Answered step by step

Verified Expert Solution

Question

1 Approved Answer

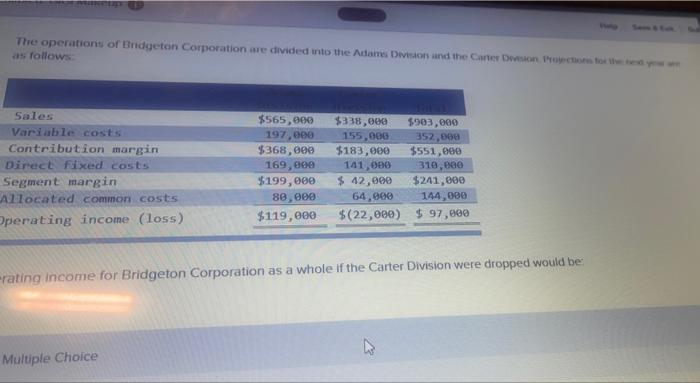

thanks so much thanks so much The operations of Bridgeton Corporation are divided into the Adams Divisaon and the Carter Dein Proyecto as follows Sales

thanks so much

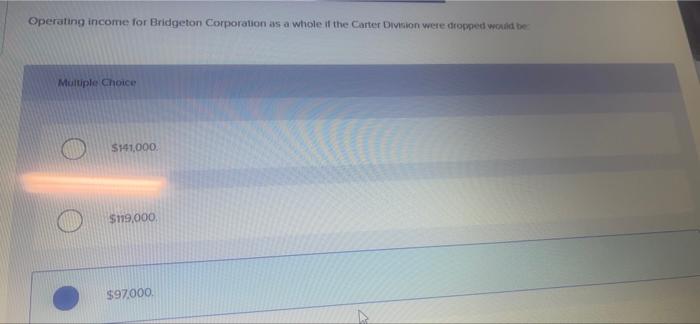

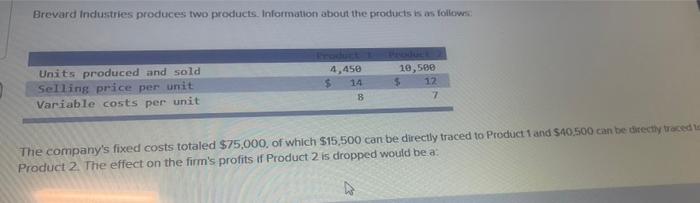

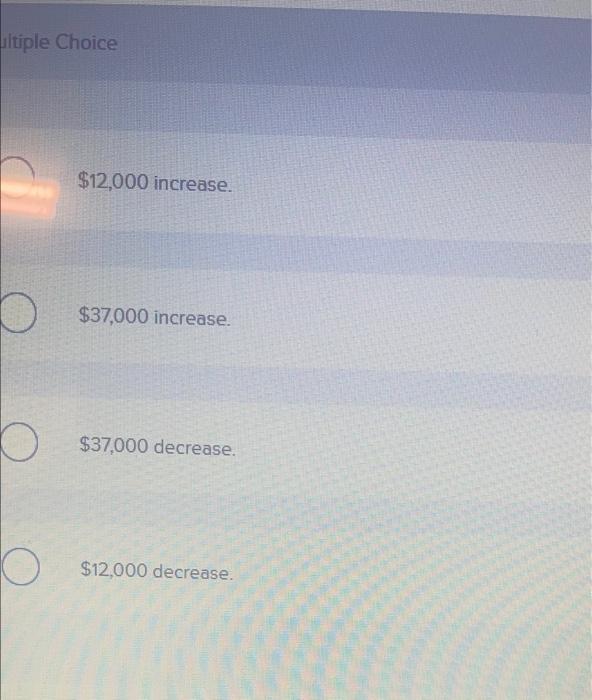

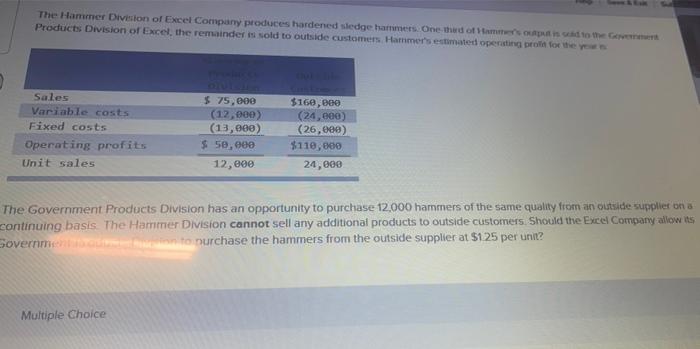

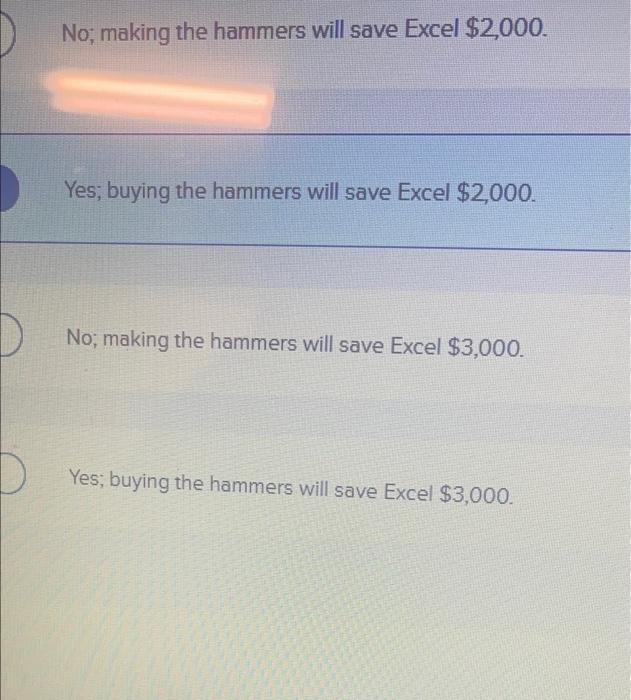

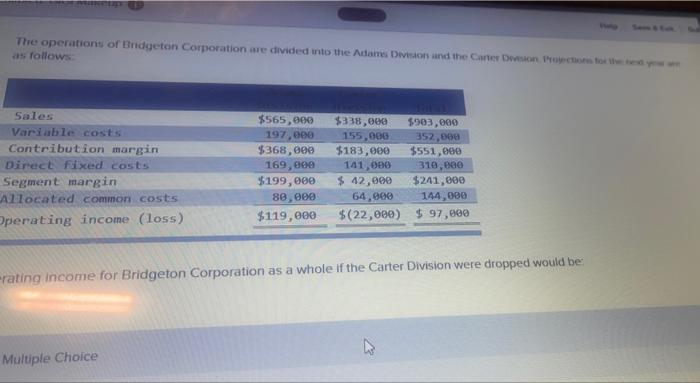

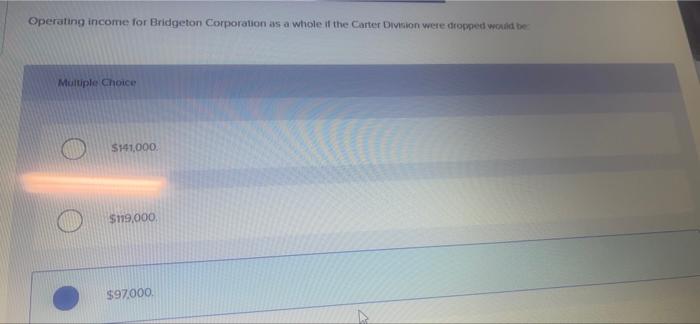

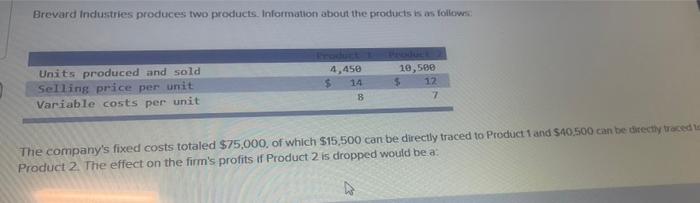

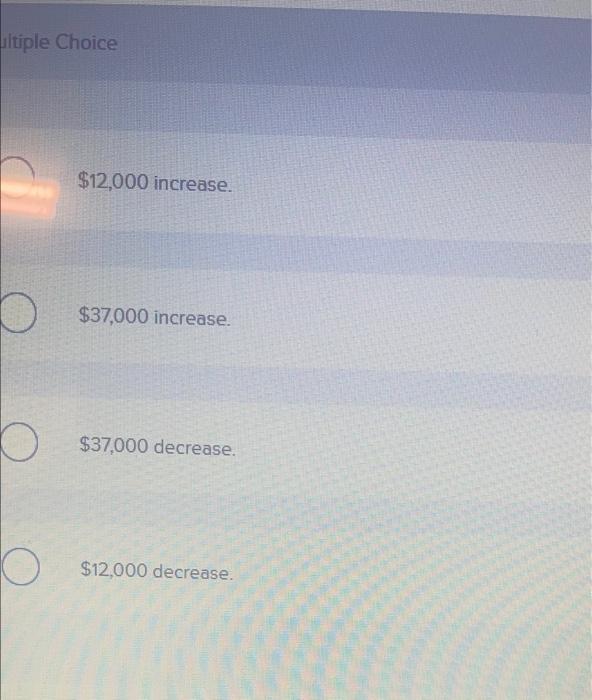

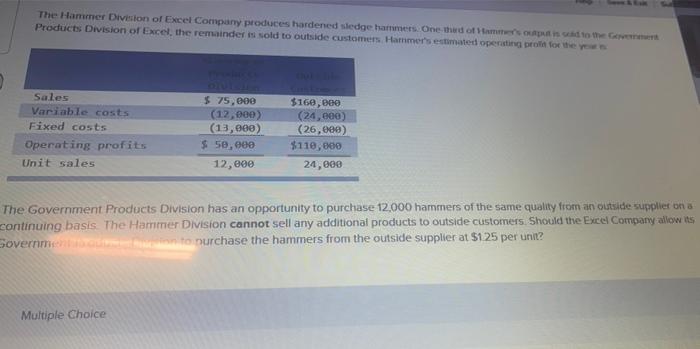

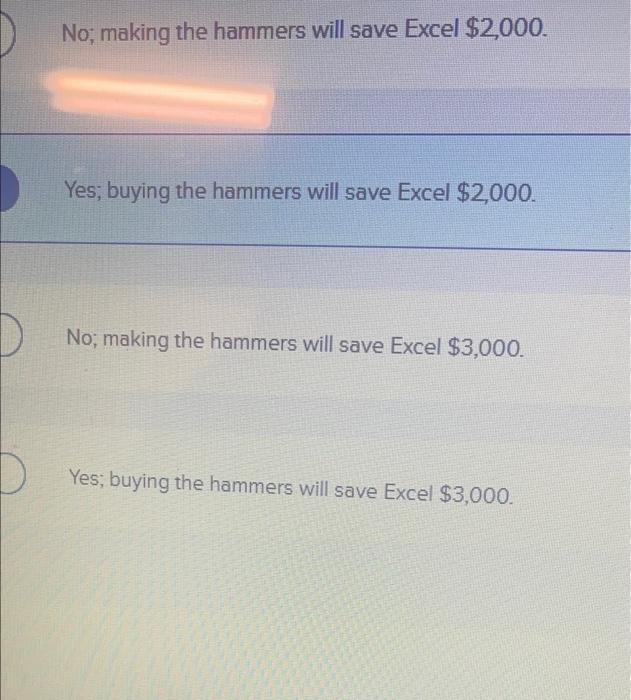

The operations of Bridgeton Corporation are divided into the Adams Divisaon and the Carter Dein Proyecto as follows Sales Variable costs Contribution margin Direct fixed costs Segment margin Allocated common costs Operating income (loss) $565,000 197,000 $368,000 169,800 $199,000 80,000 $119,000 $338,000 $903,000 155,000 352,000 $183, eee $551,000 141,000 310,000 $ 42,000 $241,000 64,800 144,880 $(22,000) $ 97,800 -rating income for Bridgeton Corporation as a whole if the Carter Division were dropped would be Multiple Choice Operating income for Bridgeton Corporation as a whole of the Carter Division were dropped would be Multiple Choice $1,000 $119,000 $97.000 Brevard Industries produces two products. Information about the produs is as follows Units produced and sold Selling price per unit Variable costs per unit 4.450 $ 14 8 10,500 5 12 7 The company's fixed costs totaled $75,000, of which $15,500 can be directly traced to Product and 540,500 can be directly traced to Product 2. The effect on the firm's profits if Product 2 is dropped would be a iltiple Choice $12,000 increase. O $37,000 increase. $37.000 decrease. O $12,000 decrease. The Hammer Division of Excel Company produces hardened sledgehammers. One the famous to the Products Division of Excel, the remainder is sold to outside customers Hammer's estimated operating pro for the Sales Variable costs Fixed costs Operating profits Unit sales $ 75,000 (12,000) (13,980) $50,00 $160,000 (24,000) (26,000) $110,000 24,000 12, eee The Government Products Division has an opportunity to purchase 12,000 hammers of the same quality from an outside supplier on a continuing basis. The Hammer Division cannot sell any additional products to outside customers. Should the Excel Company allow its Sovernment to purchase the hammers from the outside supplier at $125 per unit? Multiple Choice No; making the hammers will save Excel $2,000. Yes, buying the hammers will save Excel $2,000. No, making the hammers will save Excel $3,000. Yes, buying the hammers will save Excel $3,000 thanks so much

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started