Answered step by step

Verified Expert Solution

Question

1 Approved Answer

That's all the information that they have provided to us, what else do you need? Question 4 Jill is planning to retire in five years,

That's all the information that they have provided to us, what else do you need?

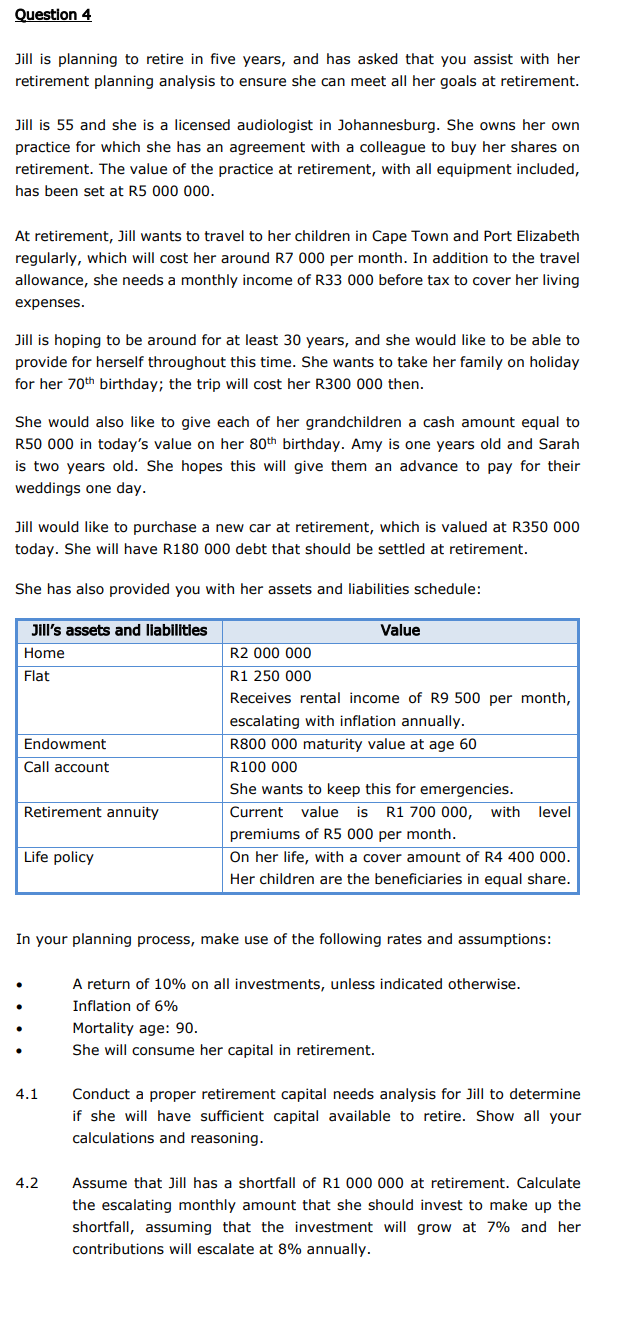

Question 4 Jill is planning to retire in five years, and has asked that you assist with her retirement planning analysis to ensure she can meet all her goals at retirement. Jill is 55 and she is a licensed audiologist in Johannesburg. She owns her own practice for which she has an agreement with a colleague to buy her shares on retirement. The value of the practice at retirement, with all equipment included, has been set at R5 000 000. At retirement, Jill wants to travel to her children in Cape Town and Port Elizabeth regularly, which will cost her around R7 000 per month. In addition to the travel allowance, she needs a monthly income of R33 000 before tax to cover her living expenses. Jill is hoping to be around for at least 30 years, and she would like to be able to provide for herself throughout this time. She wants to take her family on holiday for her 70th birthday; the trip will cost her R300 000 then. She would also like to give each of her grandchildren a cash amount equal to R50 000 in today's value on her 80th birthday. Amy is one years old and Sarah is two years old. She hopes this will give them an advance to pay for their weddings one day. Jill would like to purchase a new car at retirement, which is valued at R350 000 today. She will have R180 000 debt that should be settled at retirement. She has also provided you with her assets and liabilities schedule: Jill's assets and liabilities Home Flat Endowment Call account Value R2 000 000 R1 250 000 Receives rental income of R9 500 per month, escalating with inflation annually. R800 000 maturity value at age 60 R100 000 She wants to keep this for emergencies. Current value is R1 700 000, with level premiums of R5 000 per month. On her life, with a cover amount of R4 400 000. Her children are the beneficiaries in equal share. Retirement annuity Life policy In your planning process, make use of the following rates and assumptions: A return of 10% on all investments, unless indicated otherwise. Inflation of 6% Mortality age: 90. She will consume her capital in retirement. 4.1 Conduct a proper retirement capital needs analysis for Jill to determine if she will have sufficient capital available to retire. Show all your calculations and reasoning. 4.2 Assume that Jill has a shortfall of R1 000 000 at retirement. Calculate the escalating monthly amount that she should invest to make up the shortfall, assuming that the investment will grow at 7% and her contributions will escalate at 8% annually. Question 4 Jill is planning to retire in five years, and has asked that you assist with her retirement planning analysis to ensure she can meet all her goals at retirement. Jill is 55 and she is a licensed audiologist in Johannesburg. She owns her own practice for which she has an agreement with a colleague to buy her shares on retirement. The value of the practice at retirement, with all equipment included, has been set at R5 000 000. At retirement, Jill wants to travel to her children in Cape Town and Port Elizabeth regularly, which will cost her around R7 000 per month. In addition to the travel allowance, she needs a monthly income of R33 000 before tax to cover her living expenses. Jill is hoping to be around for at least 30 years, and she would like to be able to provide for herself throughout this time. She wants to take her family on holiday for her 70th birthday; the trip will cost her R300 000 then. She would also like to give each of her grandchildren a cash amount equal to R50 000 in today's value on her 80th birthday. Amy is one years old and Sarah is two years old. She hopes this will give them an advance to pay for their weddings one day. Jill would like to purchase a new car at retirement, which is valued at R350 000 today. She will have R180 000 debt that should be settled at retirement. She has also provided you with her assets and liabilities schedule: Jill's assets and liabilities Home Flat Endowment Call account Value R2 000 000 R1 250 000 Receives rental income of R9 500 per month, escalating with inflation annually. R800 000 maturity value at age 60 R100 000 She wants to keep this for emergencies. Current value is R1 700 000, with level premiums of R5 000 per month. On her life, with a cover amount of R4 400 000. Her children are the beneficiaries in equal share. Retirement annuity Life policy In your planning process, make use of the following rates and assumptions: A return of 10% on all investments, unless indicated otherwise. Inflation of 6% Mortality age: 90. She will consume her capital in retirement. 4.1 Conduct a proper retirement capital needs analysis for Jill to determine if she will have sufficient capital available to retire. Show all your calculations and reasoning. 4.2 Assume that Jill has a shortfall of R1 000 000 at retirement. Calculate the escalating monthly amount that she should invest to make up the shortfall, assuming that the investment will grow at 7% and her contributions will escalate at 8% annuallyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started