Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The 2) selections : long or short? Woodside Petroleum will soon receive $6.640 million from the sale of a patent to another company. The company

The 2) selections : long or short?

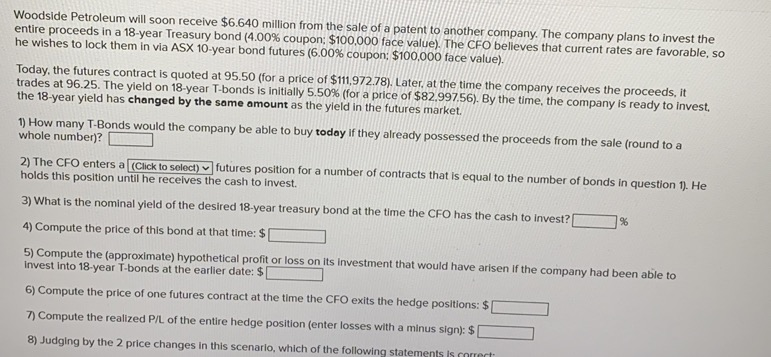

Woodside Petroleum will soon receive $6.640 million from the sale of a patent to another company. The company plans to invest the entire proceeds in a 18-year Treasury bond (4.00% coupon: $100,000 face value). The CFO believes that current rates are favorable, so he wishes to lock them in via ASX 10-year bond futures (6.00% coupon: $100.000 face value). Today, the futures contract is quoted at 95.50 (for a price of $111,972.78). Later, at the time the company receives the proceeds, it trades at 96.25. The yield on 18-year T-bonds is initially 5.50% (for a price of $82.997.56). By the time, the company is ready to invest, the 18-year yield has changed by the same amount as the yield in the futures market. 1) How many T-Bonds would the company be able to buy today if they already possessed the proceeds from the sale (round to a whole number)? 2) The CFO enters a (Click to select), futures position for a number of contracts that is equal to the number of bonds in question 1). He holds this position until he receives the cash to invest. 3) What is the nominal yield of the desired 18-year treasury bond at the time the CFO has the cash to invest? 4) Compute the price of this bond at that time: $ 5) Compute the (approximate) hypothetical profit or loss on its investment that would have arisen if the company had been able to Invest into 18-year T-bonds at the earlier date: $ 6) Compute the price of one futures contract at the time the CFO exits the hedge positions: $ 7) Compute the realized P/L of the entire hedge position (enter losses with a minus sign): $ 8) Judging by the 2 price changes in this scenario, which of the following statements is correct %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started