Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thats all the info Given the following information: (all numbers are in millions) Fixed rate CD's Treasury bills = Savings Deposits = Discount loans =

thats all the info

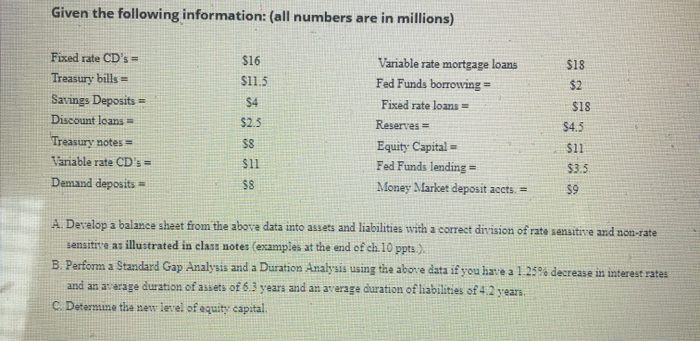

Given the following information: (all numbers are in millions) Fixed rate CD's Treasury bills = Savings Deposits = Discount loans = Treasury notes = Variable rate CD's = Demand deposits = $16 $11.5 $4 $2.3 $18 $2 $18 Variable rate mortgage loans Fed Funds borrowing = Fixed rate loans = Reserves = Equity Capital - Fed Funds lending = Money Market deposit accts = $4.5 S8 $11 $11 $3.5 $9 S8 A. Develop a balance sheet from the above data into assets and liabilities with a correct division of rate sensitive and non-tate sensitive as illustrated in class notes (examples at the end of ch.10 ppts.). B. Perform a Standard Gap Analysis and a Duration Analysis using the above data if you have a 1.25% decrease in interest rates and an average duration of assets of 6.3 years and an average duration of liabilities of 4.2 years c Determine the new level of equity capital Given the following information: (all numbers are in millions) Fixed rate CD's Treasury bills = Savings Deposits = Discount loans = Treasury notes = Variable rate CD's = Demand deposits = $16 $11.5 $4 $2.3 $18 $2 $18 Variable rate mortgage loans Fed Funds borrowing = Fixed rate loans = Reserves = Equity Capital - Fed Funds lending = Money Market deposit accts = $4.5 S8 $11 $11 $3.5 $9 S8 A. Develop a balance sheet from the above data into assets and liabilities with a correct division of rate sensitive and non-tate sensitive as illustrated in class notes (examples at the end of ch.10 ppts.). B. Perform a Standard Gap Analysis and a Duration Analysis using the above data if you have a 1.25% decrease in interest rates and an average duration of assets of 6.3 years and an average duration of liabilities of 4.2 years c Determine the new level of equity capital Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started