Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thats how the questions is... please help me QUESTION 1 25 MARKS Numerical Ltd (Numerical), a company listed on the Namibia stock exchange (NSE), is

Thats how the questions is...

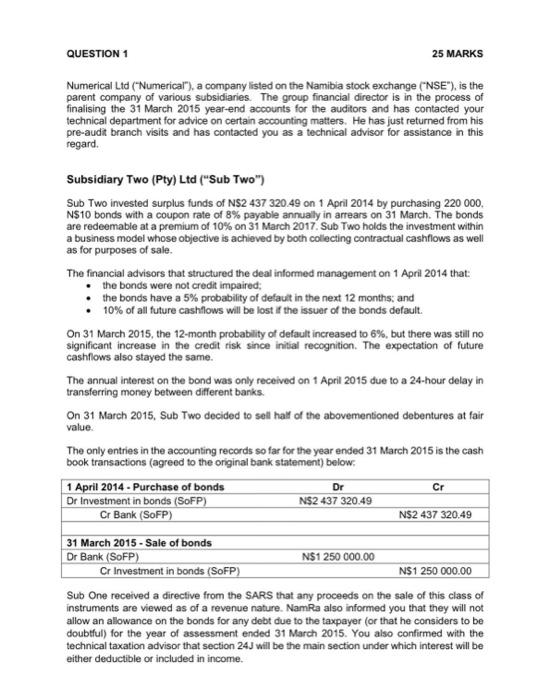

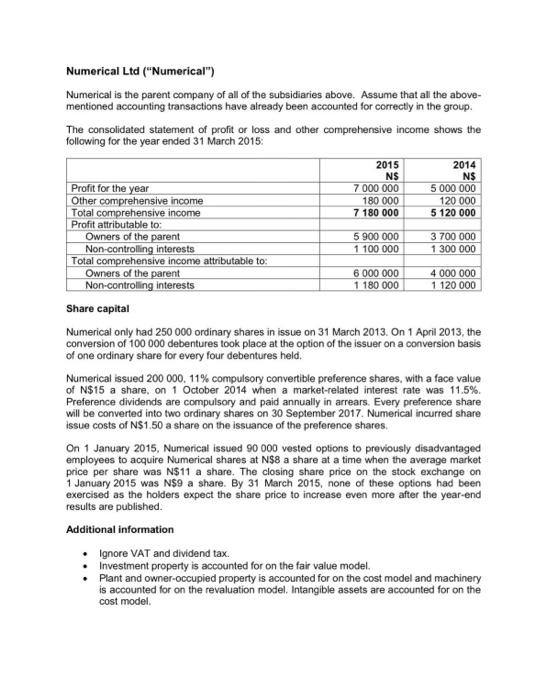

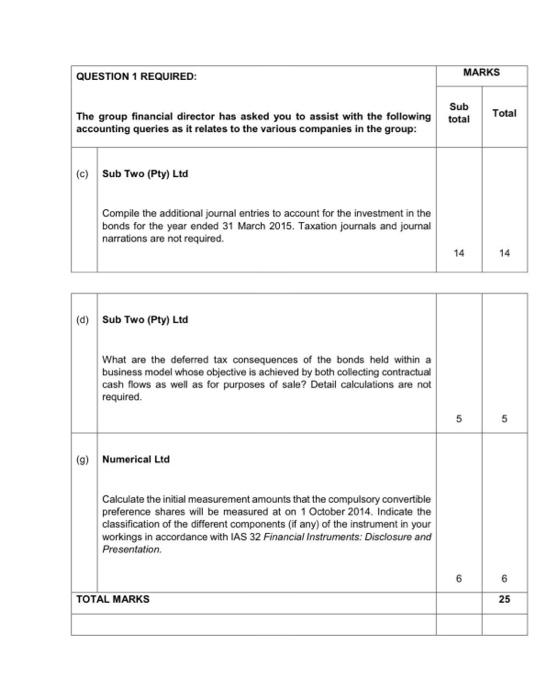

QUESTION 1 25 MARKS Numerical Ltd ("Numerical"), a company listed on the Namibia stock exchange ("NSE"), is the parent company of various subsidiaries. The group financial director is in the process of finalising the 31 March 2015 year-end accounts for the auditors and has contacted your technical department for advice on certain accounting matters. He has just returned from his pre-audit branch visits and has contacted you as a technical advisor for assistance in this regard. Subsidiary Two (Pty) Ltd ("Sub Two") Sub Two invested surplus funds of NS2 437320.49 on 1 April 2014 by purchasing 220000. NS10 bonds with a coupon rate of 8% payable annually in arrears on 31 March. The bonds are redeemable at a premium of 10% on 31 March 2017 . Sub Two holds the investment within a business model whose objective is achieved by both collecting contractual cashflows as well as for purposes of sale. The financial advisors that structured the deal informed management on 1 April 2014 that: - the bonds were not credit impaired; - the bonds have a 5% probability of defauat in the next 12 months; and - 10% of all future cashflows will be lost if the issuer of the bonds default. On 31 March 2015, the 12-month probability of default increased to 6%, but there was still no significant increase in the credit risk since initial recognition. The expectation of future cashflows also stayed the same. The annual interest on the bond was only received on 1 April 2015 due to a 24-hour delay in transferring money between different banks. On 31 March 2015. Sub Two decided to sell half of the abovementioned debentures at fair value. The only entries in the accounting records so far for the year ended 31 March 2015 is the cash book transactions (agreed to the original bank statement) below: Sub One received a directive from the SARS that any proceeds on the sale of this class of instruments are viewed as of a revenue nature. NamRa also informed you that they will not allow an allowance on the bonds for any debt due to the taxpayer (or that he considers to be doubthul) for the year of assessment ended 31 March 2015 . You also confirmed with the technical taxation advisor that section 24J will be the main section under which interest will be either deductible or included in income. Numerical Ltd ("Numerical") Numerical is the parent company of all of the subsidiaries above. Assume that all the abovementioned accounting transactions have already been accounted for correctly in the group. The consolidated statement of profit or loss and other comprehensive income shows the following for the year ended 31 March 2015: \begin{tabular}{|l|r|r|} \hline & 2015 NS & 2014 NS \\ \hline Profit for the year & 7000000 & 5000000 \\ \hline Other comprehensive income & 180000 & 120000 \\ \hline Total comprehensive income & 7180000 & 5120000 \\ \hline Profit attributable to: & & \\ \hline Owners of the parent & 5900000 & 3700000 \\ \hline Non-controlling interests & 1100000 & 1300000 \\ \hline Total comprehensive income attributable to: & & \\ \hline Owners of the parent & 6000000 & 4000000 \\ \hline Non-controling interests & 1180000 & 1120000 \\ \hline \end{tabular} Share capital Numerical only had 250000 ordinary shares in issue on 31 March 2013. On 1 April 2013, the conversion of 100000 debentures took place at the option of the issuer on a conversion basis of one ordinary share for every four debentures held. Numerical issued 200000,11% compulsory convertible preference shares, with a face value of N\$15 a share, on 1 October 2014 when a market-related interest rate was 11.5\%. Preference dividends are compulsory and paid annually in arrears. Every preference share will be converted into two ordinary shares on 30 September 2017 . Numerical incurred share issue costs of N\$1.50 a share on the issuance of the preference shares. On 1 January 2015, Numerical issued 90000 vested options to previously disadvantaged employees to acquire Numerical shares at N\$8 a share at a time when the average market price per share was N$11 a share. The closing share price on the stock exchange on 1 January 2015 was N\$9 a share. By 31 March 2015, none of these options had been exercised as the holders expect the share price to increase even more after the year-end results are published. Additional information - Ignore VAT and dividend tax. - Investment property is accounted for on the fair value model. - Plant and owner-occupied property is accounted for on the cost model and machinery is accounted for on the revaluation model. Intangible assets are accounted for on the cost model. \begin{tabular}{|l|l|l|} \hline QUESTION 1 REQUIRED: & MARKS \\ \hline The group financial director has asked you to assist with the following accounting queries as it relates to the various companies in the group: & Sub \\ \hline (c) & Sub Two (Pty) Ltd \\ Compile the additional journal entries to account for the investment in the bonds for the year ended 31 March 2015 . Taxation journals and journal narrations are not required. \\ \hline \end{tabular} QUESTION 1 25 MARKS Numerical Ltd ("Numerical"), a company listed on the Namibia stock exchange ("NSE"), is the parent company of various subsidiaries. The group financial director is in the process of finalising the 31 March 2015 year-end accounts for the auditors and has contacted your technical department for advice on certain accounting matters. He has just returned from his pre-audit branch visits and has contacted you as a technical advisor for assistance in this regard. Subsidiary Two (Pty) Ltd ("Sub Two") Sub Two invested surplus funds of NS2 437320.49 on 1 April 2014 by purchasing 220000. NS10 bonds with a coupon rate of 8% payable annually in arrears on 31 March. The bonds are redeemable at a premium of 10% on 31 March 2017 . Sub Two holds the investment within a business model whose objective is achieved by both collecting contractual cashflows as well as for purposes of sale. The financial advisors that structured the deal informed management on 1 April 2014 that: - the bonds were not credit impaired; - the bonds have a 5% probability of defauat in the next 12 months; and - 10% of all future cashflows will be lost if the issuer of the bonds default. On 31 March 2015, the 12-month probability of default increased to 6%, but there was still no significant increase in the credit risk since initial recognition. The expectation of future cashflows also stayed the same. The annual interest on the bond was only received on 1 April 2015 due to a 24-hour delay in transferring money between different banks. On 31 March 2015. Sub Two decided to sell half of the abovementioned debentures at fair value. The only entries in the accounting records so far for the year ended 31 March 2015 is the cash book transactions (agreed to the original bank statement) below: Sub One received a directive from the SARS that any proceeds on the sale of this class of instruments are viewed as of a revenue nature. NamRa also informed you that they will not allow an allowance on the bonds for any debt due to the taxpayer (or that he considers to be doubthul) for the year of assessment ended 31 March 2015 . You also confirmed with the technical taxation advisor that section 24J will be the main section under which interest will be either deductible or included in income. Numerical Ltd ("Numerical") Numerical is the parent company of all of the subsidiaries above. Assume that all the abovementioned accounting transactions have already been accounted for correctly in the group. The consolidated statement of profit or loss and other comprehensive income shows the following for the year ended 31 March 2015: \begin{tabular}{|l|r|r|} \hline & 2015 NS & 2014 NS \\ \hline Profit for the year & 7000000 & 5000000 \\ \hline Other comprehensive income & 180000 & 120000 \\ \hline Total comprehensive income & 7180000 & 5120000 \\ \hline Profit attributable to: & & \\ \hline Owners of the parent & 5900000 & 3700000 \\ \hline Non-controlling interests & 1100000 & 1300000 \\ \hline Total comprehensive income attributable to: & & \\ \hline Owners of the parent & 6000000 & 4000000 \\ \hline Non-controling interests & 1180000 & 1120000 \\ \hline \end{tabular} Share capital Numerical only had 250000 ordinary shares in issue on 31 March 2013. On 1 April 2013, the conversion of 100000 debentures took place at the option of the issuer on a conversion basis of one ordinary share for every four debentures held. Numerical issued 200000,11% compulsory convertible preference shares, with a face value of N\$15 a share, on 1 October 2014 when a market-related interest rate was 11.5\%. Preference dividends are compulsory and paid annually in arrears. Every preference share will be converted into two ordinary shares on 30 September 2017 . Numerical incurred share issue costs of N\$1.50 a share on the issuance of the preference shares. On 1 January 2015, Numerical issued 90000 vested options to previously disadvantaged employees to acquire Numerical shares at N\$8 a share at a time when the average market price per share was N$11 a share. The closing share price on the stock exchange on 1 January 2015 was N\$9 a share. By 31 March 2015, none of these options had been exercised as the holders expect the share price to increase even more after the year-end results are published. Additional information - Ignore VAT and dividend tax. - Investment property is accounted for on the fair value model. - Plant and owner-occupied property is accounted for on the cost model and machinery is accounted for on the revaluation model. Intangible assets are accounted for on the cost model. \begin{tabular}{|l|l|l|} \hline QUESTION 1 REQUIRED: & MARKS \\ \hline The group financial director has asked you to assist with the following accounting queries as it relates to the various companies in the group: & Sub \\ \hline (c) & Sub Two (Pty) Ltd \\ Compile the additional journal entries to account for the investment in the bonds for the year ended 31 March 2015 . Taxation journals and journal narrations are not required. \\ \hline \end{tabular} please help me

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started