thanks

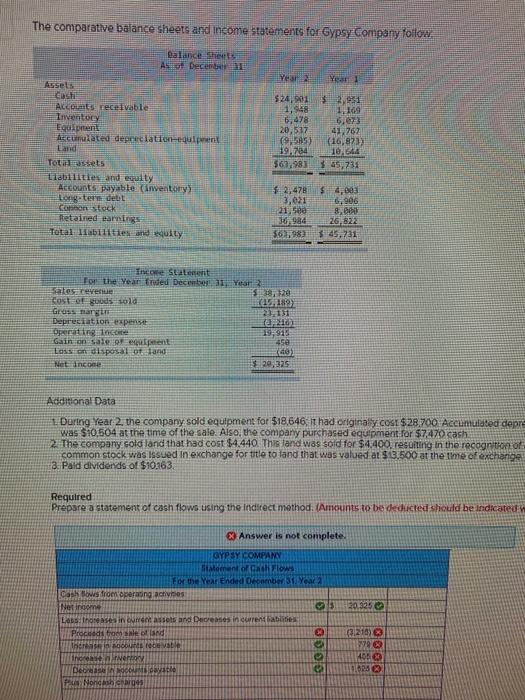

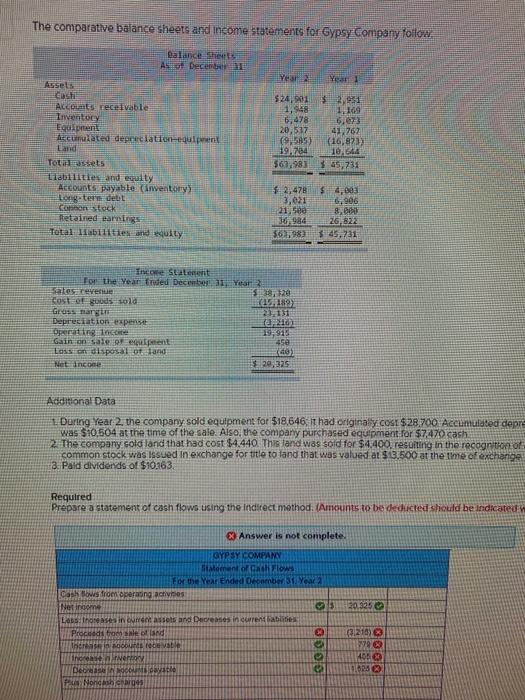

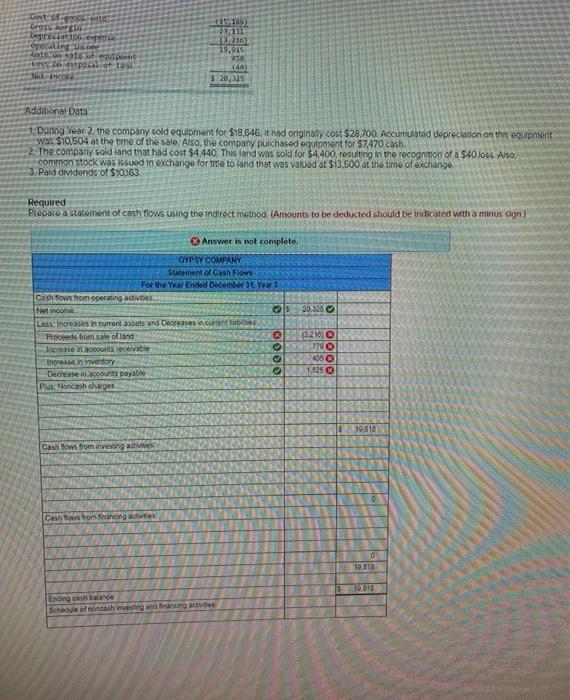

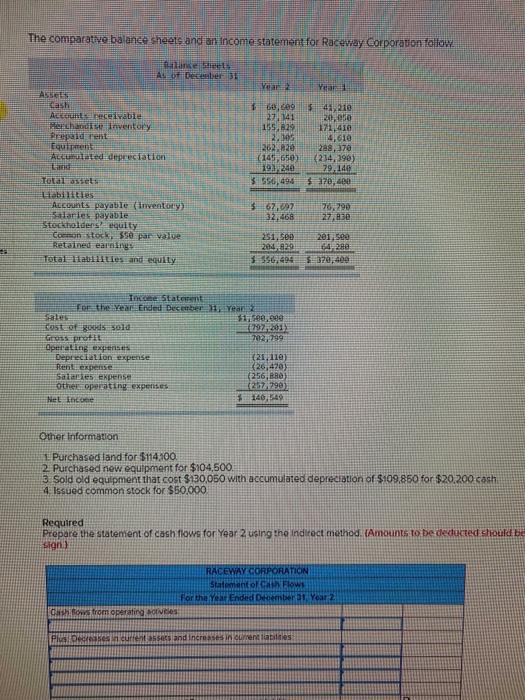

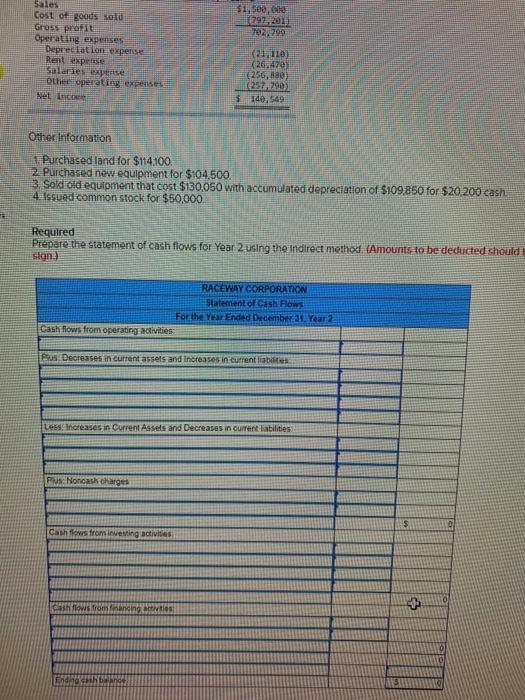

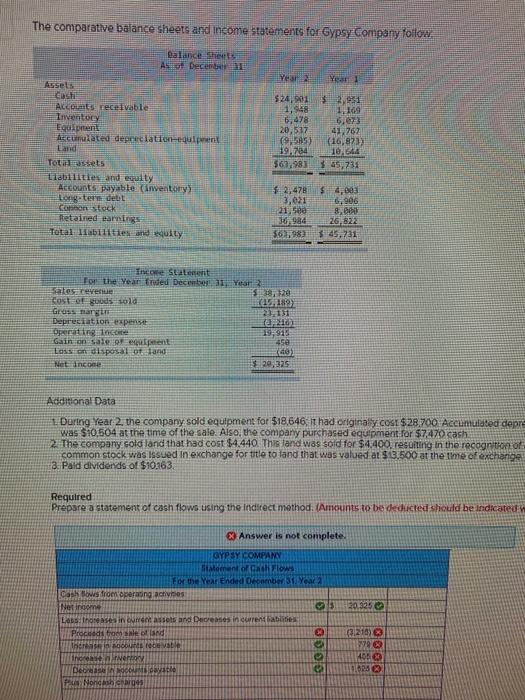

The comparative balance sheets and income Statements for Gypsy Company follow Balance ASDF Decem Year 32.95 $24 1,948 1,478 20,517 Assets Edasti Accounts receivable Inventory Equipment Acumulated depreciation equipment Larid Tot assets Liabilities and enalty Accounts payable inventory Longtere dett soiton stock retained earnings Total liabilities and equity 15,073 412262 16,8713 10,6 65,731 19.784 $67,987 2,478 $ 4,003 3,031 6906 21. See 8 0934 26 822 $6,983 45.731 Income Statement for the Year Ended Decembar 2 Batcevere S, 720 fost of ouds sold Depreciation expense Operating Inco Gain on sateen Lasse Bisposal of land het Inco e 210 1591 458 do) 329,325 Additional Data 1. During Year 2. the company sold equipment for $18,646, I had original y cost $28.700 Accumulated depre was $10.504 at the time of the sale. Also, the company purchased equipment for $7.470 cash 2. The company sold land that had cost $4.440. This land was sold for $4.400, resulting in the recognition of common stock was issued in exchange for titlo to land that was valued at $ 3.500 at the time of exchange 3. Pald dividends of $10.963. Required Prepare a statement of cash flows using the Indirect method. (Amounts to be deducted should be indicated 3 Answer is not complete. GYPSY COMPANY Statement of Glow For the Year Ended contier 31 Year? Cash ofron opera ng activities Net Income 20.325.2 Les horases incurrent assets and Deresin current babit Proceeds trams of land (1218) the reove WA 4053 100 Fonds 2005 @DOS Conto sol Gross Depreciation expe Ogece sorun Geguent Los polo lad 189) 11 2101 19.15 (de) $ 20,325 Additional Data During Year 2, the company sold equipment for $18.646, it had originally cost $28.700 Accumulated depreciation on this equipment was $10,504 at the ume of the sale. Ako the company purchased equipment for $7470 cash 9. The company cold and that had cost $4.440. This land was sold for $4,400, resulting in the recognition of a $40 loss. Also, common stock was issued in exchange for tite to land that was valued at $13.500 at the time of exchange 3. Pald dividends of $10.163. Required Prepare a statement of cash flows using the Indirect method (Anmounts to be decirted should be indicated with a minus aign) 3 Answer is not complete. GYPSY COMPANY Statement of Cash Flow For the Year Ended December 31 Year 2 Cash flows from operating at Ne conse Os 20.325 Less Increases incurrent assets and Decreases incurrentes Proceeds come of land 3210) Increase in counts receivable 7700 Increase in inventory 4053 Decrease in counts payable 1.525 Pos No cash charges OOOOO 19 818 Cash flow from investing activities Cash flow from fancing 0 D Ending asli Schedule of cash lovesting and financing The comparative balance sheets and an income statement for Raceway Corporation follow et All of December 31 Van Year 1 ASSES tas Altreceivable Merchandise Inventory repaid rent Equipment Anated depreciation 1 0,09 15 41 210 27 141 2,950 165,829 171410 2.00 4.610 26220 28,370 (149 650) 234.1987 19240 29,140 350.4940, Total assets Lailes Accounts payable (Inventory) Salaries payaule Stockholders quity Common stock, sse par valve Retained earning Total Ilabilities and equity $67,97 32,468 20290 27, BD 251. See 2011 500 204,929 14, 2e 3356.404 370,400 ce State ne the Year Ended December Year Sales 9,29 05 Rosso 22.11 Go proti 27999 Operating expenses Depreciation expense (21.110) Rent expense 26,420 salaries expense (256 BRD the operating expenses (257290 Hel income 146.14 Other Information 1 Purchased land for $114100 2. Purchased new equipment for $104,500. 3. Sold old equipment that cost $130,050 with accumulated depreciation of $109.850 for $20,200 cash 4 Issued common stock for $50.000 Required Prepare the statement of cash flows for Year 2 using the Indirect method (Amounts to be deducted should be sign) RACEWAY CORPORATION Statement of Flow For the Year Ended Desember Year 2 Cashionstrom operating at Plus Des current and increases in tatiles Sales Cost of goods sold Gross profit Operating expenses Deprecatlon expense Rent expens 5100, 297, 2013 200 the operating expenses Set Inc 110) 26,4707 256,80 052290 140,549 Other Information Purchased land for $114 100. 2. Purchased new equipment for $104.500 3. Sold old equipment that cost $130.050 with accumulated depreciation of $109,850 for $20, 200 cash 4 Issued common stock for $50,000 Required Prepare the statement of cash flows for Year 2 using the Indirect methof. {Amounts to be deducted should RACEWAY CORPORATION Statement of Cash Flows For the Year Ended December 31 Year 2 Cash flows from operating activities Po Decreases the current assets and increases in current liable Les increases in Current Assets and Decreases incurrent abilities PS Noncash charges Cash flows from westing activities cash flows from fibanding at 3 Ending and