Answered step by step

Verified Expert Solution

Question

1 Approved Answer

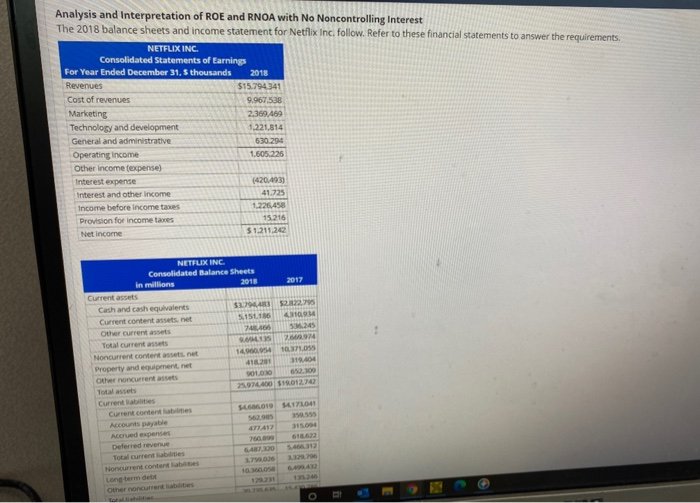

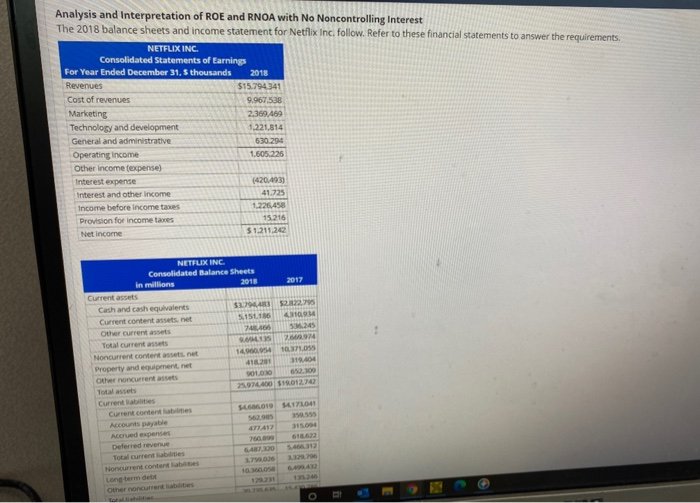

The 2018 balance sheets and income statement for Netflix Inc. follow. Analysis and Interpretation of ROE and RNOA with No Noncontrolling Interest The 2018 balance

The 2018 balance sheets and income statement for Netflix Inc. follow.

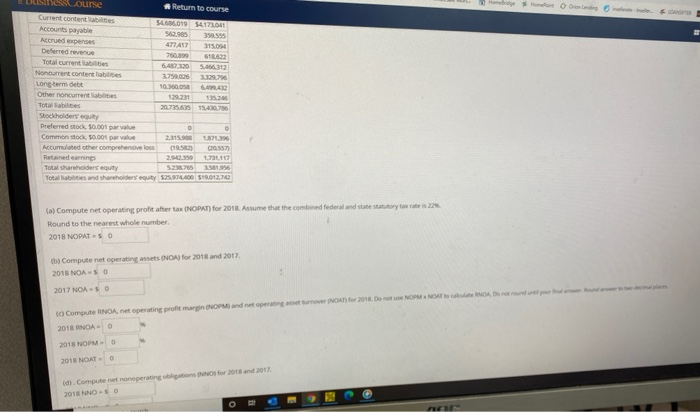

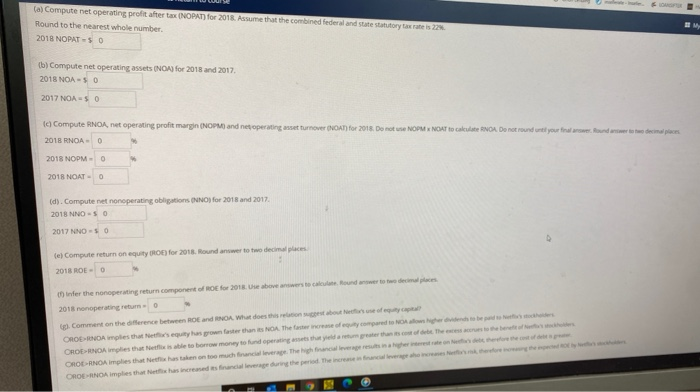

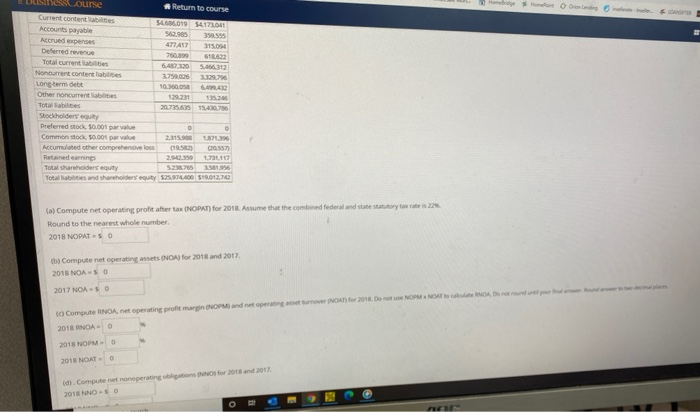

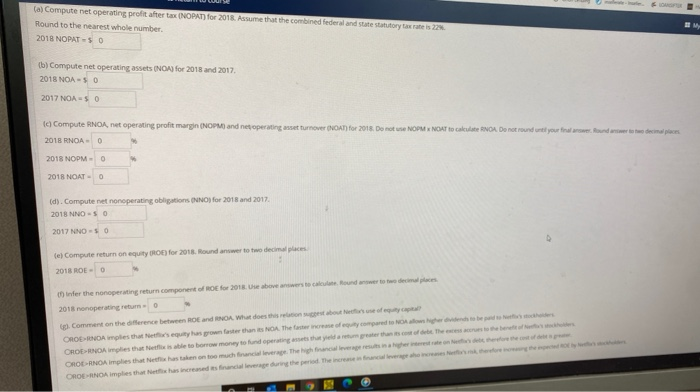

Analysis and Interpretation of ROE and RNOA with No Noncontrolling Interest The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements. NETFLIX INC. Consolidated Statements of Earnings For Year Ended December 31, 5 thousands 2018 Revenues $15.794 341 Cost of revenues 9.967.538 Marketing 2.369.469 Technology and development 1,221,814 General and administrative 630.290 Operating income 1,605,226 Other Income (expense) Interest expense (420493) Interest and other income 41.725 Income before income taxes 1.226.458 Provision for income taxes 15.216 Net income $1.211.242 NETFLIX INC Consolidated Balance Sheets in millions 2018 2017 Current assets Cash and cash equivalents $944 122795 Current content assets.net 5.15.15 M Other current assets 74.40 SM245 Total current assets SAMS 14 Noncurrent content assets.net 14900054 07.055 Property and equipment, net Other non current assets 01 652100 Total assets 25.974400 $19.012.10 Current abilities Current content bites 6019 4171041 Accounts payable 2. 555 Accrued expenses Deferred revenue Total current abilities 6.437.300 Noncurrent content abates Long-term der Other noncurrenties FI CSSLUIS Return to course Current content 5019 34173041 Accounts payable 39555 Accrued expenses 1417 315.094 Deferred revenue 618.623 Total current lates 6.43.130 5.312 Noncurrent contentables 3.799.006 76 Long-term debt 10_3500 Other noncurrenties 12231 Totables 20.750 15.4.2017 Stockholders equity Preferred stock. $0.001 par valve Common stock, 50.001 para 2.315 371.396 Accumulated other comprehensive loss 00:557) Rendering 2000 1,731117 SE Total Shareholders equity 3581.956 Total Babies and shareholders equity 525.974.400 519.01270 0 (a) Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate 224 Round to the nearest whole number 2018 NOPAT=50 b) Compute net operating assets (NCA) for 2018 and 2017 2018 NOASO 2017 NOASO to Compute RNDA, net operating profit margin OPM and net operating turnover INOAT for 2018. Do not use NOM NORTO Dordre 2018 BOA- 2018 NOMO 2018 NOAT d. Compute net nonoperating in for 2018 and 2017 2015 NOSO O (a) Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22 Round to the nearest whole number 2018 NOPAT-50 (b) Compute net operating assets (NOA) for 2018 and 2017, 2018 NOA-50 2017 NOA=50 Compute RNOA, net operating profit margin (OPM) and net operating asset turnover NOAT for 2018. Do not use NOx NOAT to calculate NOA. Do not round us your final roundedecim 2018 RNOA - 0 2018 NOPM - 0 2018 NOAT - 0 (d). Compute net nonoperating obligations (NNO) for 2018 and 2017 2018 NNO=50 2017 NNO-SO Les Compute return on equity ROD for 2018. Round answer to two decimales 2018 ROE- Infer the nonoperating return component of ROE for 2018. Use above answers to calculate. Round wertowe decides 2013 nonoperating retum 0 Comment on the difference between ROE and RENOA. What does this relation est about to stop ORDERNDAmples that he's equity has grown faster than it NOA. The faster rease of compared to Nowhere to be CROERNOA implies that it is able to borrow money to fund operating that you are great the CROERNOA implies that Nexhas taken on too much financial leverage. The high facere ORDERNOA implies that has increased financial leverage during the period. The research

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started