Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THANKS THUMBS UP The following information relates to Johnson, Inc.'s overhead costs for the month: Click the icon to view the information.) Requirements 1. Compute

THANKS

THUMBS UP

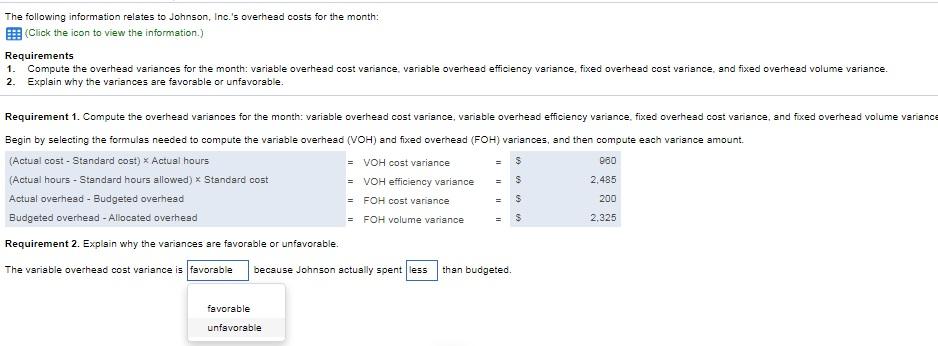

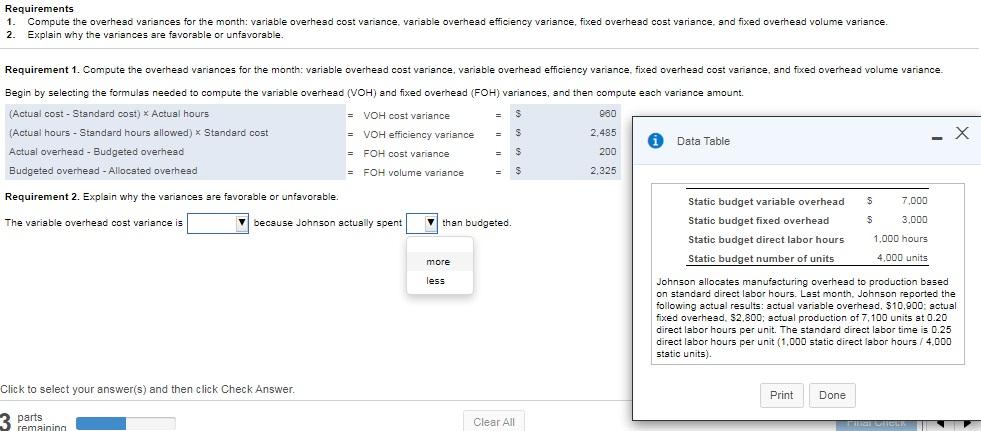

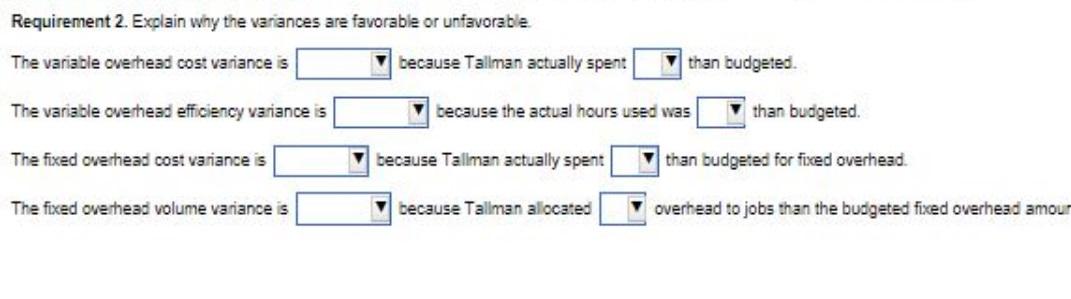

The following information relates to Johnson, Inc.'s overhead costs for the month: Click the icon to view the information.) Requirements 1. Compute the overhead variances for the month: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable. $ A 2,485 Requirement 1. Compute the overhead variances for the month: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance Begin by selecting the formulas needed to compute the variable overhead (VOH) and fixed overhead (FOH) variances, and then compute each variance amount. (Actual cost - Standard cost) * Actual hours = VOH cost variance 960 (Actual hours - Standard hours allowed) * Standard cost = VOH efficiency variance Actual overhead - Budgeted overhead = FOH cost variance Budgeted overhead - Allocated overhead = FOH volume variance 2,325 Requirement 2. Explain why the variances are favorable or unfavorable. The variable overhead cost variance is favorable because Johnson actually spent less than budgeted = $ 200 $ favorable unfavorable Requirements 1. Compute the overhead variances for the month: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable. . Requirement 1. Compute the overhead variances for the month: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance Begin by selecting the formulas needed to compute the variable overhead (VOH) and fixed overhead (FOH) variances, and then compute each variance amount. (Actual cost - Standard cost) * Actual hours = VOH cost variance $ 980 (Actual hours - Standard hours allowed) x Standard cost = VOH efficiency variance s 2.485 Data Table Actual overhead - Budgeted overhead = FOH cost variance $ 200 Budgeted overhead - Allocated overhead = FOH volume variance $ 2.325 -X Requirement 2. Explain why the variances are favorable or unfavorable. $ 7,000 3.000 The variable overhead cost variance is because Johnson actually spent than budgeted Static budget variable overhead Static budget fixed overhead Static budget direct labor hours Static budget number of units 1,000 hours more 4,000 units less Johnson allocates manufacturing overhead to production based on standard direct labor hours. Last month. Johnson reported the following actual results: actual variable overhead, $10.900: actual fixed overhead, S2.800; actual production of 7,100 units at 0.20 direct labor hours per unit. The standard direct labor time is 0.25 direct labor hours per unit (1.000 static direct labor hours / 4.000 static units). Click to select your answer(s) and then click Check Answer. . Print Done 3 parts remaining Clear All Requirement 2. Explain why the variances are favorable or unfavorable The variable overhead cost variance is because Tallman actually spent than budgeted The variable overhead efficiency variance is because the actual hours used was than budgeted. The fixed overhead cost variance is because Tallman actually spent than budgeted for fixed overhead. The fixed overhead volume variance is because Tallman allocated overhead to jobs than the budgeted fixed overhead amour

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started