that is all the question

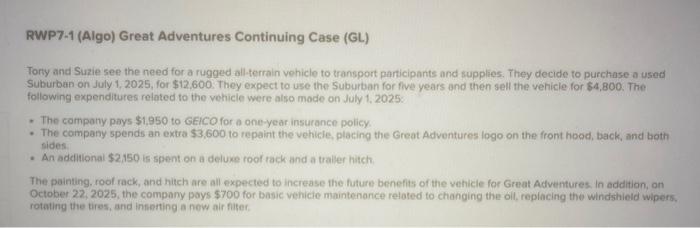

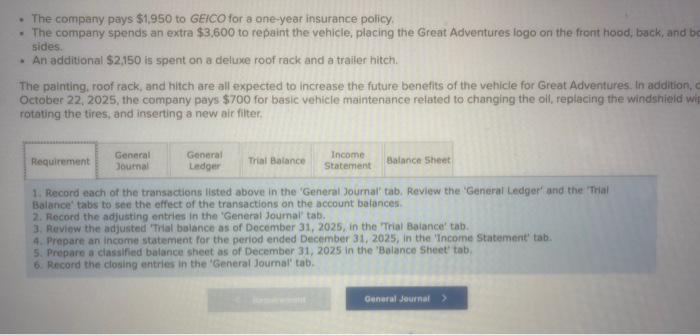

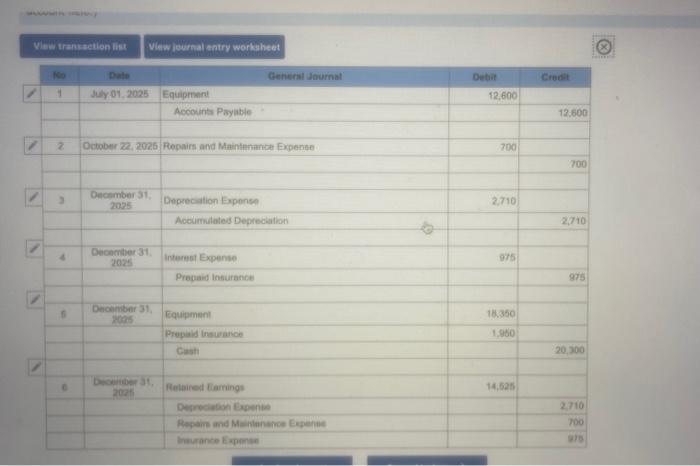

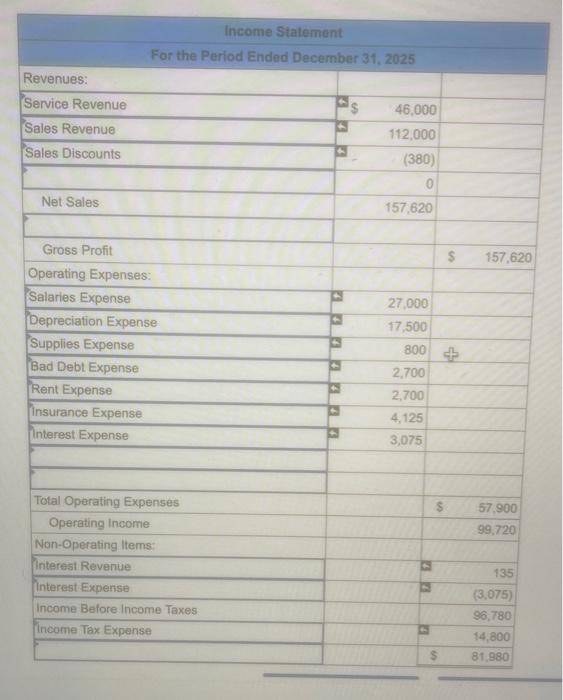

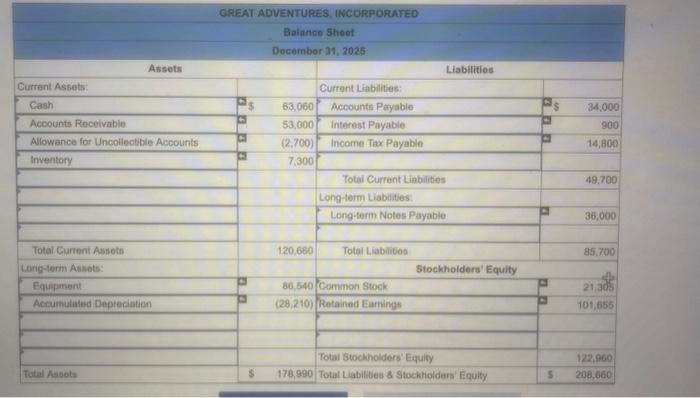

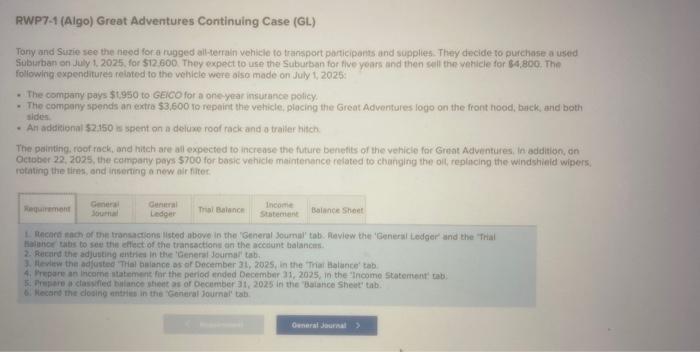

RWP7-1 (Algo) Great Adventures Continuing Case (GL) Torty and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $12.600. They expect to use the Suburban for five years and then sell the vehicle for $4,800. The following expenditures related to the vehicie were also mode on July 1, 2025: - The compony pays $1,950 to GEiCO for a one-year insurance policy. - The company spends an extra $3,600 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An adcitional $2.150 is spent on a deluxe roof rack and a tralier hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2025, the company pays $700 for basic vehicie maintenance retated to changing the oll, replacing the windshield wipers. rotating the tires, and inserting a new air filter. - The company pays $1,950 to GEiCO for a one-year insurance policy. - The company spends an extra $3,600 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and to sides. - An additional $2,150 is spent on a deluve roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, October 22, 2025, the company pays $700 for basic vehicle maintenance related to changing the oll, replacing the windshieid w rotating the tires, and inserting a new air filter. 1. Record each of the transactions listed above in the 'General Journal' tab. Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account batances. 2. Record the adjusting entries in the 'General Joumal' tab. 3. Review the adjusted 'Trial balance as of Docember 31, 2025, in the 'Trial Baiance' tab. 4. Prepare an income statement for the period ended December 31, 2025, in the 'Income Statement' tab. 5. Prepare a classified balance sheet as of December 31, 2025 in the 'Balance Steet' tab. 6. Record the dosing entries in the 'General Joumal' tab. Yiew tranketion lisk View learnal sentry worksheet \begin{tabular}{l} Income Statement \\ \hline For the Period Ended December 31, 2025 \end{tabular} Revenues: Service Revenue Sales Revenue Sales Discounts RWP7-1 (Algo) Great Adventures Continuing Case (GL) Tony and Surie see the need for a rugged ailterrain vehicle to transport participants and supplies. They decide to purchase a used Subirban on July 1. 2025. for \$12.600. They expect to use the Suburban for flve years and then sell the yehicle for \$4,800. The following expenditures relinted to the vehicle were aiso made on July 1, 2025: - The company pays $1,950 to Geico for a oneyear insurance policy. - The company spends an extro 53,600 ro repaint the vehicle, plocing the Great Adventures logo on the front hood, buck, and both sides - An adititional $2.150 is spent on a deluxe roaf rack and a trailer hifch. The pointing, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Grat Adventures, in addition, on October 22, 2025, the company pays $700 for basic vehicle maintenarice related to changing the oll, replacing the windshieid wipers. rotating the tifins, and inserting a new air filter. Balincer tabs to see thin effect of the trancactions an the accodunt tialancims. 4. Prepare an income atatemers far the period ended December 31, 2075, in the "Inoome statement' tab: 5. Prestere in claswfied tillance stieet at of oecumber. 31,2025 in the Baiance Sheet' tab. 6. Hecans the dosing antilies in the 'Goneral Journal' tab. RWP7-1 (Algo) Great Adventures Continuing Case (GL) Torty and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $12.600. They expect to use the Suburban for five years and then sell the vehicle for $4,800. The following expenditures related to the vehicie were also mode on July 1, 2025: - The compony pays $1,950 to GEiCO for a one-year insurance policy. - The company spends an extra $3,600 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An adcitional $2.150 is spent on a deluxe roof rack and a tralier hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2025, the company pays $700 for basic vehicie maintenance retated to changing the oll, replacing the windshield wipers. rotating the tires, and inserting a new air filter. - The company pays $1,950 to GEiCO for a one-year insurance policy. - The company spends an extra $3,600 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and to sides. - An additional $2,150 is spent on a deluve roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, October 22, 2025, the company pays $700 for basic vehicle maintenance related to changing the oll, replacing the windshieid w rotating the tires, and inserting a new air filter. 1. Record each of the transactions listed above in the 'General Journal' tab. Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account batances. 2. Record the adjusting entries in the 'General Joumal' tab. 3. Review the adjusted 'Trial balance as of Docember 31, 2025, in the 'Trial Baiance' tab. 4. Prepare an income statement for the period ended December 31, 2025, in the 'Income Statement' tab. 5. Prepare a classified balance sheet as of December 31, 2025 in the 'Balance Steet' tab. 6. Record the dosing entries in the 'General Joumal' tab. Yiew tranketion lisk View learnal sentry worksheet \begin{tabular}{l} Income Statement \\ \hline For the Period Ended December 31, 2025 \end{tabular} Revenues: Service Revenue Sales Revenue Sales Discounts RWP7-1 (Algo) Great Adventures Continuing Case (GL) Tony and Surie see the need for a rugged ailterrain vehicle to transport participants and supplies. They decide to purchase a used Subirban on July 1. 2025. for \$12.600. They expect to use the Suburban for flve years and then sell the yehicle for \$4,800. The following expenditures relinted to the vehicle were aiso made on July 1, 2025: - The company pays $1,950 to Geico for a oneyear insurance policy. - The company spends an extro 53,600 ro repaint the vehicle, plocing the Great Adventures logo on the front hood, buck, and both sides - An adititional $2.150 is spent on a deluxe roaf rack and a trailer hifch. The pointing, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Grat Adventures, in addition, on October 22, 2025, the company pays $700 for basic vehicle maintenarice related to changing the oll, replacing the windshieid wipers. rotating the tifins, and inserting a new air filter. Balincer tabs to see thin effect of the trancactions an the accodunt tialancims. 4. Prepare an income atatemers far the period ended December 31, 2075, in the "Inoome statement' tab: 5. Prestere in claswfied tillance stieet at of oecumber. 31,2025 in the Baiance Sheet' tab. 6. Hecans the dosing antilies in the 'Goneral Journal' tab