Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks in advance the (7.6) The returm on any stock traded in a financial market is composed of two parts. P that return from the

Thanks in advance

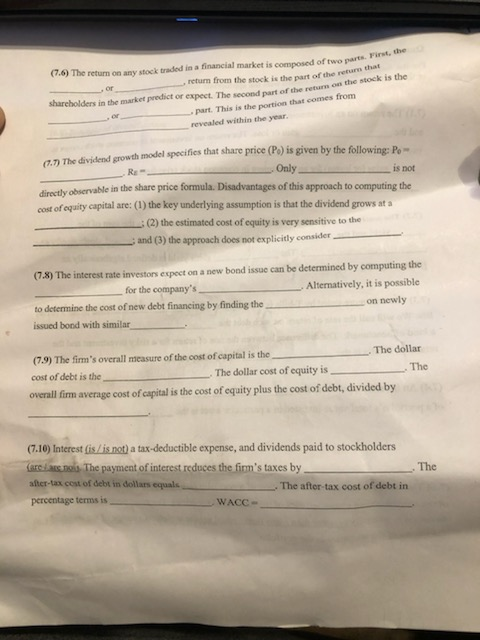

the (7.6) The returm on any stock traded in a financial market is composed of two parts. P that return from the stock is the part of the refurn h part. This is the portion that comes from n on the stock is the sharcholdes in the market preodict or xThet retun revealed within the year 0,7) The dividend growth model specifies that share price (Po) is given by the following: Po 7.7 Only RE- is not directly observable in the share price formula. Disadvantages of this approach to computing the cost of equity capital are: (1) the key underlying assumption is that the dividend grows at a (2) the estimated cost of equity is very sensitive to the and (3) the approach does not explicitly consider (7.8) The interest rate investons expect on a new bond issue can be determined by computing the for the company'sAltermatively, it is possible to determine the cost of new debt financing by finding the issued bond with similar on newly (7.9) The fim's overall measure of the cost of capital is the cost of debt the overall firn average cost of capital is the cost of equity plus the cost of debt, divided by The dollar The is theThe dollar cost of equity is 7.10) Interest lis /is not) a tax-deductible expense, and dividends paid to stockholders payment of interest reduces the firm's taxes by The after-tax cest of debt in dollars equals percentage terms is . The after-tax cost of debt in WACC the (7.6) The returm on any stock traded in a financial market is composed of two parts. P that return from the stock is the part of the refurn h part. This is the portion that comes from n on the stock is the sharcholdes in the market preodict or xThet retun revealed within the year 0,7) The dividend growth model specifies that share price (Po) is given by the following: Po 7.7 Only RE- is not directly observable in the share price formula. Disadvantages of this approach to computing the cost of equity capital are: (1) the key underlying assumption is that the dividend grows at a (2) the estimated cost of equity is very sensitive to the and (3) the approach does not explicitly consider (7.8) The interest rate investons expect on a new bond issue can be determined by computing the for the company'sAltermatively, it is possible to determine the cost of new debt financing by finding the issued bond with similar on newly (7.9) The fim's overall measure of the cost of capital is the cost of debt the overall firn average cost of capital is the cost of equity plus the cost of debt, divided by The dollar The is theThe dollar cost of equity is 7.10) Interest lis /is not) a tax-deductible expense, and dividends paid to stockholders payment of interest reduces the firm's taxes by The after-tax cest of debt in dollars equals percentage terms is . The after-tax cost of debt in WACCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started