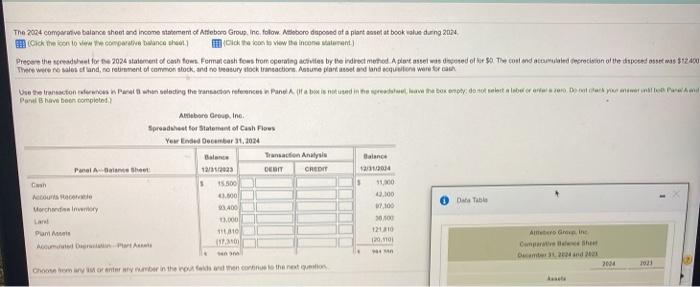

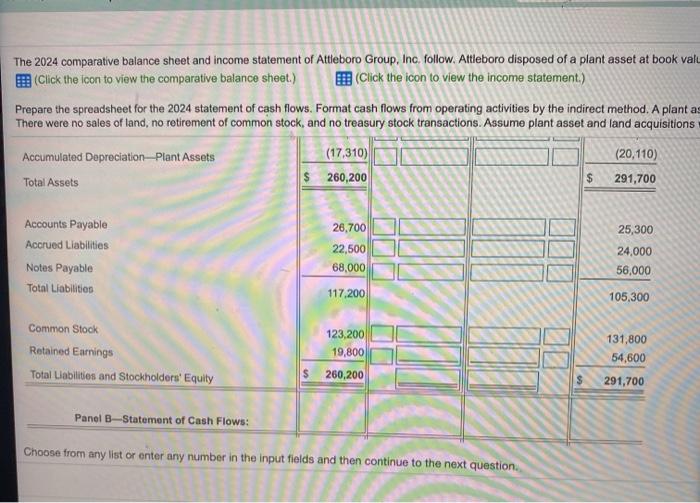

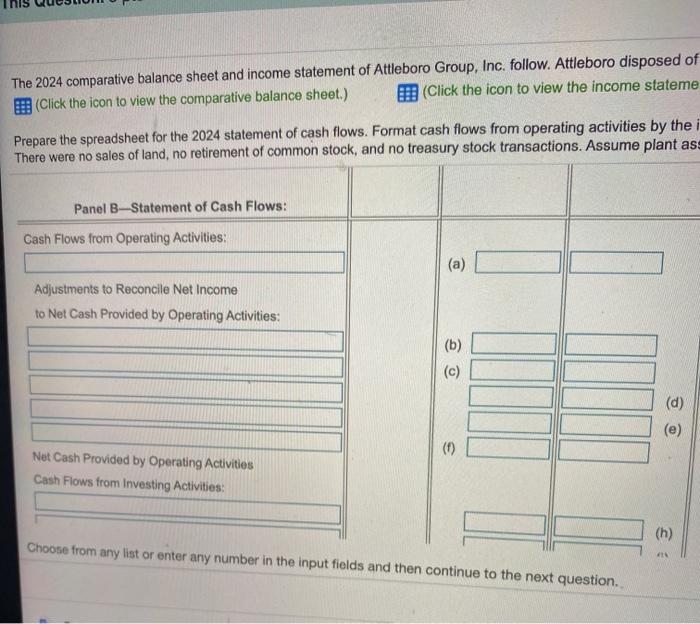

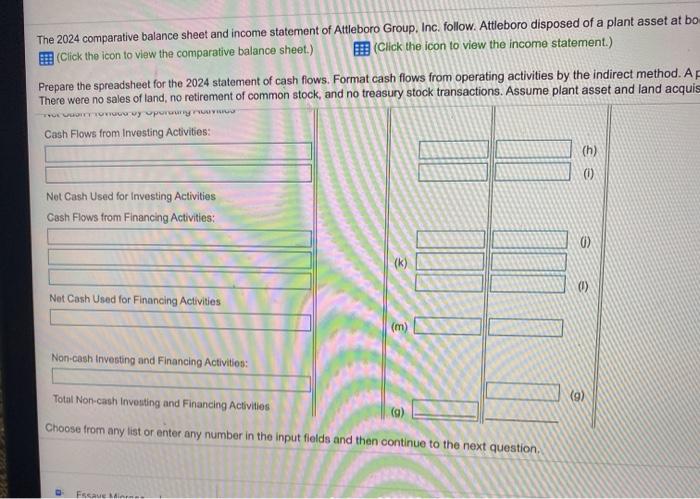

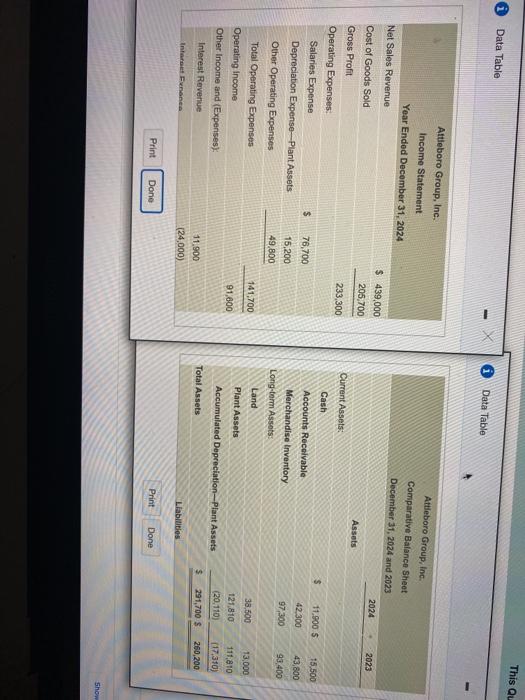

The 2004 com a balance sheet and income statement of Atleboro Group, Inc. follow. Asheboro disponed at a plant annet at book wale during 2014 Click the icon to wear ances miks View the income woment) Precere the speed for 2024 statement of cathows.Format cash fows from operating activities by the indirect method A dle set wisdeed of tot $0 The contended concretason of the disposed asset mas $12.00 There were no los af and no retirement of common stock and to reasury stock transactions. Antune part et end and equions were forca Ve the transactions when welding the vanaton reference and a bow is now in the red boken of electro Dar Para Bhave been complet Alboro Group, Inc. Spreadsheet for Statement of Cash Flows Yew End December 31, 2024 Transaction Analysis Panel AB 127313 DEBIT CREDIT 120100 Cuan 5 15 500 1100 0.000 2.100 Data Table Morchelry 93400 07.100 Land 13.000 3000 Paris 12110 Aeroine 1 12.10 Cave 2014 Choom w wybor in the road the rest The 2024 comparative balance sheet and income statement of Attleboro Group, Inc. follow, Attleboro disposed of a plant asset at book valu (Click the icon to view the comparative balance sheet.) (Click the icon to view the income statement.) Prepare the spreadsheet for the 2024 statement of cash flows. Format cash flows from operating activities by the indirect method. A plantas There were no sales of land, no retirement of common stock, and no treasury stock transactions. Assume plant asset and land acquisitions Accumulated DepreciationPlant Assets (17,310) (20,110) Total Assets $ 260,200 291,700 $ Accounts Payable Accrued Liabilities Notes Payable Total Liabilities 26,700 22,500 68,000 25,300 24,000 56,000 117,200 105,300 Common Stock 123,200 19,800 Retained Earnings Total Liabilities and Stockholders' Equity 131,800 54,600 260,200 291,700 Panel B Statement of Cash Flows: Choose from any list or enter any number in the input fields and then continue to the next question The 2024 comparative balance sheet and income statement of Attleboro Group, Inc. follow. Attleboro disposed of (Click the icon to view the comparative balance sheet.) (Click the icon to view the income stateme Prepare the spreadsheet for the 2024 statement of cash flows. Format cash flows from operating activities by the i There were no sales of land, no retirement of common stock, and no treasury stock transactions. Assume plant ass Panel B-Statement of Cash Flows: Cash Flows from Operating Activities: (a) Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: (b) (c) (d) Net Cash Provided by Operating Activities Cash Flows from Investing Activities: (h) Choose from any list or enter any number in the input fields and then continue to the next question. The 2024 comparative balance sheet and income statement of Attleboro Group, Inc. follow. Attleboro disposed of a plant asset at bo (Click the icon to view the comparative balance sheet.) (Click the icon to view the income statement.) Prepare the spreadsheet for the 2024 statement of cash flows. Format cash flows from operating activities by the indirect method. A There were no sales of land, no retirement of common stock, and no treasury stock transactions. Assume plant asset and land acquis Lowy purcury Cash Flows from Investing Activities: 0) Not Cash Used for Investing Activities Cash Flows from Financing Activities: 0) (k) Net Cash Used for Financing Activities (m) Non cash investing and Financing Activities: Total Non-cash Investing and Financing Activities (9) Choose from any list or enter any number in the input fields and then continue to the next question. Frauen This Qu 0 Data Table Data Table 1 Attleboro Group, Inc. Income Statement Year Ended December 31, 2024 Net Sales Revenue Attleboro Group, Inc. Comparative Balance Sheet December 31, 2024 and 2023 $ 439,000 205,700 2024 2023 Assets 233,300 Current Assets Cash $ 11,900 S 15,500 $ 76,700 43,800 Cost of Goods Sold Gross Profit Operating Expenses Salaries Expense Depreciation Expense Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses Interest Revenue 15,200 49 800 42,300 97,300 93.400 Accounts Receivable Merchandise Inventory Long-term Assets Land Plant Assets Accumulated Depreciation-Plant Assets 141,700 38,500 13,000 91,800 121,81 111.810 (17,310) (20.110) 291,700 $ Total Assets $ 260,200 11.900 (24,000) Liabilities Print Done Print Done Show