Answered step by step

Verified Expert Solution

Question

1 Approved Answer

that all bonds' expected returns exactly equal 5%4 What will be the stated interest rates of the senior and junior bonds, respectively? (b) (1 point)

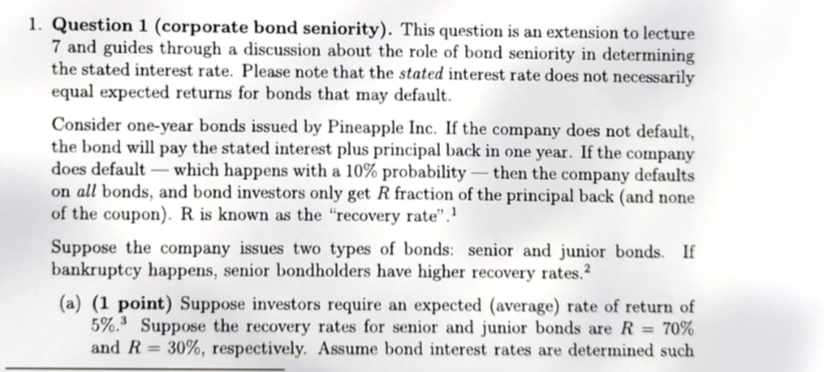

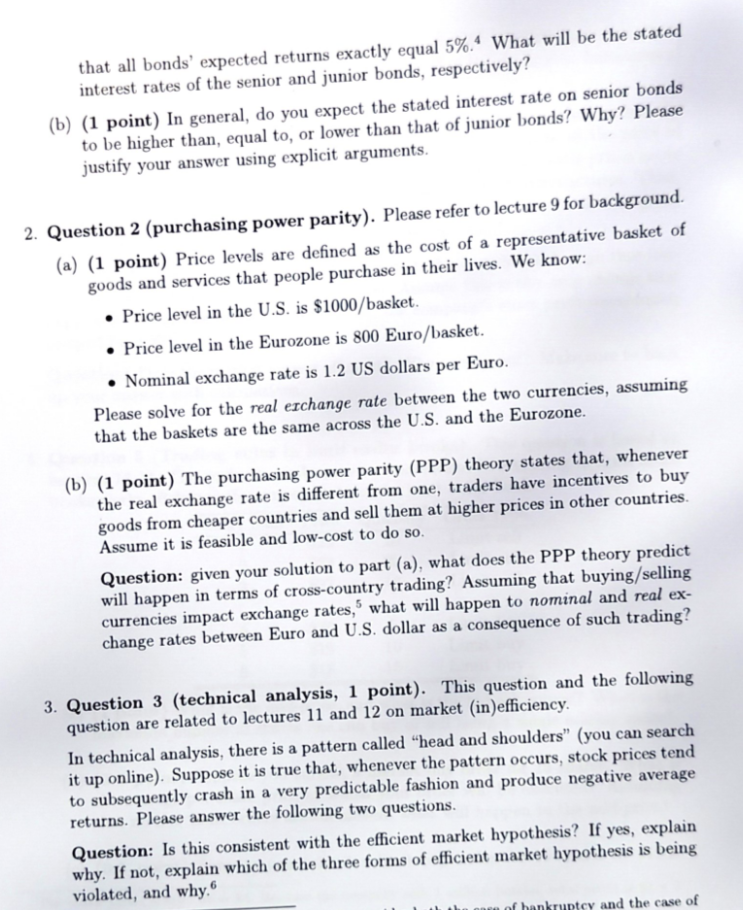

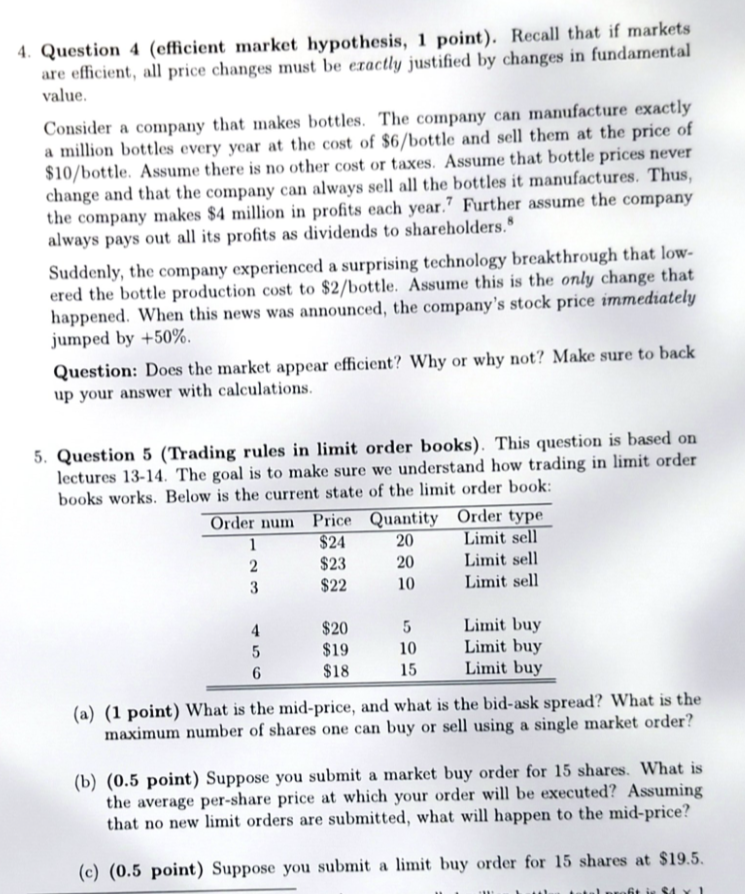

that all bonds' expected returns exactly equal 5%4 What will be the stated interest rates of the senior and junior bonds, respectively? (b) (1 point) In general, do you expect the stated interest rate on senior bonds to be higher than, equal to, or lower than that of junior bonds? Why? Please justify your answer using explicit arguments. 2. Question 2 (purchasing power parity). Please refer to lecture 9 for background. (a) (1 point) Price levels are defined as the cost of a representative basket of goods and services that people purchase in their lives. We know: - Price level in the U.S. is $1000/ basket. - Price level in the Eurozone is 800 Euro/basket. - Nominal exchange rate is 1.2 US dollars per Euro. Please solve for the real exchange rate between the two currencies, assuming that the baskets are the same across the U.S. and the Eurozone. (b) (1 point) The purchasing power parity (PPP) theory states that, whenever the real exchange rate is different from one, traders have incentives to buy goods from cheaper countries and sell them at higher prices in other countries. Assume it is feasible and low-cost to do so. Question: given your solution to part (a), what does the PPP theory predict will happen in terms of cross-country trading? Assuming that buying/selling currencies impact exchange rates, 5 what will happen to nominal and real exchange rates between Euro and U.S. dollar as a consequence of such trading? 3. Question 3 (technical analysis, 1 point). This question and the following question are related to lectures 11 and 12 on market (in)efficiency. In technical analysis, there is a pattern called "head and shoulders" (you can search it up online). Suppose it is true that, whenever the pattern occurs, stock prices tend to subsequently crash in a very predictable fashion and produce negative average returns. Please answer the following two questions. Question: Is this consistent with the efficient market hypothesis? If yes, explain why. If not, explain which of the three forms of efficient market hypothesis is being violated, and why. 6 1. Question 1 (corporate bond seniority). This question is an extension to lecture 7 and guides through a discussion about the role of bond seniority in determining the stated interest rate. Please note that the stated interest rate does not necessarily equal expected returns for bonds that may default. Consider one-year bonds issued by Pineapple Inc. If the company does not default, the bond will pay the stated interest plus principal back in one year. If the company does default - which happens with a 10% probability - then the company defaults on all bonds, and bond investors only get R fraction of the principal back (and none of the coupon). R is known as the "recovery rate". 1 Suppose the company issues two types of bonds: senior and junior bonds. If bankruptcy happens, senior bondholders have higher recovery rates. 2 (a) (1 point) Suppose investors require an expected (average) rate of return of 5%3 Suppose the recovery rates for senior and junior bonds are R=70% and R=30%, respectively. Assume bond interest rates are determined such Where would your order be inserted into the limit order book ?9 What will be the mid-price and bid-ask spread after the submission of your limit order? 4. Question 4 (efficient market hypothesis, 1 point). Recall that if markets are efficient, all price changes must be exactly justified by changes in fundamental value. Consider a company that makes bottles. The company can manufacture exactly a million bottles every year at the cost of $6/ bottle and sell them at the price of $10/ bottle. Assume there is no other cost or taxes. Assume that bottle prices never change and that the company can always sell all the bottles it manufactures. Thus, the company makes $4 million in profits each year. 7 Further assume the company always pays out all its profits as dividends to shareholders. 8 Suddenly, the company experienced a surprising technology breakthrough that lowered the bottle production cost to $2/ bottle. Assume this is the only change that happened. When this news was announced, the company's stock price immediately jumped by +50%. Question: Does the market appear efficient? Why or why not? Make sure to back up your answer with calculations. 5. Question 5 (Trading rules in limit order books). This question is based on lectures 13-14. The goal is to make sure we understand how trading in limit order books works. Below is the current state of the limit order book: (a) (1 point) What is the mid-price, and what is the bid-ask spread? What is the maximum number of shares one can buy or sell using a single market order? (b) (0.5 point) Suppose you submit a market buy order for 15 shares. What is the average per-share price at which your order will be executed? Assuming that no new limit orders are submitted, what will happen to the mid-price? (c) (0.5 point) Suppose you submit a limit buy order for 15 shares at $19.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started