Answered step by step

Verified Expert Solution

Question

1 Approved Answer

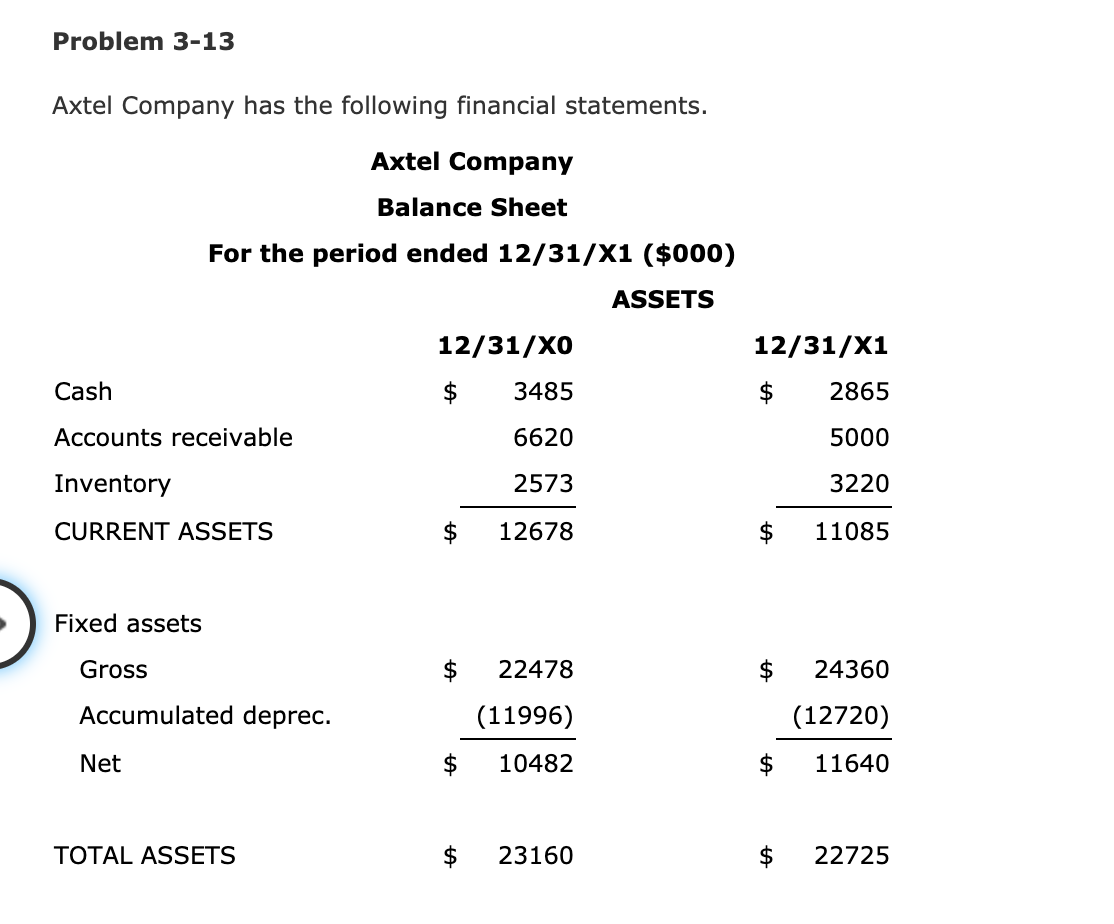

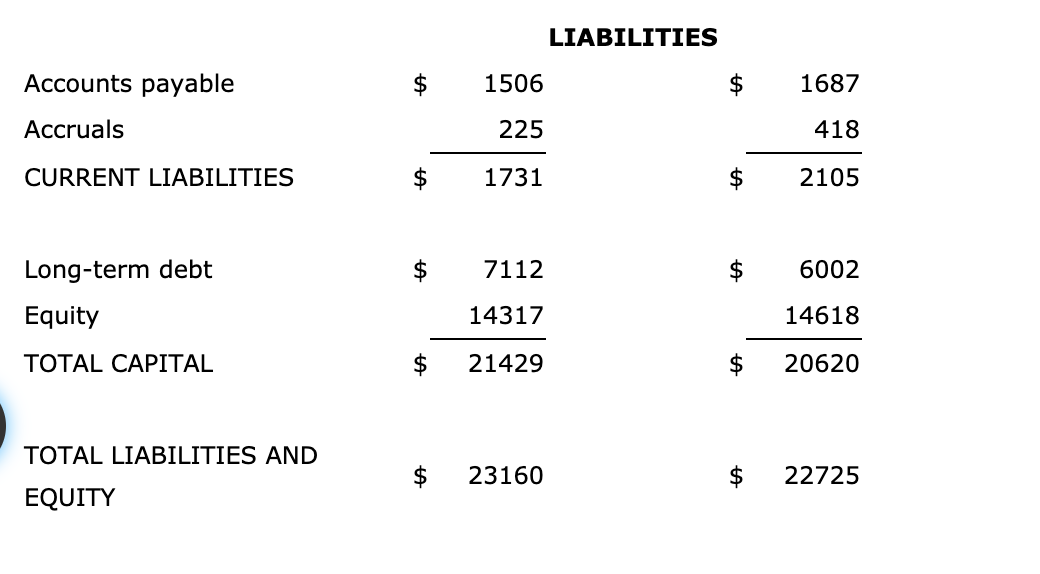

Thanks a lot! Problem 3-13 Axtel Company has the following financial statements. Axtel Company Balance Sheet For the period ended 12/31/X1 ($000) ASSETS 12/31/X1 12/31/10

Thanks a lot!

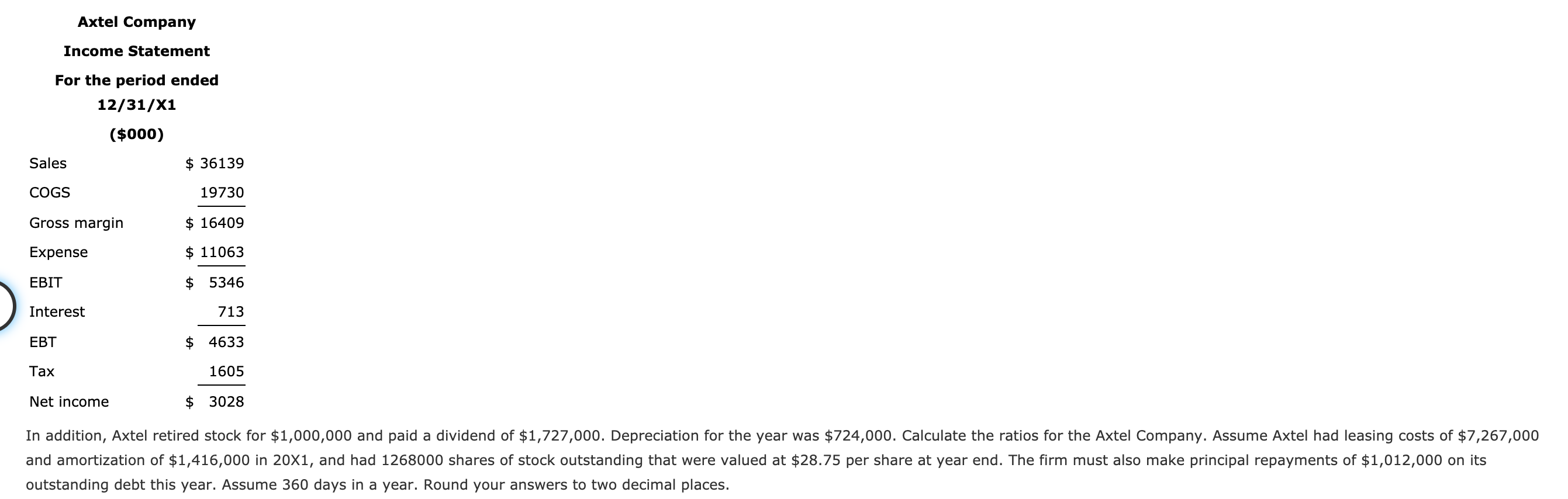

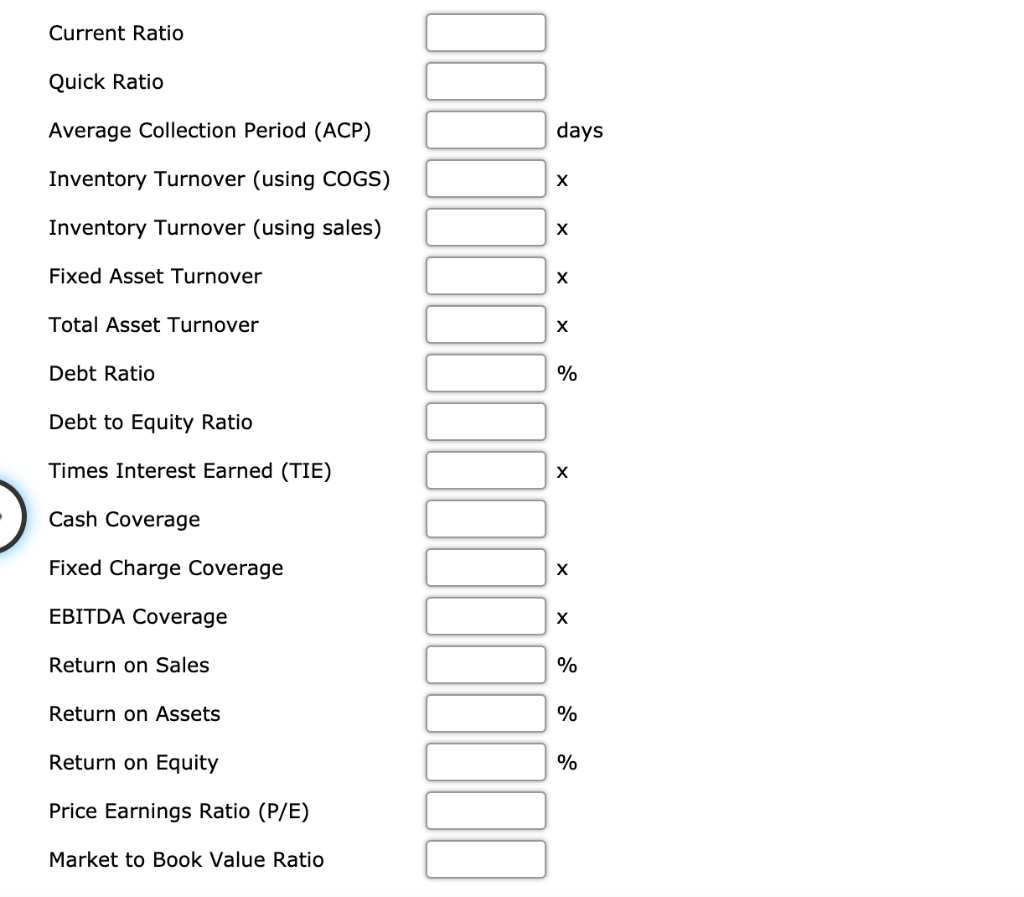

Problem 3-13 Axtel Company has the following financial statements. Axtel Company Balance Sheet For the period ended 12/31/X1 ($000) ASSETS 12/31/X1 12/31/10 $ 3485 Cash $ 2865 Accounts receivable 6620 5000 Inventory 2573 3220 CURRENT ASSETS $ 12678 11085 Fixed assets Gross $ 22478 $ 24360 Accumulated deprec. (11996) (12720) Net $ 10482 11640 TOTAL ASSETS $ 23160 $ 22725 LIABILITIES Accounts payable $ 1506 $ 1687 Accruals 225 418 CURRENT LIABILITIES 1731 2105 $ 7112 $ 6002 Long-term debt Equity 14317 14618 TOTAL CAPITAL 21429 20620 TOTAL LIABILITIES AND $ 23160 $ 22725 EQUITY Axtel Company Income Statement For the period ended 12/31/X1 ($000) Sales $ 36139 COGS 19730 Gross margin $ 16409 Expense $ 11063 EBIT $ 5346 Interest 713 EBT $ 4633 Tax 1605 Net income $ 3028 In addition, Axtel retired stock for $1,000,000 and paid a dividend of $1,727,000. Depreciation for the year was $724,000. Calculate the ratios for the Axtel Company. Assume Axtel had leasing costs of $7,267,000 and amortization of $1,416,000 in 20X1, and had 1268000 shares of stock outstanding that were valued at $28.75 per share at year end. The firm must also make principal repayments of $1,012,000 on its outstanding debt this year. Assume 360 days in a year. Round your answers to two decimal places. Current Ratio Quick Ratio Average Collection Period (ACP) days Inventory Turnover (using COGS) Inventory Turnover (using sales) Fixed Asset Turnover Total Asset Turnover Debt Ratio % Debt to Equity Ratio Times Interest Earned (TIE) Cash Coverage Fixed Charge Coverage EBITDA Coverage Return on Sales % Return on Assets % Return on Equity % Price Earnings Ratio (P/E) Market to Book Value RatioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started