Answered step by step

Verified Expert Solution

Question

1 Approved Answer

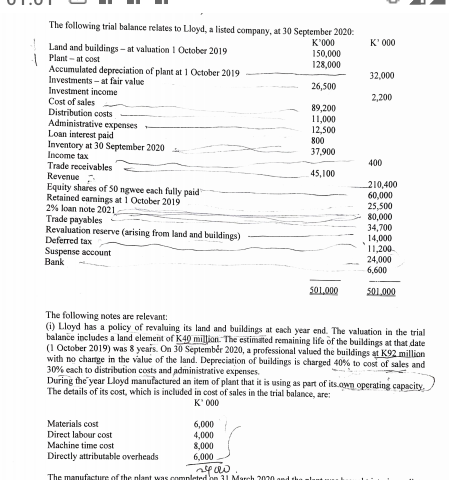

that's 1 question from financial reporting K'000 32,000 2,200 The following trial balance relates to Lloyd, a listed company, at 30 September 2020- K'000 Land

that's 1 question from financial reporting

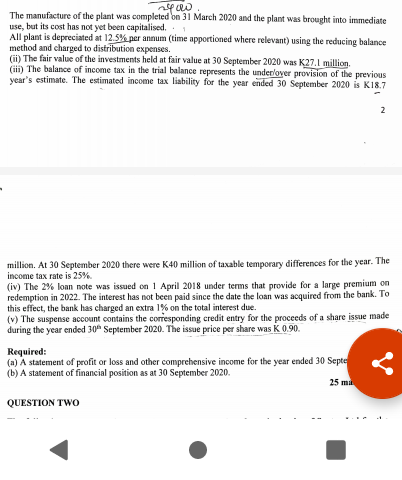

K'000 32,000 2,200 The following trial balance relates to Lloyd, a listed company, at 30 September 2020- K'000 Land and buildings - at valuation 1 October 2019 150,000 Plantat cost 128,000 Accumulated depreciation of plant at 1 October 2019 Investments - at fair value 26,500 Investment income Cost of sales 89,200 Distribution costs 11,000 Administrative expenses 12,500 Loan interest paid 800 Inventory at 30 September 2020 37.900 Income tax Trade receivables 45,100 Revenue Equity shares of 50 ngwee each fully paid Retained earnings at 1 October 2019 2% loan note 2021 Trade payables Revaluation reserve (arising from land and buildings) Deferred tax Suspense account Bank 400 210,400 60,000 25,500 80,000 34,700 14,000 11,200 24,000 6,600 SO1,000 501.000 The following notes are relevant: (i) Lloyd has a policy of revaluing its land and buildings at each year end. The valuation in the trial balance includes a land element of K 40 million. The estimated remaining life of the buildings at that date (1 October 2019) was 8 years. On 30 September 2020, a professional valued the buildings at 92 million with no charge in the value of the land. Depreciation of buildings is charged 40% to cost of sales and 30% each to distribution costs and administrative expenses. During the year Lloyd manufactured an item of plant that it is using as part of its own operating capacity The details of its cost, which is included in cost of sales in the trial balance, are: K 000 Materials cost 6,000 Direct labour cost 4,000 Machine time cost 8,000 Directly attributable overheads 6,000 The manufacture of the lant was completed h1 March 2007 and the POD The manufacture of the plant was completed on 31 March 2020 and the plant was brought into immediate use, but its cost has not yet been capitalised All plant is depreciated at 12.5% per annum (time apportioned where relevant) using the reducing balance method and charged to distribution expenses. (ii) The fair value of the investments held at fair value at 30 September 2020 was K27.1 million (iii) The balance of income tax in the trial balance represents the underloyer provision of the previous year's estimate. The estimated income tax liability for the year ended 30 September 2020 is K18.7 2 million. At 30 September 2020 there were K40 million of taxable temporary differences for the year. The income tax rate is 25% (iv) The 2% loan note was issued on 1 April 2018 under terms that provide for a large premium on redemption in 2022. The interest has not been paid since the date the loan was acquired from the bank. To this effect, the bank has charged an extra 1% on the total interest due. (V) The suspense account contains the corresponding credit entry for the proceeds of a share issue made during the year ended 30 September 2020. The issue price per share was K 0.90. Required: (a) A statement of profit or loss and other comprehensive income for the year ended 30 Septe (b) A statement of financial position as at 30 September 2020. 25 ma QUESTION TWOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started