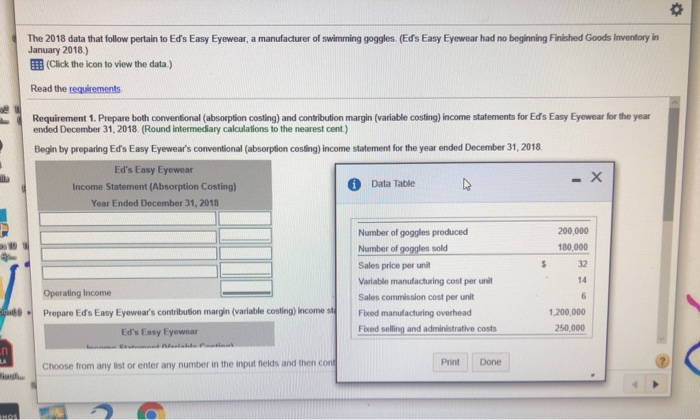

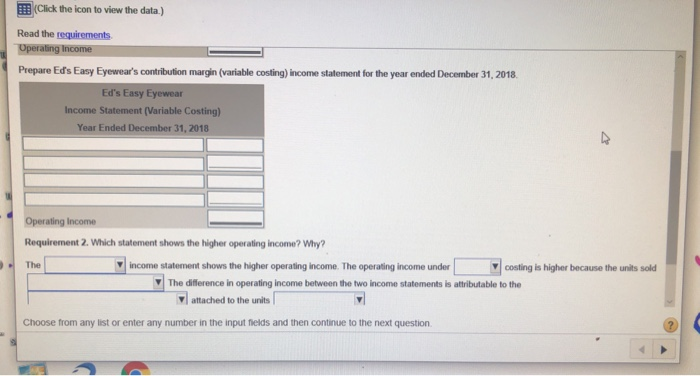

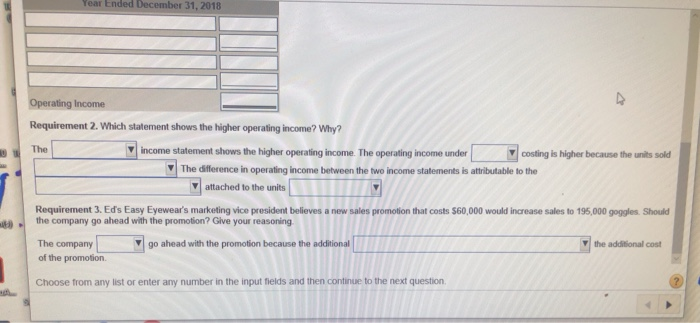

The 2018 data that follow pertain to Ed's Easy Eyewear, a manufacturer of swimming goggles. (Eds Easy Eyewear had no beginning Finished Goods Inventory in January 2018.) (Click the icon to view the data.) Read the requirements Requirement 1. Prepare both conventional (absorption costing) and contribution margin (variable costing) income statements for Ed's Easy Eyewear for the year ended December 31, 2018 (Round intermediary calculations to the nearest cent.) Begin by preparing Ed's Easy Eyewear's conventional (absorption costing) income statement for the year ended December 31, 2018 Ed's Easy Eyewear Income Statement (Absorption Costing) Data Table Year Ended December 31, 2018 - X 200.000 180,000 Number of goggles produced Number of goggles sold Sales price per unit Variable manufacturing cost per unit Sales commission cost per unit Fixed manufacturing overhead Fixed selling and administrative costs Operating Income Prepare Ed's Easy Eyewear's contribution margin (variable costing) Incomes Ed's Easy Eyewear 1.200,000 250,000 Choose from any list or enter any number in the input fields and then con Done Print (Click the icon to view the data) Read the requirements Operating Income Prepare Ed's Easy Eyewear's contribution margin (variable costing) income statement for the year ended December 31, 2018 Ed's Easy Eyewear Income Statement (Variable Costing) Year Ended December 31, 2018 Operating Income Requirement 2. Which statement shows the higher operating incomo? Why? The income statement shows the higher operating income. The operating income under costing is higher because the units sold The difference in operating income between the two income statements is attributable to the w attached to the units Choose from any list or enter any number in the input fields and then continue to the next question Tear Ended December 31, 2018 Operating Income Requirement 2. Which statement shows the higher operating income? Why? The Income statement shows the higher operating income. The operating income under costing is higher because the units sold The difference in operating income between the two income statements is attributable to the attached to the units Requirement 3. Ed's Easy Eyewear's marketing vice president believes a new sales promotion that costs $60,000 would increase sales to 195,000 goggles. Should the company go ahead with the promotion? Give your reasoning The company go ahead with the promotion because the additional the additional cost of the promotion Choose from any list or enter any number in the input fields and then continue to the next