Answered step by step

Verified Expert Solution

Question

1 Approved Answer

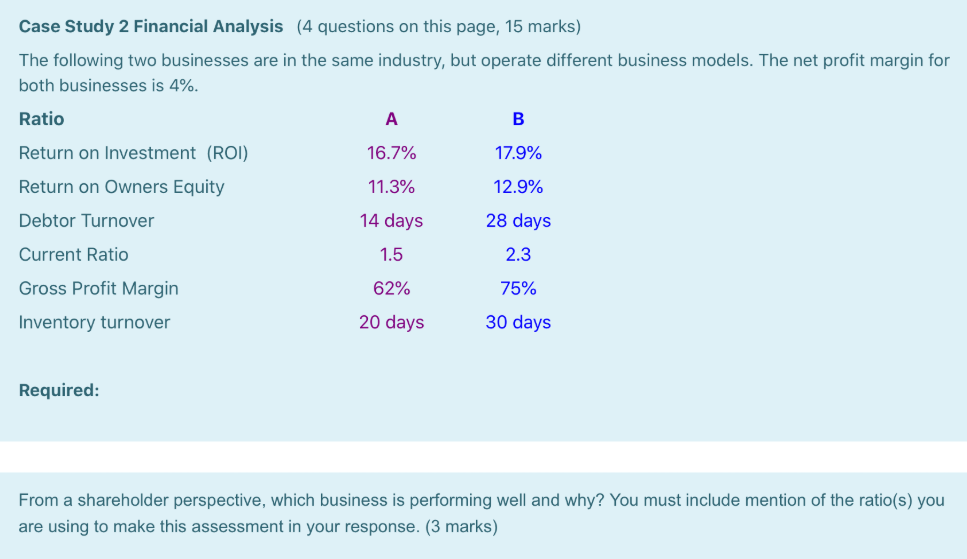

Thanks Case Study 2 Financial Analysis (4 questions on this page, 15 marks) The following two businesses are in the same industry, but operate different

Thanks

Case Study 2 Financial Analysis (4 questions on this page, 15 marks) The following two businesses are in the same industry, but operate different business models. The net profit margin for both businesses is 4%. Ratio A B 16.7% 17.9% Return on Investment (ROI) Return on Owners Equity 11.3% 12.9% Debtor Turnover 14 days 28 days Current Ratio 1.5 2.3 75% Gross Profit Margin Inventory turnover 62% 20 days 30 days Required: From a shareholder perspective, which business is performing well and why? You must include mention of the ratio(s) you are using to make this assessment in your responseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started