Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks for your help!! Please write down the explanation. Olivia deposited $1,700 in a savings account at her bank. Her account will earn an annual

Thanks for your help!! Please write down the explanation.

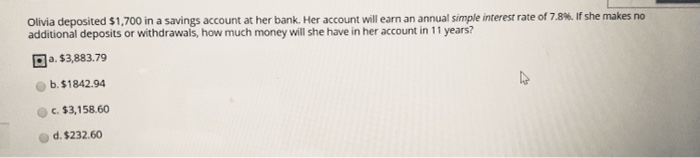

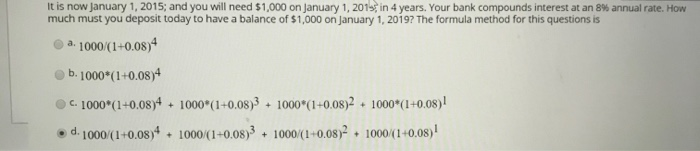

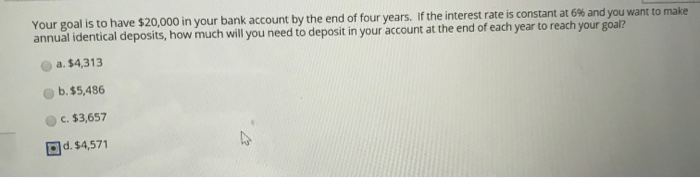

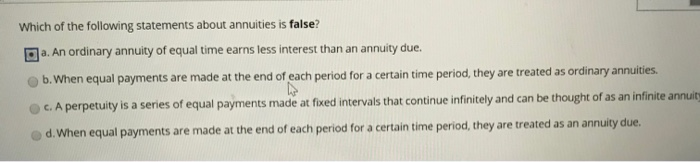

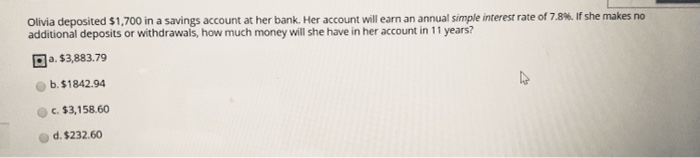

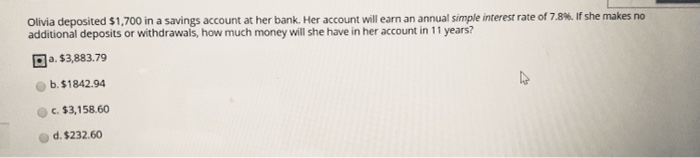

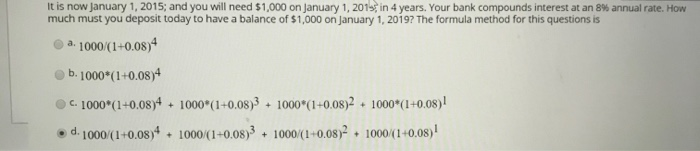

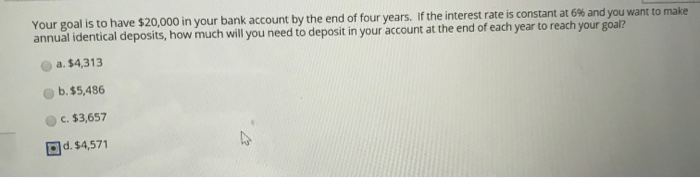

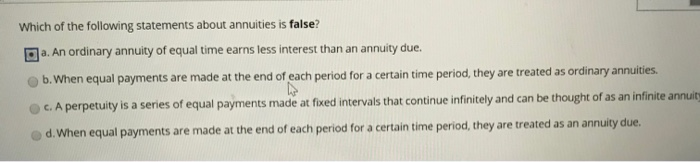

Olivia deposited $1,700 in a savings account at her bank. Her account will earn an annual simple interest rate of 7.8%. If she makes no additional deposits or withdrawals, how much money will she have in her account in 11 years? Ja. $3,883.79 b. $1842.94 c. $3,158.60 d. $232.60 It is now January 1, 2015; and you will need $1,000 on January 1, 2015 in 4 years. Your bank compounds interest at an 8% annual rate. How much must you deposit today to have a balance of $1,000 on January 1, 2019? The formula method for this questions is a. 1000/(1+0.08)4 b.1000*(1+0.08)4 C. 1000*(1+0.08)+ + 1000*(1+0.08)3 + 1000*(1+0.08)2 + 1000*(1+0.08) d. 1000/(1+0.08)4 . 1000/(1+0.08)3 + 1000/(1+0.08)2 . 1000/(1+0.08) Your goal is to have $20,000 in your bank account by the end of four years. If the interest rate is constant at 6% and you want to make annual identical deposits, how much will you need to deposit in your account at the end of each year to reach your goal? a. $4,313 b.$5,486 c. $3,657 d. $4,571 Which of the following statements about annuities is false? a. An ordinary annuity of equal time earns less interest than an annuity due. b. When equal payments are made at the end of each period for a certain time period, they are treated as ordinary annuities. c. A perpetuity is a series of equal payments made at fixed intervals that continue infinitely and can be thought of as an infinite annuity d. When equal payments are made at the end of each period for a certain time period, they are treated as an annuity due

Olivia deposited $1,700 in a savings account at her bank. Her account will earn an annual simple interest rate of 7.8%. If she makes no additional deposits or withdrawals, how much money will she have in her account in 11 years? Ja. $3,883.79 b. $1842.94 c. $3,158.60 d. $232.60 It is now January 1, 2015; and you will need $1,000 on January 1, 2015 in 4 years. Your bank compounds interest at an 8% annual rate. How much must you deposit today to have a balance of $1,000 on January 1, 2019? The formula method for this questions is a. 1000/(1+0.08)4 b.1000*(1+0.08)4 C. 1000*(1+0.08)+ + 1000*(1+0.08)3 + 1000*(1+0.08)2 + 1000*(1+0.08) d. 1000/(1+0.08)4 . 1000/(1+0.08)3 + 1000/(1+0.08)2 . 1000/(1+0.08) Your goal is to have $20,000 in your bank account by the end of four years. If the interest rate is constant at 6% and you want to make annual identical deposits, how much will you need to deposit in your account at the end of each year to reach your goal? a. $4,313 b.$5,486 c. $3,657 d. $4,571 Which of the following statements about annuities is false? a. An ordinary annuity of equal time earns less interest than an annuity due. b. When equal payments are made at the end of each period for a certain time period, they are treated as ordinary annuities. c. A perpetuity is a series of equal payments made at fixed intervals that continue infinitely and can be thought of as an infinite annuity d. When equal payments are made at the end of each period for a certain time period, they are treated as an annuity due

Thanks for your help!! Please write down the explanation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started