Answered step by step

Verified Expert Solution

Question

1 Approved Answer

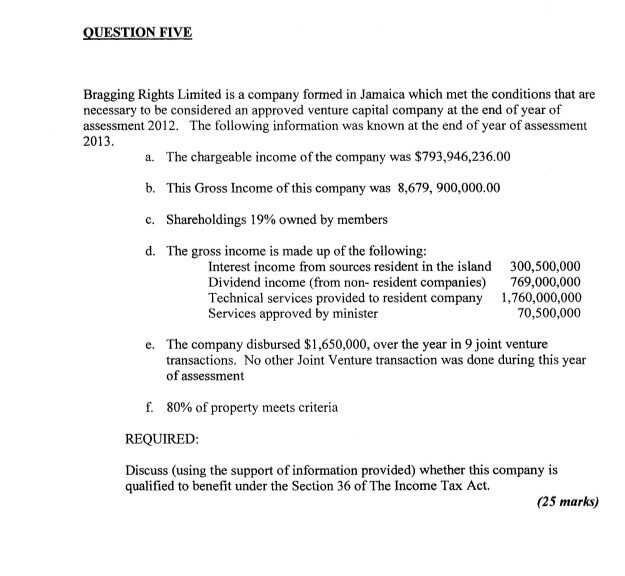

that is section 36 of the income tax in jamaica. could i get enough information for the 25 marks please QUESTION FIVE Bragging Rights Limited

that is section 36 of the income tax in jamaica. could i get enough information for the 25 marks please

QUESTION FIVE Bragging Rights Limited is a company formed in Jamaica which met the conditions that are necessary to be considered an approved venture capital company at the end of year of assessment 2012. The following information was known at the end of year of assessment 2013 a. The chargeable income of the company was $793,946,236.00 b. This Gross Income of this company was 8,679, 900,000.00 C. Shareholdings 19% owned by members d. The gross income is made up of the following: Interest income from sources resident in the island 300,500,000 Dividend income (from non- resident companies) 769,000,000 Technical services provided to resident company ,760,000,000 Services approved by minister 70,500,000 The company disbursed $1,650,000, over the year in 9 joint venture e. transactions. No other Joint Venture transaction was done during this year of assessment f. 80% of property meets criteria REQUIRED Discuss (using the support of information provided) whether this company is qualified to benefit under the Section 36 of The Income Tax Act. (25 marks) QUESTION FIVE Bragging Rights Limited is a company formed in Jamaica which met the conditions that are necessary to be considered an approved venture capital company at the end of year of assessment 2012. The following information was known at the end of year of assessment 2013 a. The chargeable income of the company was $793,946,236.00 b. This Gross Income of this company was 8,679, 900,000.00 C. Shareholdings 19% owned by members d. The gross income is made up of the following: Interest income from sources resident in the island 300,500,000 Dividend income (from non- resident companies) 769,000,000 Technical services provided to resident company ,760,000,000 Services approved by minister 70,500,000 The company disbursed $1,650,000, over the year in 9 joint venture e. transactions. No other Joint Venture transaction was done during this year of assessment f. 80% of property meets criteria REQUIRED Discuss (using the support of information provided) whether this company is qualified to benefit under the Section 36 of The Income Tax Act. (25 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started