Answered step by step

Verified Expert Solution

Question

1 Approved Answer

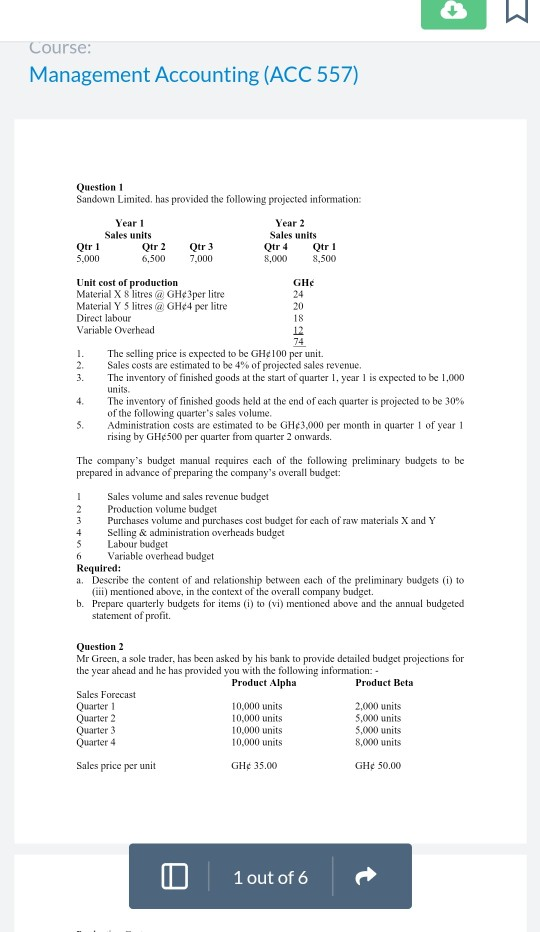

that is all for the information 3 Course: Management Accounting (ACC 557) Question 1 Sandown Limited. has provided the following projected information: Year 1 Sales

that is all for the information

3 Course: Management Accounting (ACC 557) Question 1 Sandown Limited. has provided the following projected information: Year 1 Sales units Otr 1 Qtr 3 Year 2 Sales units Qtr 4 Qtr 1 8.000 8,500 Otr 2 6,500 5,000 7,000 18 4. Unit cost of production GHE Material X 8 litres @ GH3per litre 24 Material Y 5 litres @ GH4 per litre 20 Direct labour Variable Overhead 74 1. The selling price is expected to be GH100 per unit. 2 Sales costs are estimated to be 4% of projected sales revenue. 3. The inventory of finished goods at the start of quarter 1, year 1 is expected to be 1,000 units. The inventory of finished goods held at the end of each quarter is projected to be 30% of the following quarter's sales volume. 5. Administration costs are estimated to be GH43,000 per month in quarter of year 1 rising by GH500 per quarter from quarter 2 onwards. The company's budget manual requires cach of the following preliminary budgets to be prepared in advance of preparing the company's overall budget: 1 Sales volume and sales revenue budget Production volume budget 3 Purchases volume and purchases cost budget for each of raw materials X and Y 4 Selling & administration overheads budget Labour budget 6 Variable overhead budget Required: a. Describe the content of and relationship between each of the preliminary budgets (1) to (iii) mentioned above, in the context of the overall company budget. b. Prepare quarterly budgets for items (i) to (vi) mentioned above and the annual budgeted statement of profit 2 5 Question 2 Mr Green, a sole trader, has been asked by his bank to provide detailed budget projections for the year ahead and he has provided you with the following information: Product Alpha Product Beta Sales Forecast Quarter 1 10,000 units 2,000 units Quarter 2 10,000 units 5,000 units Quarter 3 10,000 units 5,000 units Quarter 4 10,000 units 8,000 units Sales price per unit GH 35,000 GH 500,000 1 out of 6 3 Course: Management Accounting (ACC 557) Question 1 Sandown Limited. has provided the following projected information: Year 1 Sales units Otr 1 Qtr 3 Year 2 Sales units Qtr 4 Qtr 1 8.000 8,500 Otr 2 6,500 5,000 7,000 18 4. Unit cost of production GHE Material X 8 litres @ GH3per litre 24 Material Y 5 litres @ GH4 per litre 20 Direct labour Variable Overhead 74 1. The selling price is expected to be GH100 per unit. 2 Sales costs are estimated to be 4% of projected sales revenue. 3. The inventory of finished goods at the start of quarter 1, year 1 is expected to be 1,000 units. The inventory of finished goods held at the end of each quarter is projected to be 30% of the following quarter's sales volume. 5. Administration costs are estimated to be GH43,000 per month in quarter of year 1 rising by GH500 per quarter from quarter 2 onwards. The company's budget manual requires cach of the following preliminary budgets to be prepared in advance of preparing the company's overall budget: 1 Sales volume and sales revenue budget Production volume budget 3 Purchases volume and purchases cost budget for each of raw materials X and Y 4 Selling & administration overheads budget Labour budget 6 Variable overhead budget Required: a. Describe the content of and relationship between each of the preliminary budgets (1) to (iii) mentioned above, in the context of the overall company budget. b. Prepare quarterly budgets for items (i) to (vi) mentioned above and the annual budgeted statement of profit 2 5 Question 2 Mr Green, a sole trader, has been asked by his bank to provide detailed budget projections for the year ahead and he has provided you with the following information: Product Alpha Product Beta Sales Forecast Quarter 1 10,000 units 2,000 units Quarter 2 10,000 units 5,000 units Quarter 3 10,000 units 5,000 units Quarter 4 10,000 units 8,000 units Sales price per unit GH 35,000 GH 500,000 1 out of 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started