Answered step by step

Verified Expert Solution

Question

1 Approved Answer

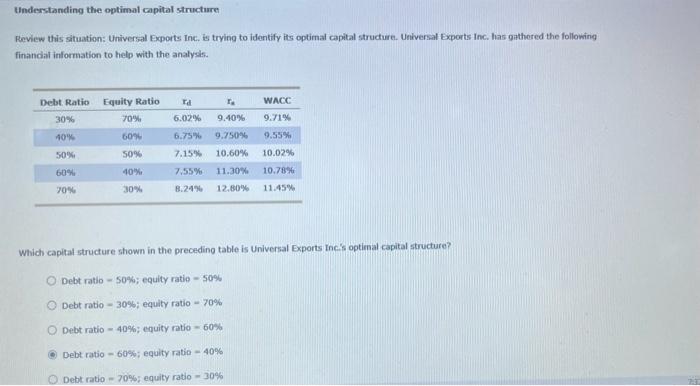

that is all the information Understanding the optimal capital structure Review this situation: Univeral Exports Inc. is trying to identify its optimal capital structure. Universal

that is all the information

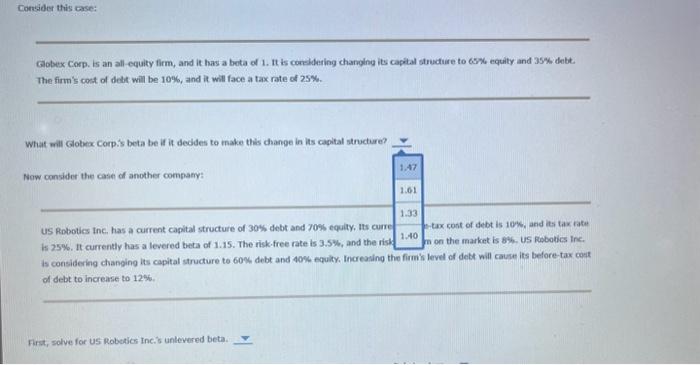

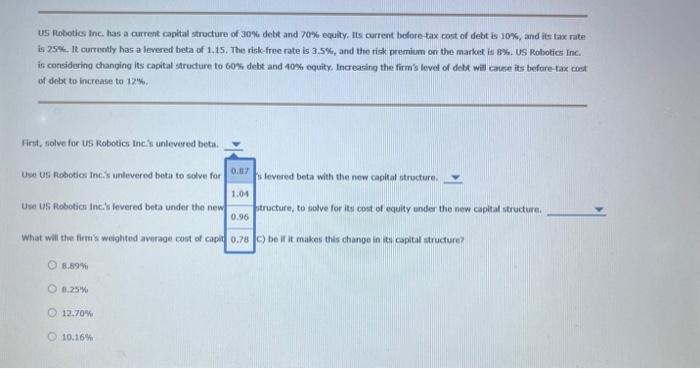

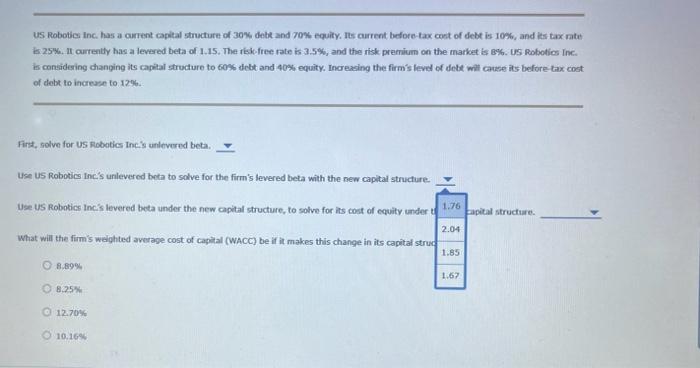

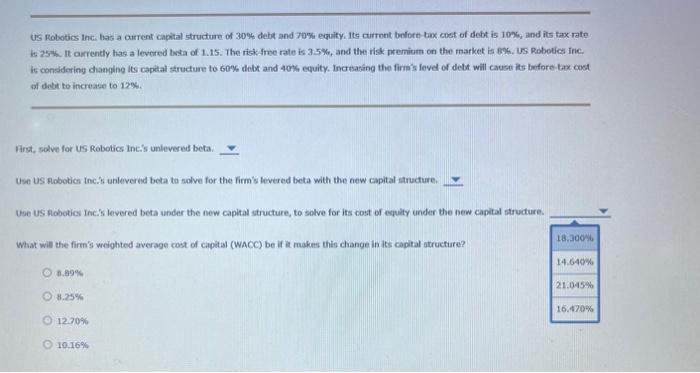

Understanding the optimal capital structure Review this situation: Univeral Exports Inc. is trying to identify its optimal capital structure. Universal Exports Inc. has githered the following finandil information to help with the analysis. Which capital structure shown in the preceding table is Universal Exports Incis optimal capital structure? Debt ratio 50%; equity ratio 50% Debt ratio 30%; equity ratio 70% Debt ratio 40%; equity mtio 60% Debt ratio 60%; equity ratio =40% Debt ratio =70%; equity ratio =30% Gobex Corp. is an all equity firm, and it has a beta of 1. It is coreldering changing its capital structure to 65% equity and 35% debt. The firm's cost of dest will be 10%, and it will face a tax rate of 25%. is 25%. It currenty has a levered beta of 1,15. The risk-free rate is 3.5%, and the risk premium on the market is 8%. US Robotics Inc. is considoring changing its capital structure to 60 th debt and 40% equity. Increacing the firmes leves of debt will catese its betore-tax coet of debt to increase to 12 the. First, solve for US Robotics lncis unleviered beta. Uwe WSi Robotics Ince's unlevered betia to solve for or levered beta with the new capital otructure. Use us foboticn Incis levered beta ender the new 0.96 ptructure, to solve for its cost of equity under the new capital structure. What Will the fires's weighted avorage cost of capht 0.78 C) be in it makes this change in it. caplal structure? 8.8994 1. 254W 12.7094 10.16% uS Robotics Inc. has a curtent caphtal structure of 30% debi and 7ow equity. fts current before-tax cont of debt is 10%6, and its tax rate is 25\%. It currenty has a levered beta of 1.15. The risk-free rate is 3.5\%, and the risk premium on the market is 8%. Us Robotios Ine. is considesing changing its capital structure to 60\%6 debt and 40% equity. Increasing the firm's leved of dete wil catese its before tax cost of debt to increase to.12\%. Fins, solve for US Robatics inc.s undevered beta. Use US Robotics Inc's unlevered bota to solve for the firm's levered beta with the new capital structure. Use US Robotics lncis levered beta under the new capital structure, to solve for its cost of equity under th What will the firm's weighted average cost of cagilal (WACC) be if it makes this change in its capital struc: 8.89% 8.25% 12.704 10,16% US Robotics lec. fack a current capital structure of 30% debt and tork equity. Its currnnt bolort tax cost of decht is 10nsy and its fax rate is 25\%w. It aurrently has a levered besa of 1.15. The risk-froe rate is 3.56, and the risk. premium on the market is doks. US Robeties inc. is considering changine its capital struchure to 60% debt and 40% eguity. Incriating the firma's lavel of debt will cause its before-tax cost af deot to increase to 1294. Iirst. colve for US Robotics Inc.'s unlevered beta. Use US Aobotich Inc.'s unlevered beta to solve for the firm's levered beta with the naw capital structure. Uoe uS Boobotics Inc.'s levered beta under the new capltal structure, to solvo for its cost of equlty under the new capltal strudure. What will the firm's weighted average cost of capital (WACC) be if it makem this change in its capital structure? 6. 8990 8.25% 12.70% 10.16% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started