Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thats all they have 7. (Chapter 8): XYZ rapid prototyping (RP) software costs $20,000, lasts one year, and will be expensed (i.e. written off in

thats all they have

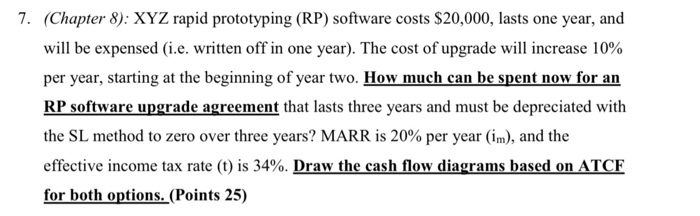

7. (Chapter 8): XYZ rapid prototyping (RP) software costs $20,000, lasts one year, and will be expensed (i.e. written off in one year). The cost of upgrade will increase 10% per year, starting at the beginning of year two. How much can be spent now for an RP software upgrade agreement that lasts three years and must be depreciated with the SL method to zero over three years? MARR is 20% per year (im), and the effective income tax rate (t) is 34%. Draw the cash flow diagrams based on ATCF for both options. (Points 25) 7. (Chapter 8): XYZ rapid prototyping (RP) software costs $20,000, lasts one year, and will be expensed (i.e. written off in one year). The cost of upgrade will increase 10% per year, starting at the beginning of year two. How much can be spent now for an RP software upgrade agreement that lasts three years and must be depreciated with the SL method to zero over three years? MARR is 20% per year (im), and the effective income tax rate (t) is 34%. Draw the cash flow diagrams based on ATCF for both options. (Points 25) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started