Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks in advance you guys rock please make it simple 17. An asset promises to pay the following: $60 each year for the next ten

Thanks in advance you guys rock

please make it simple

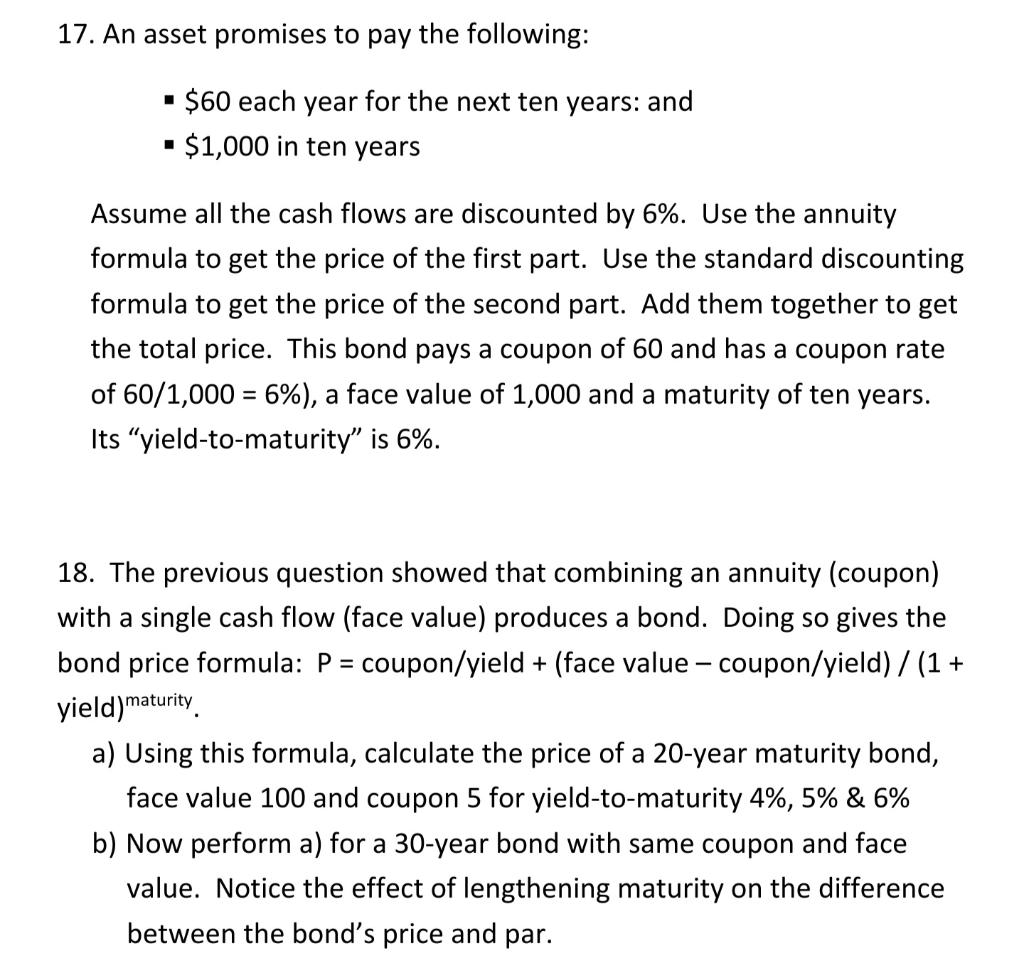

17. An asset promises to pay the following: $60 each year for the next ten years: and $1,000 in ten years Assume all the cash flows are discounted by 6%. Use the annuity formula to get the price of the first part. Use the standard discounting formula to get the price of the second part. Add them together to get the total price. This bond pays a coupon of 60 and has a coupon rate of 60/1,000 = 6%), a face value of 1,000 and a maturity of ten years. Its "yield-to-maturity is 6%. 18. The previous question showed that combining an annuity (coupon) with a single cash flow (face value) produces a bond. Doing so gives the bond price formula: P = coupon/yield + (face value - coupon/yield)/(1+ yield)maturity. a) Using this formula, calculate the price of a 20-year maturity bond, face value 100 and coupon 5 for yield-to-maturity 4%, 5% & 6% b) Now perform a) for a 30-year bond with same coupon and face value. Notice the effect of lengthening maturity on the difference between the bond's price and parStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started