Answered step by step

Verified Expert Solution

Question

1 Approved Answer

that's all The following are summaries of the cash book and bank accounts of Mr. Smith who does not keep his books using the double

that's all

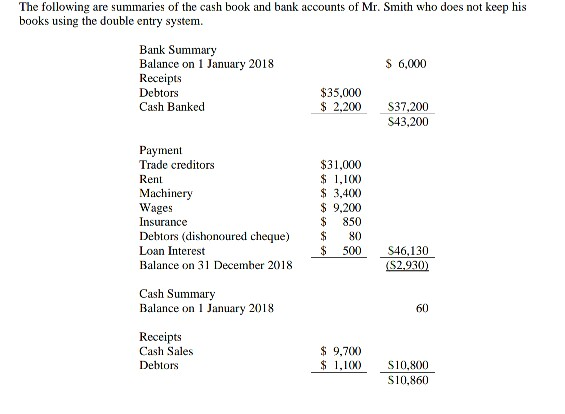

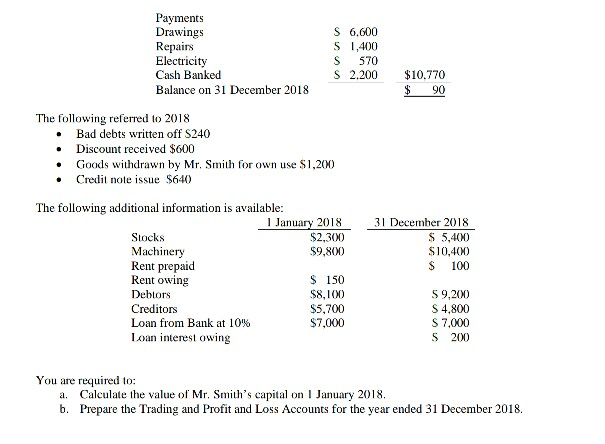

The following are summaries of the cash book and bank accounts of Mr. Smith who does not keep his books using the double entry system. $ 6,000 Bank Summary Balance on 1 January 2018 Receipts Debtors Cash Banked $35,000 $ 2,200 S37,200 S43,200 Payment Trade creditors Rent Machinery Wages Insurance Debtors (dishonoured cheque) Loan Interest Balance on 31 December 2018 $31,000 $ 1,10) $ 3,400) $ 9,200 $ 850 $ 80 $ 500 46,130 (S2.930) Cash Summary Balance on 1 January 2018 Receipts Cash Sales Debtors $ 9,70) $ 1,108) S10,800 $10,860 Payments Drawings Repairs Electricity Cash Banked Balance on 31 December 2018 S 6,600 5 1,400 S 570 S 2.200 $10,770 $ 90 The following referred to 2018 Bad debts written off S240 Discount received $600 Goods withdrawn by Mr. Smith for own use $1,200 Credit nole issue $640) 31 December 2018 $ 5,400) $10.400) $ 100 The following additional information is available: 1 January 2018 Stocks $2,300 Machinery $9,800 Rent prepaid Rent owing $ 150 Debtors $8,100 Creditors $5,700 Loan from Bank at 10% $7,000 Loan interest owing S 9,200) S 4,800 S 7,000 S 200 You are required to: a. Calculate the value of Mr. Smith's capital on 1 January 2018. b. Prepare the Trading and Profit and Loss Accounts for the year ended 31 December 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started