Answered step by step

Verified Expert Solution

Question

1 Approved Answer

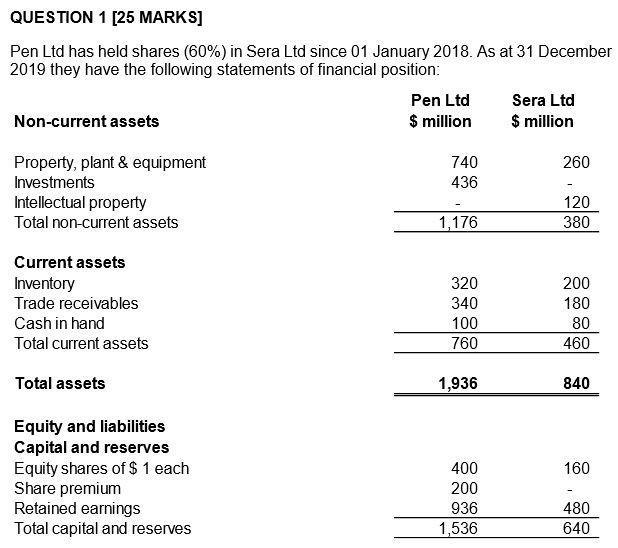

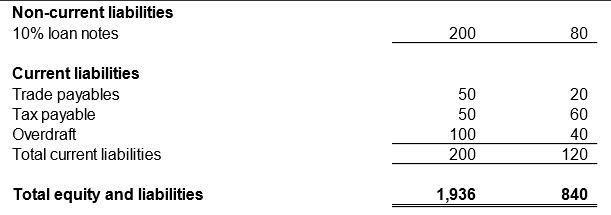

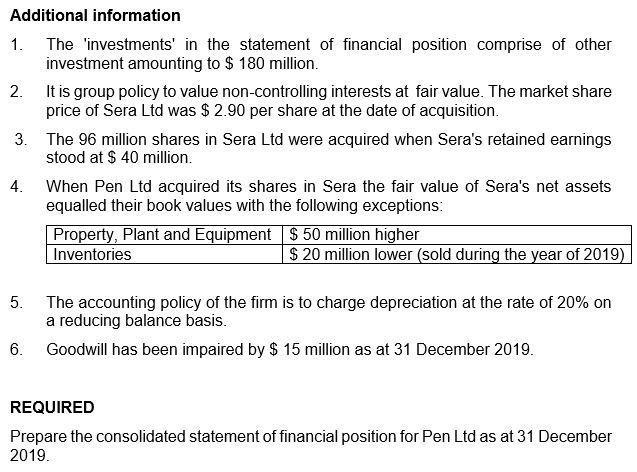

Thanks for your help QUESTION 1 [25 MARKS] Pen Ltd has held shares (60%) in Sera Ltd since 01 January 2018. As at 31 December

Thanks for your help

QUESTION 1 [25 MARKS] Pen Ltd has held shares (60%) in Sera Ltd since 01 January 2018. As at 31 December 2019 they have the following statements of financial position: Pen Ltd Sera Ltd $ million Non-current assets $ million 260 740 436 Property, plant & equipment Investments Intellectual property Total non-current assets 120 380 1,176 Current assets Inventory Trade receivables Cash in hand Total current assets 320 340 100 760 200 180 80 460 Total assets 1,936 840 160 Equity and liabilities Capital and reserves Equity shares of $ 1 each Share premium Retained earnings Total capital and reserves 400 200 936 1,536 480 640 Non-current liabilities 10% loan notes 200 80 Current liabilities Trade payables Tax payable Overdraft Total current liabilities 50 50 100 200 20 60 40 120 Total equity and liabilities 1,936 840 Additional information 1. The 'investments in the statement of financial position comprise of other investment amounting to $ 180 million. 2. It is group policy to value non-controlling interests at fair value. The market share price of Sera Ltd was $ 2.90 per share at the date of acquisition. 3. The 96 million shares in Sera Ltd were acquired when Sera's retained earnings stood at $ 40 million. 4. When Pen Ltd acquired its shares in Sera the fair value of Sera's net assets equalled their book values with the following exceptions: Property, Plant and Equipment $ 50 million higher Inventories $ 20 million lower (sold during the year of 2019) 5. The accounting policy of the firm is to charge depreciation at the rate of 20% on a reducing balance basis. 6. Goodwill has been impaired by $ 15 million as at 31 December 2019. REQUIRED Prepare the consolidated statement of financial position for Pen Ltd as at 31 December 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started