Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks for your answer and I have only 10 minutes, first question for the whole table: (Your company wants to invest in a new production

Thanks for your answer and I have only 10 minutes,

first question for the whole table:

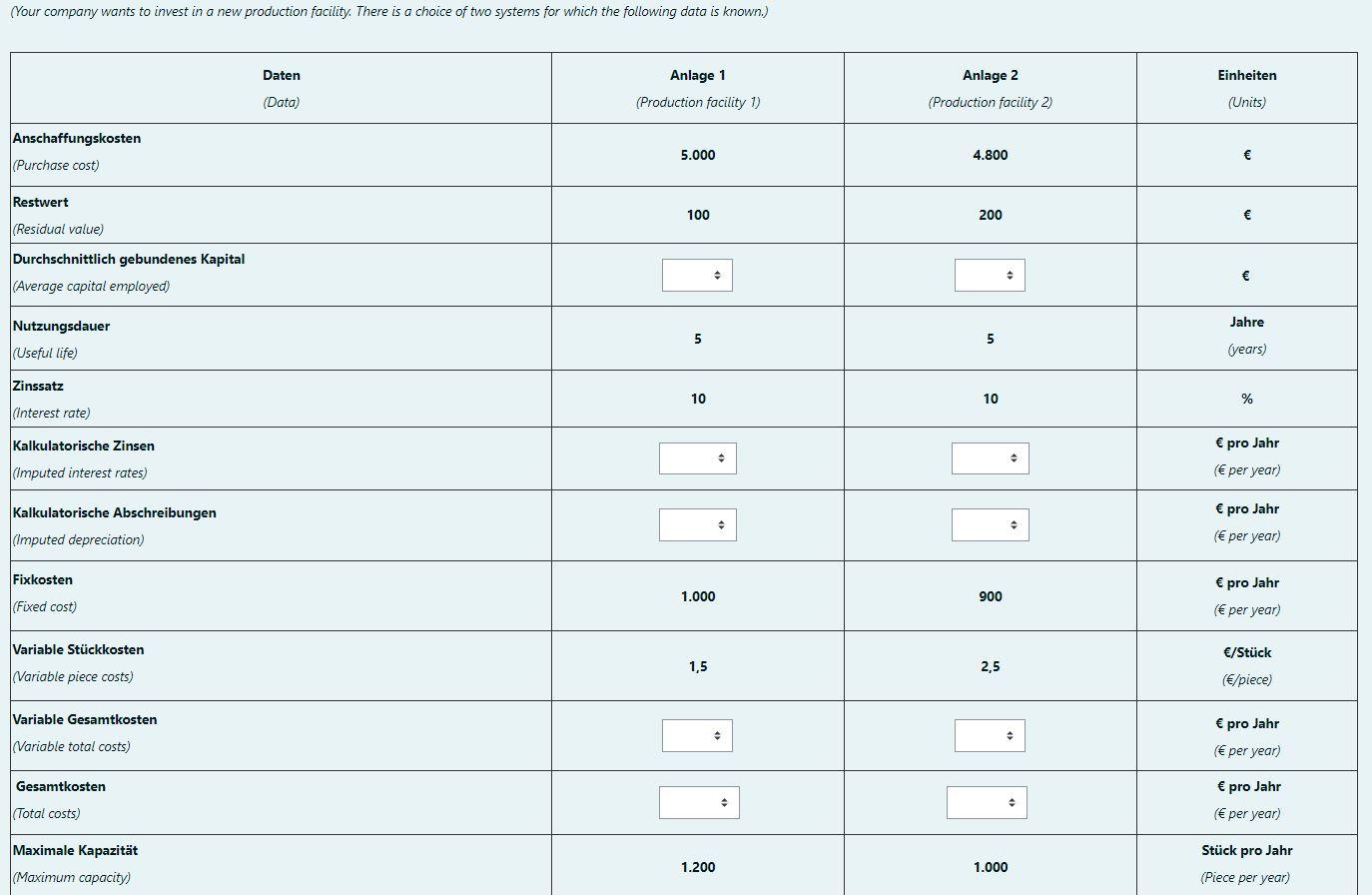

(Your company wants to invest in a new production facility. There is a choice of two systems for which the following data is known.)

To clarify the second question:

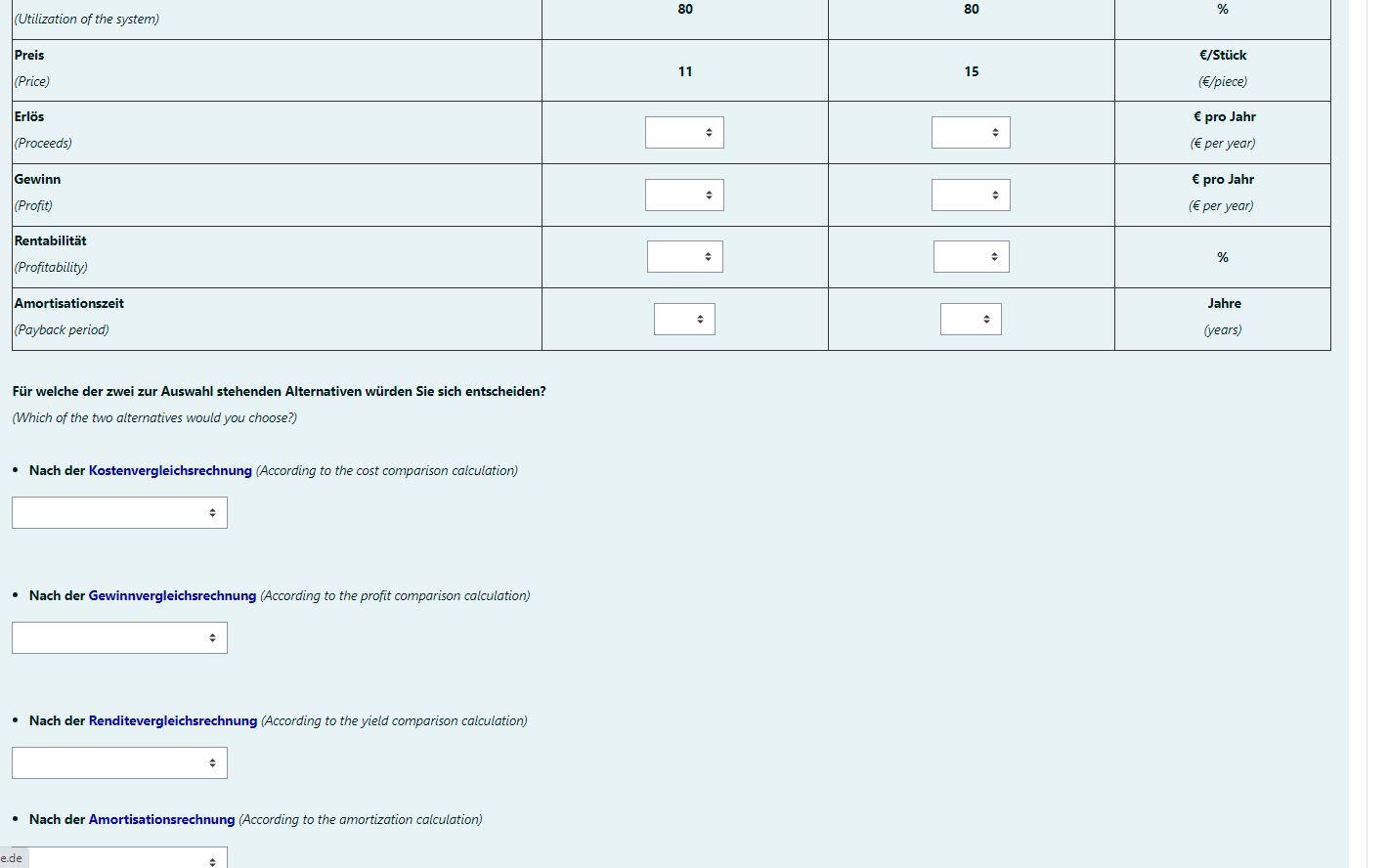

(Which of the two alternatives would you choose?)

2.1: According to the cost comparison calculation)

2.2: (According to the profit comparison calculation)

2.3: According to the yield comparison calculation)

2.4: According to the amortization calculation)

(Your company wants to invest in a new production facility. There is a choice of two systems for which the following data is known.) Daten Einheiten Anlage 1 (Production facility 1) Anlage 2 (Production facility 2) (Data) (Units) Anschaffungskosten 5.000 4.800 (Purchase cost) Restwert 100 200 (Residual value) Durchschnittlich gebundenes Kapital (Average capital employed) . Jahre Nutzungsdauer (Useful life) 5 5 5 (years) Zinssatz 10 10 % (Interest rate) ) Kalkulatorische Zinsen pro Jahr (Imputed interest rates) ( per year) Kalkulatorische Abschreibungen (Imputed depreciation) pro Jahr ( per year) Fixkosten pro Jahr 1.000 900 (Fixed cost) ( per year) Variable Stckkosten /Stck 1,5 2,5 (Variable piece costs) (/piece) Variable Gesamtkosten pro Jahr . (Variable total costs) ( per year) Gesamtkosten pro Jahr (Total costs) ( per year) Stck pro Jahr Maximale Kapazitt (Maximum capacity) 1.200 1.000 (Piece per year) 80 80 % (Utilization of the system) Preis /Stck 11 15 (Price) (/piece) Erls pro Jahr . (Proceeds) ( per year) Gewinn pro Jahr (Profit) ( per year) Rentabilitt % (Profitability) Jahre Amortisationszeit (Payback period) (years) Fr welche der zwei zur Auswahl stehenden Alternativen wrden Sie sich entscheiden? (Which of the two alternatives would you choose?) Nach der Kostenvergleichsrechnung (According to the cost comparison calculation) Nach der Gewinnvergleichsrechnung (According to the profit comparison calculation) Nach der Renditevergleichsrechnung (According to the yield comparison calculation) Nach der Amortisationsrechnung (According to the amortization calculation) e.de (Your company wants to invest in a new production facility. There is a choice of two systems for which the following data is known.) Daten Einheiten Anlage 1 (Production facility 1) Anlage 2 (Production facility 2) (Data) (Units) Anschaffungskosten 5.000 4.800 (Purchase cost) Restwert 100 200 (Residual value) Durchschnittlich gebundenes Kapital (Average capital employed) . Jahre Nutzungsdauer (Useful life) 5 5 5 (years) Zinssatz 10 10 % (Interest rate) ) Kalkulatorische Zinsen pro Jahr (Imputed interest rates) ( per year) Kalkulatorische Abschreibungen (Imputed depreciation) pro Jahr ( per year) Fixkosten pro Jahr 1.000 900 (Fixed cost) ( per year) Variable Stckkosten /Stck 1,5 2,5 (Variable piece costs) (/piece) Variable Gesamtkosten pro Jahr . (Variable total costs) ( per year) Gesamtkosten pro Jahr (Total costs) ( per year) Stck pro Jahr Maximale Kapazitt (Maximum capacity) 1.200 1.000 (Piece per year) 80 80 % (Utilization of the system) Preis /Stck 11 15 (Price) (/piece) Erls pro Jahr . (Proceeds) ( per year) Gewinn pro Jahr (Profit) ( per year) Rentabilitt % (Profitability) Jahre Amortisationszeit (Payback period) (years) Fr welche der zwei zur Auswahl stehenden Alternativen wrden Sie sich entscheiden? (Which of the two alternatives would you choose?) Nach der Kostenvergleichsrechnung (According to the cost comparison calculation) Nach der Gewinnvergleichsrechnung (According to the profit comparison calculation) Nach der Renditevergleichsrechnung (According to the yield comparison calculation) Nach der Amortisationsrechnung (According to the amortization calculation) e.deStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started