Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thanks Question III ( 30 points) Ultra is smart phone manufacturers, due to the rapid changes in technology, market competition ten minutes intense. Ultra company

thanks

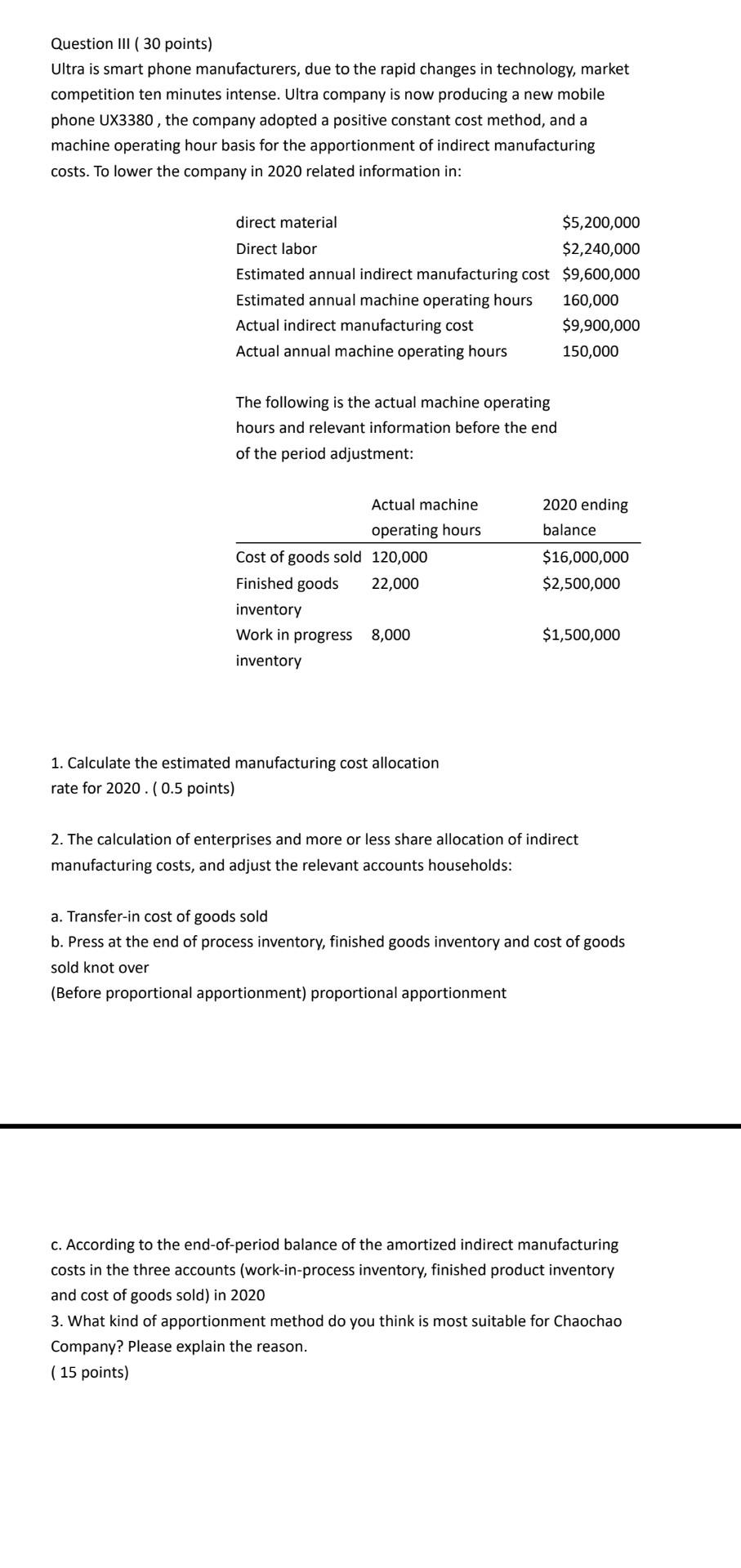

Question III ( 30 points) Ultra is smart phone manufacturers, due to the rapid changes in technology, market competition ten minutes intense. Ultra company is now producing a new mobile phone UX3380, the company adopted a positive constant cost method, and a machine operating hour basis for the apportionment of indirect manufacturing costs. To lower the company in 2020 related information in: direct material $5,200,000 Direct labor $2,240,000 Estimated annual indirect manufacturing cost $9,600,000 Estimated annual machine operating hours 160,000 Actual indirect manufacturing cost $9,900,000 Actual annual machine operating hours 150,000 The following is the actual machine operating hours and relevant information before the end of the period adjustment: 2020 ending balance Actual machine operating hours Cost of goods sold 120,000 Finished goods 22,000 inventory Work in progress 8,000 inventory $16,000,000 $2,500,000 $1,500,000 1. Calculate the estimated manufacturing cost allocation rate for 2020. (0.5 points) 2. The calculation of enterprises and more or less share allocation of indirect manufacturing costs, and adjust the relevant accounts households: a. Transfer-in cost of goods sold b. Press at the end of process inventory, finished goods inventory and cost of goods sold knot over (Before proportional apportionment) proportional apportionment C. According to the end-of-period balance of the amortized indirect manufacturing costs in the three accounts (work-in-process inventory, finished product inventory and cost of goods sold) in 2020 3. What kind of apportionment method do you think is most suitable for Chaochao Company? Please explain the reason. ( 15 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started