). (17 points) (19.2) How much more or less would the recurring after-tax cash operating savings of the new machine need to be for Y to earn exactly the 16% after-tax required rate of return? Assume that all other data about the investment do not change. (please round to the nearest hundredth) (4 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started