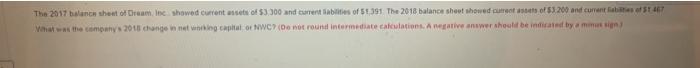

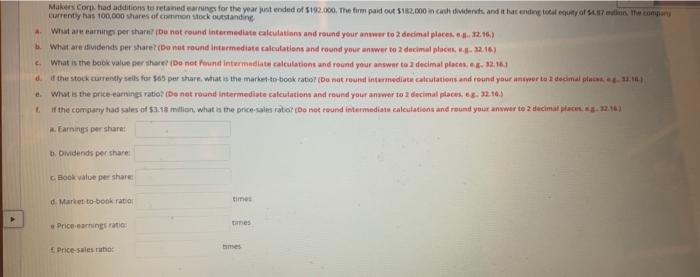

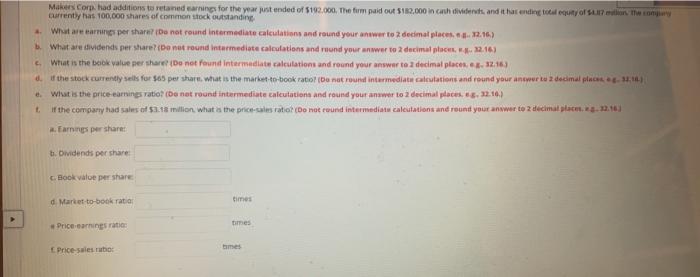

The 2017 balance sheet of Dream, Inc showed current assets of $300 and carents of 5351 The 2018 balance sheet showed us of $3200 and current afst 467 What was the company's 2018 change is net wing capital of NWC (Do not round intermediate calculations. A live answer should be indicated by a min Makers Corn had addition to retaned earnings for the year just ended of 192,000. The firm paid out 162,000 in cash dics and it has ending out of company currently has 100,000 shares of common stock outstanding What are earnings per share? Do not round intermediate calculations and round your answer to 2 decimal places.2.16) What are dividends per share? (Danut round intermediate calculations and round your answer to 2 decimal plac...2161 What is the book value per shareDo not found intermediate calculations and round your answer to 3 decimal places. e. 12.161 o the stock currently sells for $5 per share what is the market-to-book ratio (Do nat round intermediate calculations and round your answer tus decimal places, What is the price earnings vatio? (Do not round intermediate calculation and round your answer to 2 decimal places. es. 32.10) If the company had sales of $1,18 million, what is the price-sales ratio (Do not reund intermediate calestations and round your answer to decimat places 2.0) Carine per share b. Dividends per share Book value per share times d. Market to book ratio tipes Price camins ratio Price-sales to Makers Corn had addition to retaned earnings for the year just ended of 192.000. The fum paid out $160,000 in carth dividers and it has ending to to try Currently has 100,000 shares of common stock outstanding What are carrings per share? Do not round intermediate calculations and round your answer to 2 decimal places.2.16) What are dividends per share? Do not reund intermediate calculations and round your awer to 2 decimal place 2161 What is the book value per share Do not found intermediate calculations and round your answer to decimal places. e. 32.16) the stock currently sells for $65 per share, what is the market-to-book ratio (Donat round intermediate calestations and round your newer tu 2 decimal place, What is the price earnings ratio? (Do not round intermediate calculations and round your answer to 2 decimal places. *8.32.16.) if the company had sales of $1.18 million what is the price-sales ratio (Do not round intermediate calculations and round your answer to decimal places 2.16 Farines per share e b. Dividends per share Book vale per share times d Market-to-bookratia tipes Price carings at mes Price sales