Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks for your answered. I will upvote you. QUESTION 3 a) You are considering to construct an optimal portfolio for your company based on the

Thanks for your answered. I will upvote you.

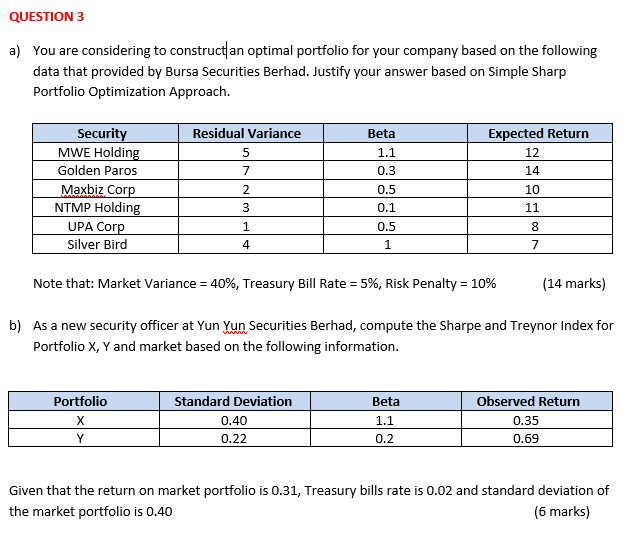

QUESTION 3 a) You are considering to construct an optimal portfolio for your company based on the following data that provided by Bursa Securities Berhad. Justify your answer based on Simple Sharp Portfolio Optimization Approach. Residual Variance Beta 1.1 0.3 Expected Return 12 14 7 Security MWE Holding Golden Paros Maxbiz Corp NTMP Holding UPA Corp Silver Bird 2 3 0.5 0.1 10 11 1 0.5 8 7 4 1 Note that: Market Variance = 40%, Treasury Bill Rate = 5%, Risk Penalty = 10% (14 marks) b) As a new security officer at Yun Yun Securities Berhad, compute the Sharpe and Treynor Index for Portfolio X, Y and market based on the following information. Portfolio Y Standard Deviation 0.40 0.22 Beta 1.1 0.2 Observed Return 0.35 0.69 Given that the return on market portfolio is 0.31, Treasury bills rate is 0.02 and standard deviation of the market portfolio is 0.40 (6 marks) QUESTION 3 a) You are considering to construct an optimal portfolio for your company based on the following data that provided by Bursa Securities Berhad. Justify your answer based on Simple Sharp Portfolio Optimization Approach. Residual Variance Beta 1.1 0.3 Expected Return 12 14 7 Security MWE Holding Golden Paros Maxbiz Corp NTMP Holding UPA Corp Silver Bird 2 3 0.5 0.1 10 11 1 0.5 8 7 4 1 Note that: Market Variance = 40%, Treasury Bill Rate = 5%, Risk Penalty = 10% (14 marks) b) As a new security officer at Yun Yun Securities Berhad, compute the Sharpe and Treynor Index for Portfolio X, Y and market based on the following information. Portfolio Y Standard Deviation 0.40 0.22 Beta 1.1 0.2 Observed Return 0.35 0.69 Given that the return on market portfolio is 0.31, Treasury bills rate is 0.02 and standard deviation of the market portfolio is 0.40 (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started