Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks for your help outflows, if any. eaual the cash flows from Plan B? Round your answer to two decimal places. reinvestment of a project's

Thanks for your help

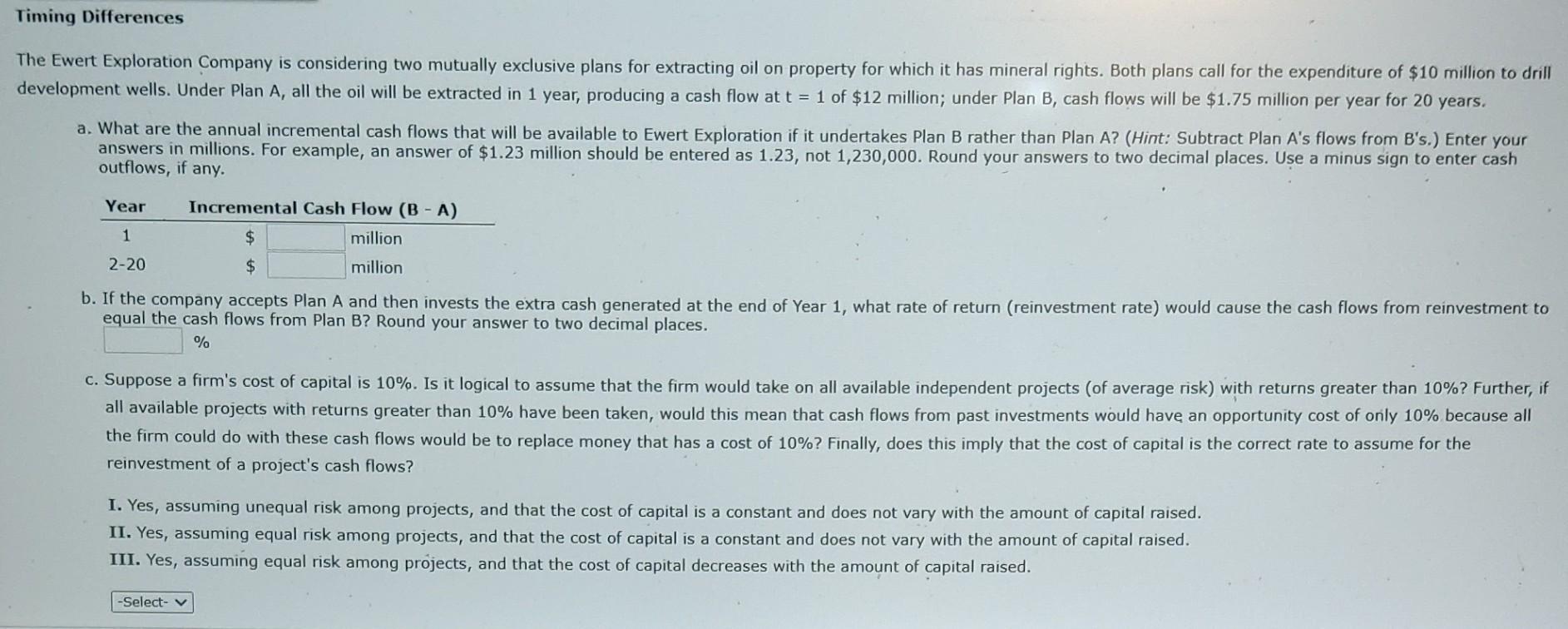

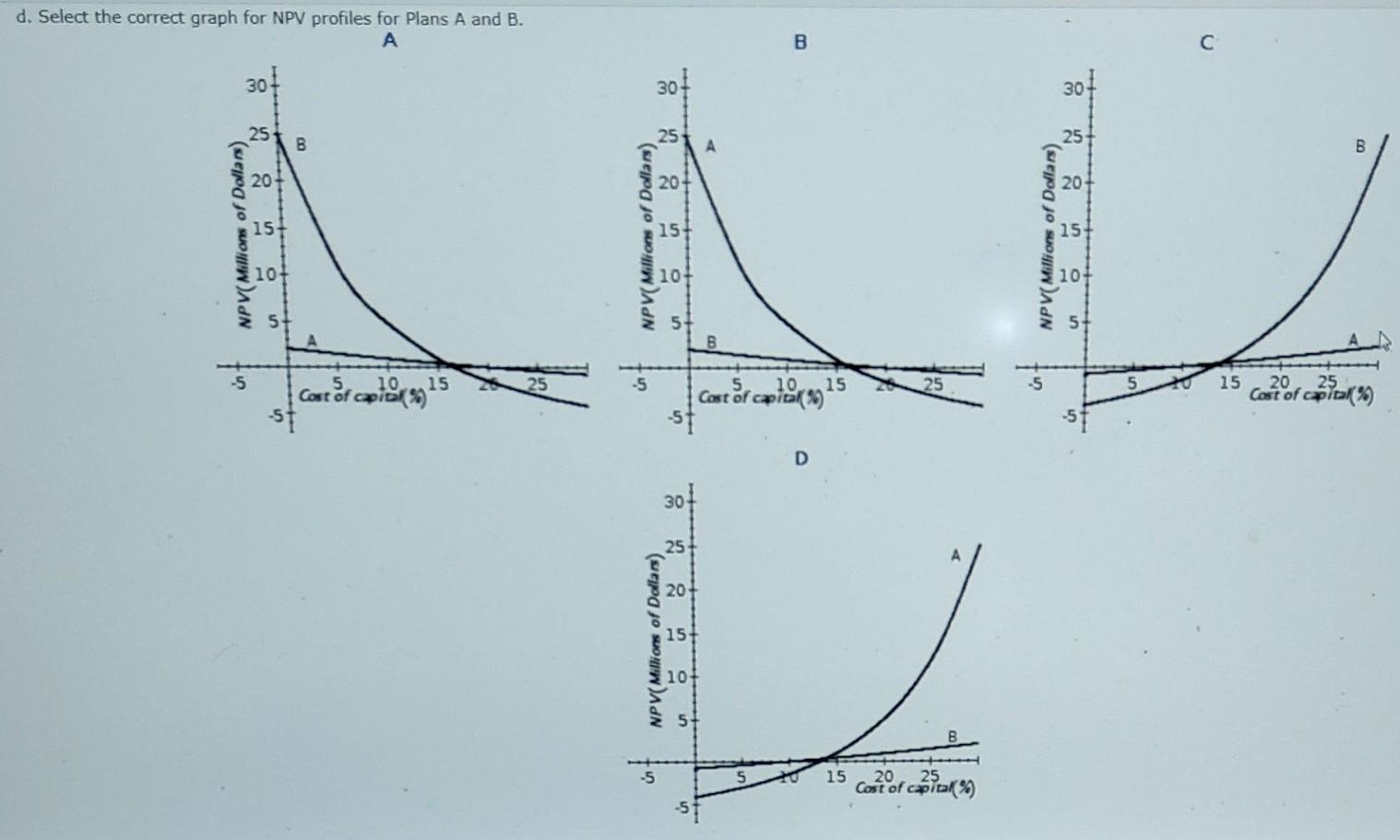

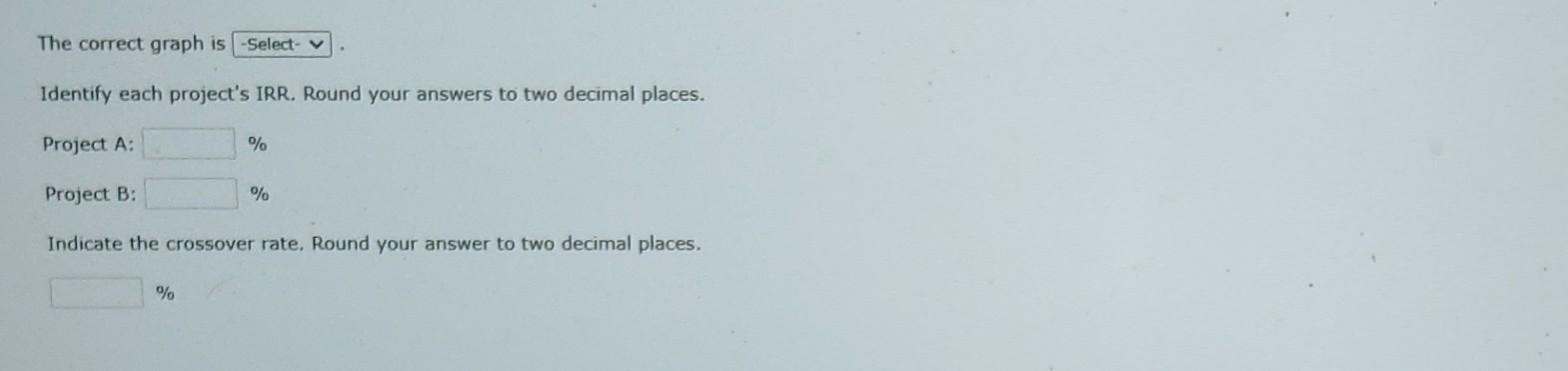

outflows, if any. eaual the cash flows from Plan B? Round your answer to two decimal places. reinvestment of a project's cash flows? I. Yes, assuming unequal risk among projects, and that the cost of capital is a constant and does not the II. Yes, assuming equal risk among projects, and that the cost of capital is a constant and does not III. Yes, assuming equal risk among projects, and that the cost of capital decreases with the amount of capital raised. d. Select the correct graph for NPV profiles for Plans A and B. A The correct graph is Identify each project's IRR. Round your answers to two decimal places. ProjectA:ProjectB:%% Indicate the crossover rate. Round your answer to two decimal places. %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started