Answered step by step

Verified Expert Solution

Question

1 Approved Answer

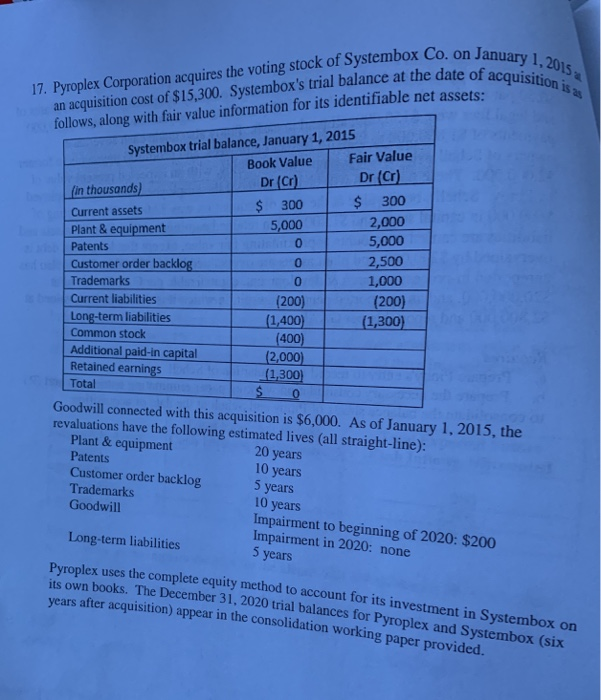

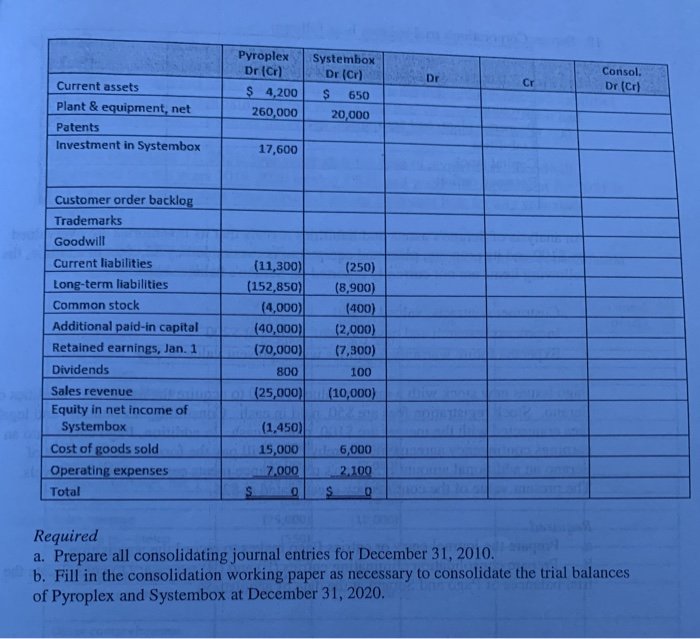

thats all the info there is. there should be two pictures. on January 1, 2015 date of acquisition is a 17. Pyroplex Corporation acquires the

thats all the info there is. there should be two pictures.

on January 1, 2015 date of acquisition is a 17. Pyroplex Corporation acquires the voting stock of Systembox Co. on Jan an acquisition cost of $15,300. Systembox's trial balance at the date of follows, along with fair value information for its identifiable net assets: Systembox trial balance, January 1, 2015 Book Value Fair Value Dr (C) in thousands) Dr $ Current assets 300 $ 300 Plant & equipment 5,000 2,000 Patents 0 5,000 Customer order backlog 0 2,500 Trademarks 1,000 Current liabilities (200) (200) Long-term liabilities (1,400) (1,300) Common stock (400) Additional paid-in capital (2,000) Retained earnings (1,300 Total $ 0 Goodwill connected with this acquisition is $6,000. As of January 1, 2015, the revaluations have the following estimated lives (all straight-line): Plant & equipment 20 years Patents 10 years Customer order backlog 5 years Trademarks Goodwill Impairment to beginning of 2020: $200 Impairment in 2020: none Long-term liabilities 5 years 10 years uses the complete equity method to account for its investment in Systembox on its own books. The December 31, 2020 trial balances for Pyroplex and Systembox (six years after acquisition) appear in the consolidation working paper working paper provided. Consol. Dr (Cr) Pyroplex Dr (ar) $ 4,200 260,000 Systembox Dr (Cr) $ 650 20,000 Current assets Plant & equipment, net Patents Investment in Systembox 17,600 Customer order backlog Trademarks Goodwill Current liabilities Long-term liabilities Common stock Additional paid-in capital Retained earnings, Jan. 1 Dividends Sales revenue Equity in net income of Systembox Cost of goods sold Operating expenses Total (11,300) (152,850) (4,000) (40,000) (70,000) 800 (25,000) (250) (8,900) (400) (2,000) (7,300) 100 (10,000) (1,450) 15,000 7.000 6,000 2.100 Required a. Prepare all consolidating journal entries for December 31, 2010. b. Fill in the consolidation working paper as necessary to consolidate the trial balances of Pyroplex and Systembox at December 31, 2020. on January 1, 2015 date of acquisition is a 17. Pyroplex Corporation acquires the voting stock of Systembox Co. on Jan an acquisition cost of $15,300. Systembox's trial balance at the date of follows, along with fair value information for its identifiable net assets: Systembox trial balance, January 1, 2015 Book Value Fair Value Dr (C) in thousands) Dr $ Current assets 300 $ 300 Plant & equipment 5,000 2,000 Patents 0 5,000 Customer order backlog 0 2,500 Trademarks 1,000 Current liabilities (200) (200) Long-term liabilities (1,400) (1,300) Common stock (400) Additional paid-in capital (2,000) Retained earnings (1,300 Total $ 0 Goodwill connected with this acquisition is $6,000. As of January 1, 2015, the revaluations have the following estimated lives (all straight-line): Plant & equipment 20 years Patents 10 years Customer order backlog 5 years Trademarks Goodwill Impairment to beginning of 2020: $200 Impairment in 2020: none Long-term liabilities 5 years 10 years uses the complete equity method to account for its investment in Systembox on its own books. The December 31, 2020 trial balances for Pyroplex and Systembox (six years after acquisition) appear in the consolidation working paper working paper provided. Consol. Dr (Cr) Pyroplex Dr (ar) $ 4,200 260,000 Systembox Dr (Cr) $ 650 20,000 Current assets Plant & equipment, net Patents Investment in Systembox 17,600 Customer order backlog Trademarks Goodwill Current liabilities Long-term liabilities Common stock Additional paid-in capital Retained earnings, Jan. 1 Dividends Sales revenue Equity in net income of Systembox Cost of goods sold Operating expenses Total (11,300) (152,850) (4,000) (40,000) (70,000) 800 (25,000) (250) (8,900) (400) (2,000) (7,300) 100 (10,000) (1,450) 15,000 7.000 6,000 2.100 Required a. Prepare all consolidating journal entries for December 31, 2010. b. Fill in the consolidation working paper as necessary to consolidate the trial balances of Pyroplex and Systembox at December 31, 2020 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started