Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thanks You have an arrangement with your broker to request 1.060 shares of all available IPOs Suppose that 10% of the time, the IPOs very

thanks

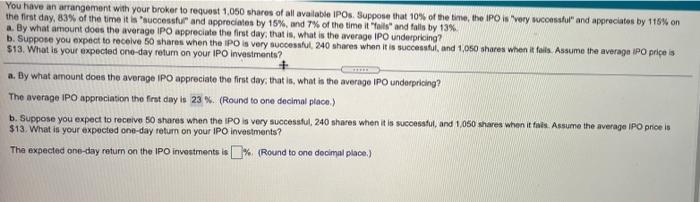

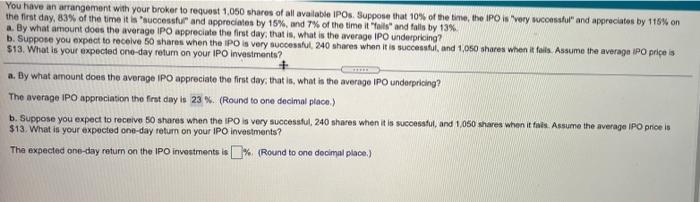

You have an arrangement with your broker to request 1.060 shares of all available IPOs Suppose that 10% of the time, the IPOs very successful and appreciates by 178% on the first day, 83% of the time it is successful and appreciates by 15%, and 7% of the time it "ails and falls by 13% a By what amount does the average IPO appreciate the first day, that is what is the average IPO underpricing? b. Suppose you expect to receive 50 shares when the IPO a very successful 240 shares when it is successful and 1,050 shares when it falls. Assume the average IPO price is $13. What is your expected one-day return on your IPO investments a. By what amount does the average IPO appreciate the first day that is what is the average IPO underpricing? The average IPO appreciation the first day is 23%. (Round to one decimal place.) b. Suppose you expect to receive 50 shares when the IPO is very successful, 240 shares when it is successful and 1050 shares when it fols. Assume the average IPO prices $13. What is your expected one-day return on your IPO investments? The expected one-day return on the IPO investments % (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started