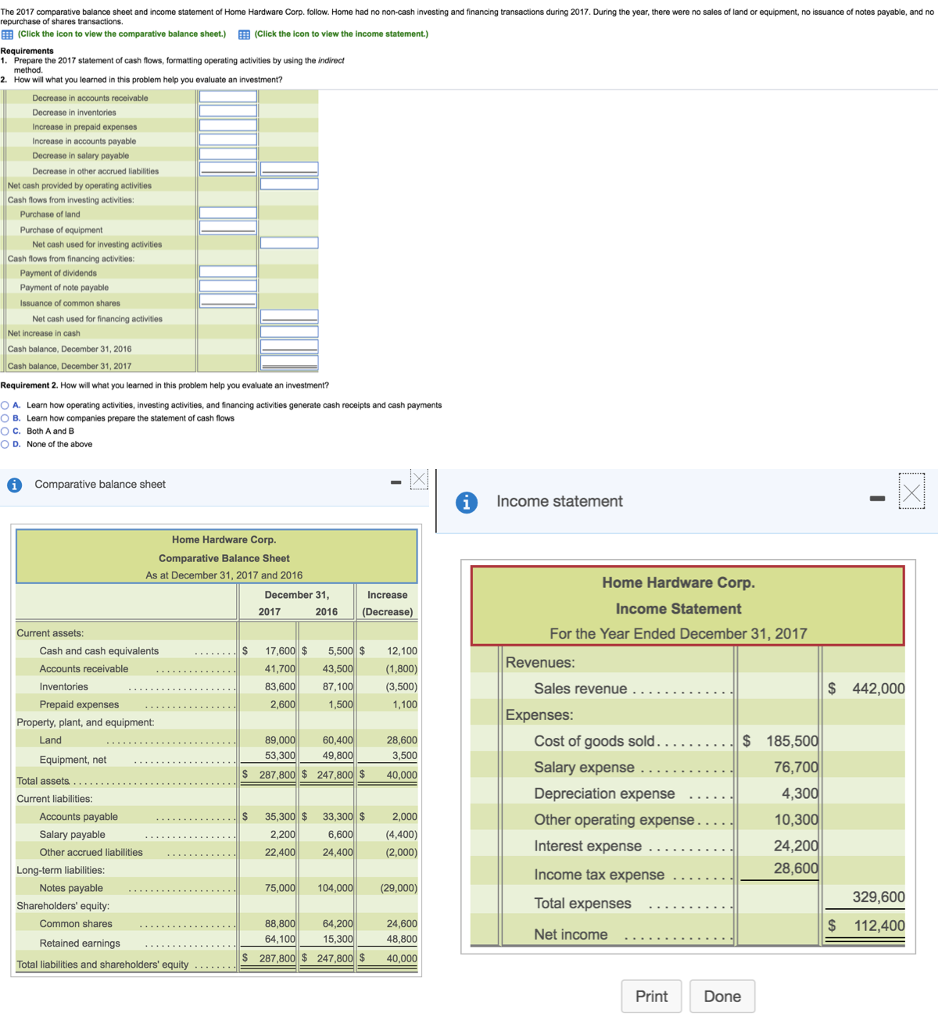

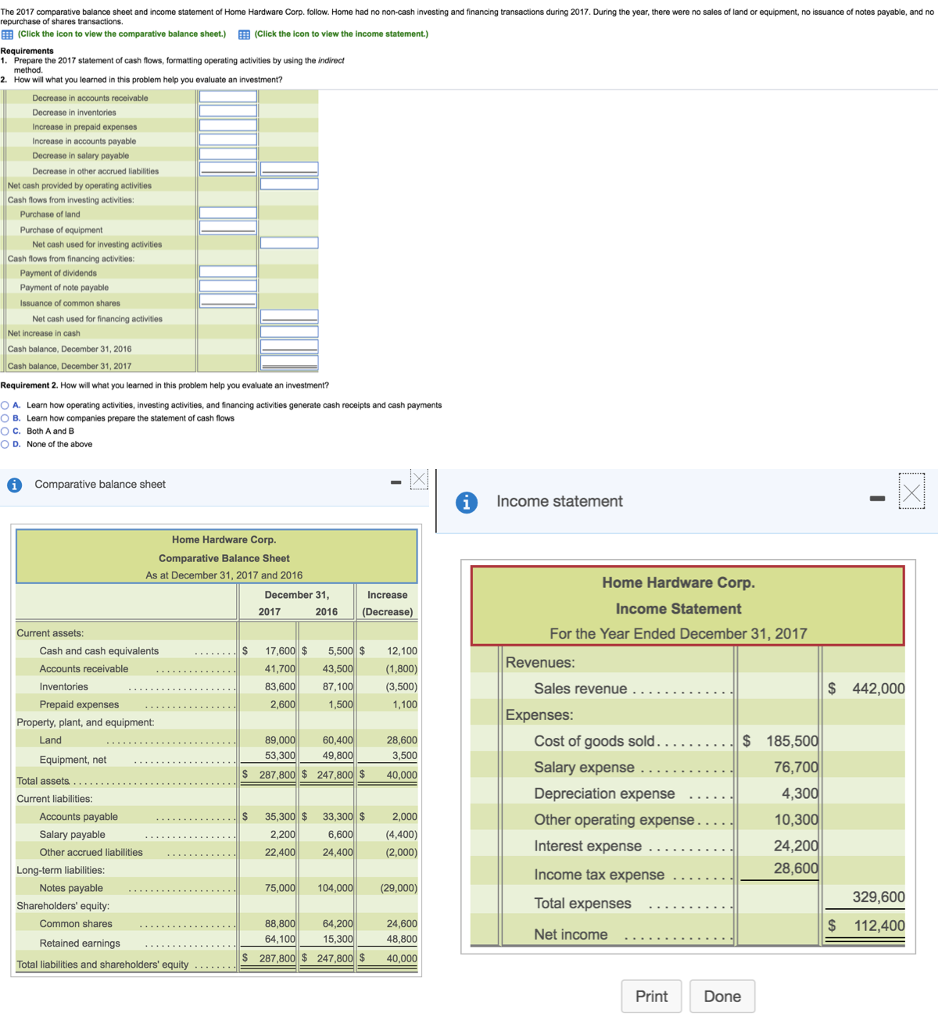

The 2017 comparative balance sheet and income statement of Home Hardware Corp. follow. Home had no non-cash investing and financing transactions during 2017. Dunring the year, there were no sales of land or equipment, no issuance of notes payable, and no repurchase of shares transactions (click the icon to view the comparative balance sheet.) 1. Prepare the 2017 statement of cash flows, formating operating activities by using the indirect 2 How will what you learned in this problem help you evaluate an investment? (Click the icon to view the income statement.) Decrease in accounts recoivable Decrease in inventories Increase in prepaid expenses Increase in accounts payable Decrease in salary payable Decrease in other accrued liabilities Net cash provided by operating activities Cash flows from investing activities Purchase of land Purchase of equipment Net cash used for investing activities Cash flows from financing activities Payment of dividends Payment of note payable Issuance of common shares Net cash used for financing activites Net increase in cash Cash balance, December 31, 2016 December 31, 2017 Requirement 2. How will what you leamed in this problem help you evaluate an investment? A. Learn how operating activities, investing activities, and financing activities generate cash receipts and cash payments O B. Leam how companies prepare the statement of cash flows OC. Both A and B O D. None of the above Comparative balance sheet Income statement Home Hardware Corp. Comparative Balance Sheet As at December 31, 2017 and 2016 Home Hardware Corp Income Statement For the Year Ended December 31, 2017 December 31 2017 2016 Current assets: Cash and cash equivalents Accounts receivable S 17,6005,500 $12,100 (1,800) (3,500) 1,100 Revenues 83 87,1 Sales revenue. _ _ _ _ . . .. $ 442,000 Prepaid expenses Expenses Property, plant, and equipment 60, 49 S 287,800 247,800$40,000 28,600 3,500 53 Equipment, net 76,7 4,3 10,30 24,20 28,60 Depreciation expense .. Other operating expense. Current liabilities: Accounts payable Salary payable Other accrued liabilities $ 35.300 $ 33.300$ 2,000 (4,400) (2,000) 2 6, Long-term liabilities: Income tax expense . . . Total expenses Net income Notes payable 75 104 (29,000) 329,600 Shareholders' equity: 24,600 48,800 S 287,800$ 247,800$ 40,000 Common shares $ 112,400 64,1 Retained earnings Total liabilities and shareholders' equity PrintDone