Answered step by step

Verified Expert Solution

Question

1 Approved Answer

That is all the information presented. Kindly just work with that. It could be the $85 000 in the 1st row v The correct amount

That is all the information presented. Kindly just work with that. It could be the $85 000 in the 1st row

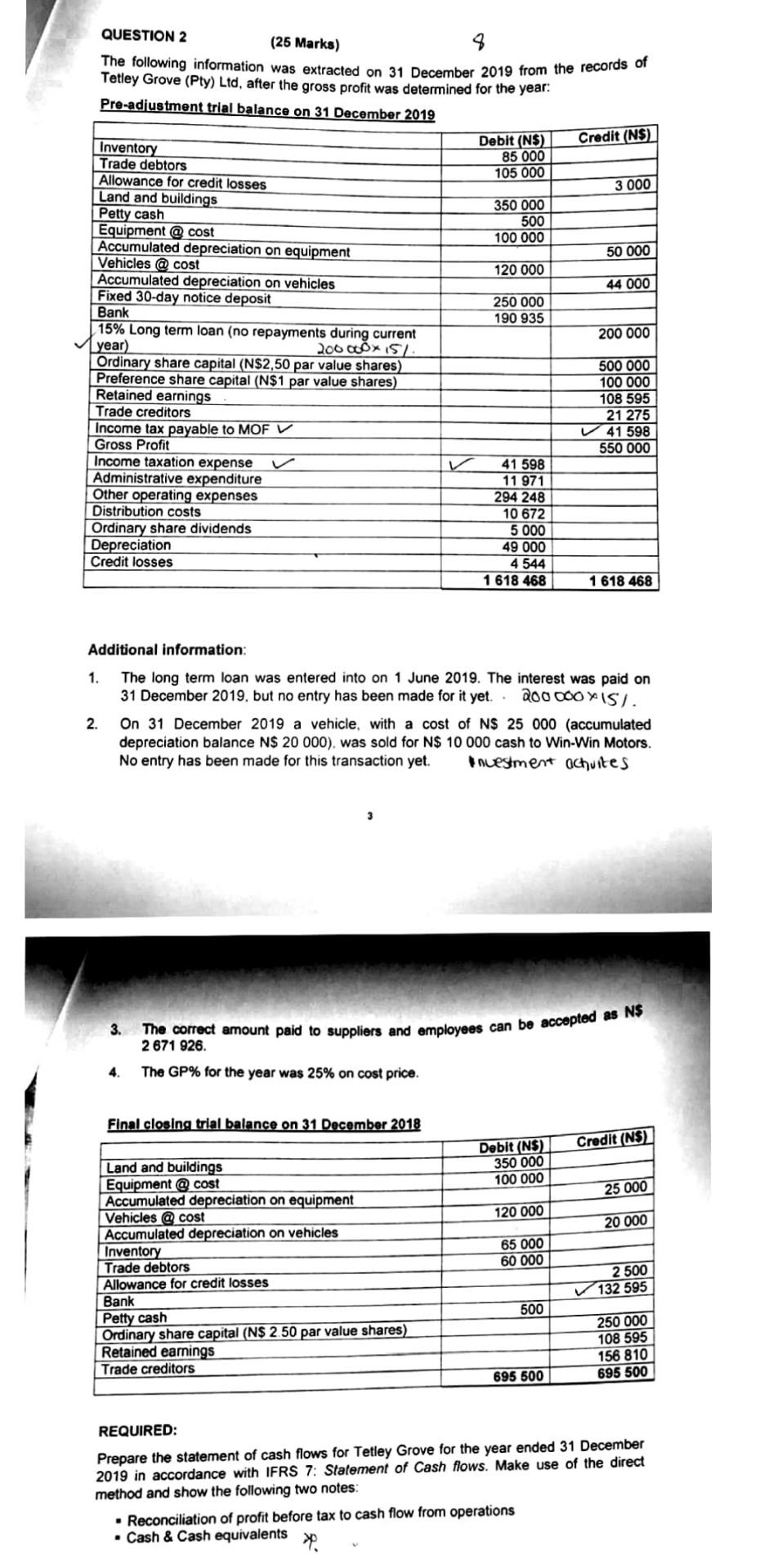

v The correct amount paid to suppliers and employees can be accepted as N$ QUESTION 2 (25 Marks) The following information was extracted on 31 December 2019 from the records of Tetley Grove (Pty) Ltd, after the gross profit was determined for the year: Pre-adjustment trial balance on 31 December 2019 Debit (NS) Credit (NS) Inventory 85 000 Trade debtors 105 000 Allowance for credit losses 3 000 Land and buildings 350 000 Petty cash 500 Equipment @ cost 100 000 Accumulated depreciation on equipment 50 000 Vehicles @ cost 120 000 Accumulated depreciation on vehicles 44 000 Fixed 30-day notice deposit 250 000 Bank 190 935 15% Long term loan (no repayments during current 200 000 year) 200 X Ordinary share capital (N$2,50 par value shares) 500 000 Preference share capital (N$1 par value shares) 100 000 Retained earnings 108 595 Trade creditors 21 275 Income tax payable to MOF V V 41 598 Gross Profit 550 000 Income taxation expense 41 598 Administrative expenditure 11 971 Other operating expenses 294 248 Distribution costs 10 672 Ordinary share dividends 5 000 Depreciation 49 000 Credit losses 4 544 1 618 468 1 618 468 Additional information: 1. The long term loan was entered into on 1 June 2019. The interest was paid on 31 December 2019. but no entry has been made for it yet.. 200 000 ISI. 2. On 31 December 2019 a vehicle, with a cost of N$ 25 000 (accumulated depreciation balance N$ 20 000), was sold for N$ 10 000 cash to Win-Win Motors. No entry has been made for this transaction yet. Investment achuites 3 3. 2 671 926. 4. The GP% for the year was 25% on cost price. Final closing trial balance on 31 December 2018 Credit (NS) Debit (NS) 350 000 100 000 25 000 120 000 20 000 65 000 60 000 Land and buildings Equipment @ cost Accumulated depreciation on equipment Vehicles @ cost Accumulated depreciation on vehicles Inventory Trade debtors Allowance for credit losses Bank Petty cash Ordinary share capital (N$ 2.50 par value shares) Retained earnings Trade creditors 2 500 132 595 500 250 000 108 595 156 810 695 500 695 500 REQUIRED: Prepare the statement of cash flows for Tetley Grove for the year ended 31 December 2019 in accordance with IFRS 7: Statement of Cash flows. Make use of the direct method and show the following two notes: Reconciliation of profit before tax to cash flow from operations Cash & Cash equivalents v The correct amount paid to suppliers and employees can be accepted as N$ QUESTION 2 (25 Marks) The following information was extracted on 31 December 2019 from the records of Tetley Grove (Pty) Ltd, after the gross profit was determined for the year: Pre-adjustment trial balance on 31 December 2019 Debit (NS) Credit (NS) Inventory 85 000 Trade debtors 105 000 Allowance for credit losses 3 000 Land and buildings 350 000 Petty cash 500 Equipment @ cost 100 000 Accumulated depreciation on equipment 50 000 Vehicles @ cost 120 000 Accumulated depreciation on vehicles 44 000 Fixed 30-day notice deposit 250 000 Bank 190 935 15% Long term loan (no repayments during current 200 000 year) 200 X Ordinary share capital (N$2,50 par value shares) 500 000 Preference share capital (N$1 par value shares) 100 000 Retained earnings 108 595 Trade creditors 21 275 Income tax payable to MOF V V 41 598 Gross Profit 550 000 Income taxation expense 41 598 Administrative expenditure 11 971 Other operating expenses 294 248 Distribution costs 10 672 Ordinary share dividends 5 000 Depreciation 49 000 Credit losses 4 544 1 618 468 1 618 468 Additional information: 1. The long term loan was entered into on 1 June 2019. The interest was paid on 31 December 2019. but no entry has been made for it yet.. 200 000 ISI. 2. On 31 December 2019 a vehicle, with a cost of N$ 25 000 (accumulated depreciation balance N$ 20 000), was sold for N$ 10 000 cash to Win-Win Motors. No entry has been made for this transaction yet. Investment achuites 3 3. 2 671 926. 4. The GP% for the year was 25% on cost price. Final closing trial balance on 31 December 2018 Credit (NS) Debit (NS) 350 000 100 000 25 000 120 000 20 000 65 000 60 000 Land and buildings Equipment @ cost Accumulated depreciation on equipment Vehicles @ cost Accumulated depreciation on vehicles Inventory Trade debtors Allowance for credit losses Bank Petty cash Ordinary share capital (N$ 2.50 par value shares) Retained earnings Trade creditors 2 500 132 595 500 250 000 108 595 156 810 695 500 695 500 REQUIRED: Prepare the statement of cash flows for Tetley Grove for the year ended 31 December 2019 in accordance with IFRS 7: Statement of Cash flows. Make use of the direct method and show the following two notes: Reconciliation of profit before tax to cash flow from operations Cash & Cash equivalentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started